Cigna 2008 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

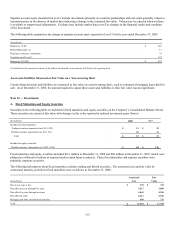

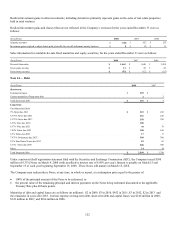

At December 31, 2008, scheduled commercial mortgage loan maturities were as follows (in millions): $266 in 2009, $255 in 2010,

$397 in 2011, $654 in 2012 and $2,045 thereafter.

Actual maturities could differ from contractual maturities for several reasons: borrowers may have the right to prepay obligations,

with or without prepayment penalties; the maturity date may be extended; and loans may be refinanced.

As of December 31, 2008, the Company had commitments to extend credit under commercial mortgage loan agreements of $65

million, all of which were at a fixed rate of interest. These loan commitments are diversified by property type and geographic region.

As of December 31, 2008, the Company had commitments to contribute additional equity of $9 million to real estate investments. The

Company expects to disburse most of the committed amounts in 2009.

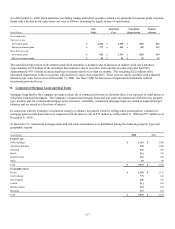

C. Other Long-term Investments

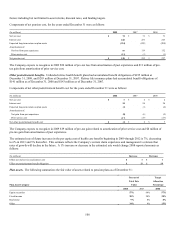

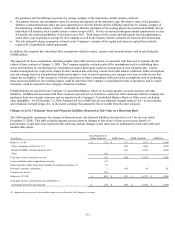

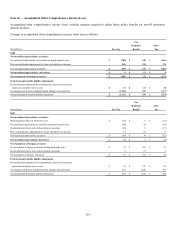

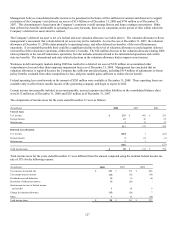

As of December 31, other long-term investments consisted of the following:

(In millions) 2008 2007

Real estate entities $ 321 $ 313

Securities partnerships 242 171

Interest rate and foreign currency swaps 45 3

Mezzanine loans 21 30

Other 3 3

Total $ 632 $ 520

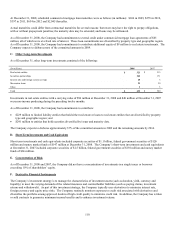

Investments in real estate entities with a carrying value of $96 million at December 31, 2008 and $40 million at December 31, 2007

were non-income producing during the preceding twelve months.

As of December 31, 2008, the Company had commitments to contribute:

• $229 million to limited liability entities that hold either real estate or loans to real estate entities that are diversified by property

type and geographic region; and

• $241 million to entities that hold securities diversified by issuer and maturity date.

The Company expects to disburse approximately 35% of the committed amounts in 2009 and the remaining amounts by 2014.

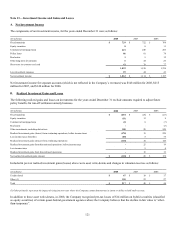

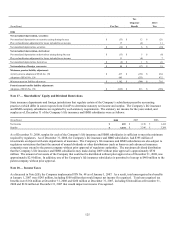

D. Short-Term Investments and Cash Equivalents

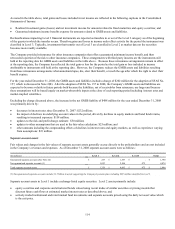

Short-term investments and cash equivalents included corporate securities of $1.1 billion, federal government securities of $126

million and money market funds of $147 million at December 31, 2008. The Company’s short-term investments and cash equivalents

at December 31, 2007 included corporate securities of $1.5 billion, federal government securities of $192 million and money market

funds of $66 million.

E. Concentration of Risk

As of December 31, 2008 and 2007, the Company did not have a concentration of investments in a single issuer or borrower

exceeding 10% of shareholders’ equity.

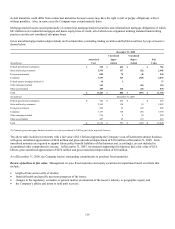

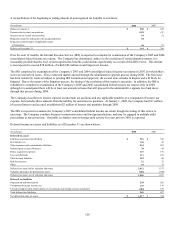

F. Derivative Financial Instruments

The Company’s investment strategy is to manage the characteristics of investment assets (such as duration, yield, currency and

liquidity) to meet the varying demands of the related insurance and contractholder liabilities (such as paying claims, investment

returns and withdrawals). As part of this investment strategy, the Company typically uses derivatives to minimize interest rate,

foreign currency and equity price risks. The Company routinely monitors exposure to credit risk associated with derivatives and

diversifies the portfolio among approved dealers of high credit quality to minimize credit risk. In addition, the Company has written

or sold contracts to guarantee minimum income benefits and to enhance investment returns.