Cigna 2008 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

123

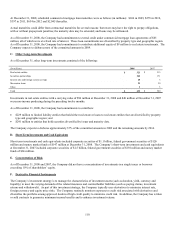

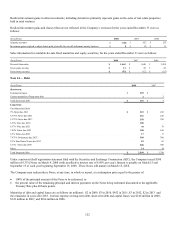

On March 14, 2008, the Company entered into a new commercial paper program (“the Program”). Under the Program, the Company

is authorized to sell from time to time short-term unsecured commercial paper notes up to a maximum of $500 million. The proceeds

are used for general corporate purposes, including working capital, capital expenditures, acquisitions and share repurchases. The

Company uses the credit facility entered into in June 2007, as back-up liquidity to support the outstanding commercial paper. If at any

time funds are not available on favorable terms under the Program, the Company may use its credit agreement for funding. In October

2008, the Company added an additional dealer to its Program. As of December 31, 2008, the Company had $299 million in

commercial paper outstanding, at a weighted average interest rate of 6.31%, used to finance the Great-West Healthcare acquisition and

for other corporate purposes.

In June 2007, the Company amended and restated its five-year revolving credit and letter of credit agreement for $1.75 billion, which

permits up to $1.25 billion to be used for letters of credit. The credit agreement includes options, which are subject to consent by the

administrative agent and the committing bank, to increase the commitment amount up to $2.0 billion and to extend the term of the

agreement. The Company entered into the agreement for general corporate purposes, including support for the issuance of

commercial paper and to obtain statutory reserve credit for certain reinsurance arrangements. There was a $25 million letter of credit

issued as of December 31, 2008. As of December 31, 2008, the Company had an additional $750 million of borrowing capacity

within the maximum debt leverage covenant in the line of credit agreement in addition to the $2.4 billion of debt outstanding.

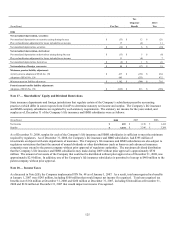

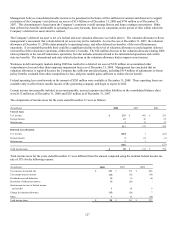

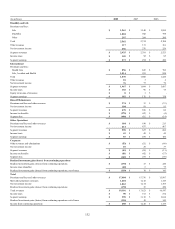

Note 15 — Common and Preferred Stock

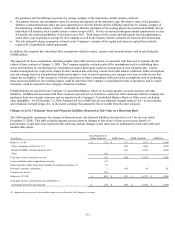

As of December 31, the Company had issued the following shares:

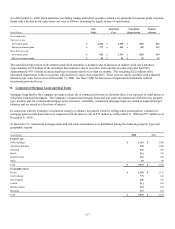

(Shares in thousands) 2008 2007

Common: Par value $0.25

600,000 shares authorized

Outstanding - January 1 279,588 98,654

Issuance of shares in split - 190,917

Issued for stock option and other benefit

plans 1,458 3,244

Repurchase of common stock (10,010) (13,227)

Outstanding - December 31 271,036 279,588

Treasury stock 79,910 71,358

Issued - December 31 350,946 350,946

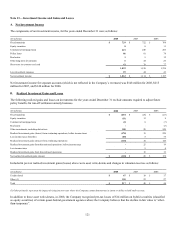

The Company maintains a share repurchase program, which was authorized by its Board of Directors. Decisions to repurchase shares

depend on market conditions and alternative uses of capital. The Company has, and may continue from time to time, to repurchase

shares on the open market through a Rule 10b5-1 plan which permits a company to repurchase its shares at times when it otherwise

might be precluded from doing so under insider trading laws or because of self-imposed trading blackout periods.

The Company has authorized a total of 25 million shares of $1 par value preferred stock. No shares of preferred stock were

outstanding at December 31, 2008 or 2007.