Cigna 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

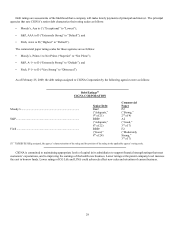

Several states also require HMOs to participate in guaranty funds, special risk pools and administrative funds. For additional

information about guaranty fund and other assessments, see Note 22 to CIGNA’s Consolidated Financial Statements beginning on

page 133 of this Form 10-K.

Some states also require health insurers and HMOs to participate in assigned risk plans, joint underwriting authorities, pools or

other residual market mechanisms to cover risks not acceptable under normal underwriting standards.

Solvency and Capital Requirements

Many states have adopted some form of the National Association of Insurance Commissioners (“NAIC”) model solvency-related

laws and risk-based capital rules (“RBC rules”) for life and health insurance companies. The RBC rules recommend a minimum level

of capital depending on the types and quality of investments held, the types of business written and the types of liabilities incurred. If

the ratio of the insurer’s adjusted surplus to its risk-based capital falls below statutory required minimums, the insurer could be subject

to regulatory actions ranging from increased scrutiny to conservatorship.

In addition, various non-U.S. jurisdictions prescribe minimum surplus requirements that are based upon solvency, liquidity and

reserve coverage measures. During 2008, CIGNA’s HMOs and life and health insurance subsidiaries, as well as non-U.S. insurance

subsidiaries, were compliant with applicable RBC and non-U.S. surplus rules.

In 2008, the NAIC adopted Actuarial Guideline VACARVM, Commissioners Annuity Reserve Valuation Method for Variable

Annuities, which will be effective December 31, 2009. VACARVM will impact statutory and tax reserves for CIGNA’s contracts

covering guaranteed minimum death benefits and guaranteed minimum income benefits. Upon implementation, it is anticipated that

statutory reserves for those products will increase and thus statutory surplus for Connecticut General Life Insurance Company will be

reduced. The magnitude of any impact depends on equity market and interest rate levels at the time of implementation.

Holding Company Laws

CIGNA’s domestic insurance companies and certain of its HMOs are subject to state laws regulating subsidiaries of insurance

holding companies. Under such laws, certain dividends, distributions and other transactions between an insurance or HMO subsidiary

and its affiliates may require notification to, or approval by, one or more state insurance commissioners.

Oversight of Marketing, Advertising and Broker Compensation

State and/or federal regulatory scrutiny of life and health insurance company and HMO marketing and advertising practices,

including the adequacy of disclosure regarding products and their administration, may result in increased regulation. Products offering

limited benefits, such as those issued in connection with the Star HRG business acquired in July 2006, may attract increased

regulatory scrutiny. States have responded to concerns about the marketing, advertising and administration of insurance and HMO

products and administrative practices by increasing the number and frequency of market conduct examinations and imposing larger

penalties for violations of applicable laws and regulations.

In recent years, perceived abuses in broker compensation practices have been the focus of greatly heightened regulatory scrutiny.

This increased regulatory focus may lead to legislative or regulatory changes that would affect the manner in which CIGNA and its

competitors compensate brokers. For more information regarding general governmental inquiries relating to CIGNA subsidiaries, see

“Legal Proceedings” in Item 3 beginning on page 39.

Licensing Requirements

Pharmacy Licensure Laws

Certain CIGNA subsidiaries are pharmacies, which dispense prescription drugs to participants of benefit plans administered or

insured by CIGNA subsidiary HMOs and insurance companies. These pharmacy-subsidiaries are subject to state licensing

requirements and regulation.