Cigna 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

120

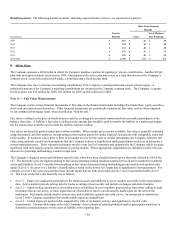

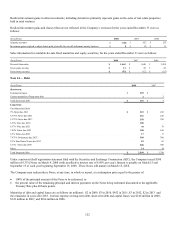

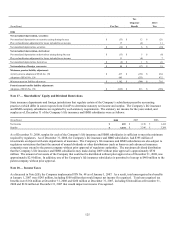

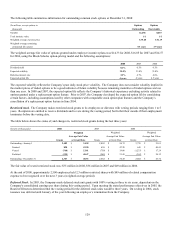

Instrument

Risk

Purpose

Cash Flows

Accounting Policy

Futures Primarily

equity and

foreign

currency risks

To reduce domestic and international equity

market exposures for certain reinsurance contracts

that guarantee death benefits resulting from

changes in variable annuity account values based

on underlying mutual funds. Currency futures are

primarily euros, Japanese yen and British pounds.

The Company receives (pays) cash daily in the

amount of the change in fair value of the futures

contracts.

Fair value changes are reported in other revenues

and cash flows are included in operating

activities.

Interest rate

risk

To hedge fair value changes of fixed maturity and

commercial mortgage loan investments to be

purchased.

The Company receives (pays) cash daily in the

amount of the change in fair value of the futures

contracts.

Using cash flow hedge accounting, fair value

changes are reported in accumulated other

comprehensive income and amortized into net

investment income over the life of the investments

purchased. Cash flows are included in operating

activities.

Swaps Interest rate

and foreign

currency risks

To hedge the interest or foreign currency cash

flows of fixed maturities and commercial

mortgage loans to match associated liabilities.

Currency swaps are primarily Canadian dollars,

euros, Australian dollars and British pounds for

periods of up to 13 years.

The Company periodically exchanges cash flows

between variable and fixed interest rates or

between two currencies for both principal and

interest.

Using cash flow hedge accounting, fair values are

reported in other long-term investments or other

liabilities and accumulated other comprehensive

income. Net interest cash flows are reported in net

investment income and included in operating

activities. When hedge accounting does not

apply, fair value changes and net interest cash

flows are reported in realized investment gains

and losses.

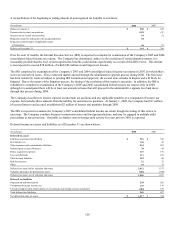

Credit and

interest rate

risks

To enhance investment returns, the Company sells

Dow Jones indexed credit default swaps on a

basket of primarily investment grade corporate

bonds.

The Company receives quarterly fees and will

make future payments if an issuer of an

underlying corporate bond defaults on scheduled

payments or files for bankruptcy. These

payments will equal the par value of the

underlying corporate bond and the Company may

subsequently sell or hold that bond as an invested

asset. If the most current indexed swaps are

determined desirable for liquidity, credit risk or

other reasons, the Company also pays or receives

cash to settle purchases and sales.

Fair values of the swaps are reported in other

long-term investments or other liabilities, with

changes in fair value reported in realized

investment gains and losses. Quarterly fees and

gains and losses on purchases and sales are also

reported in realized investment gains and losses.

These cash flows are reported in investing

activities.

Treasury lock Interest rate

risk

To hedge the variability of and fix at inception

date, the benchmark Treasury rate component of

future interest payments on debt to be issued in

2009.

The Company will receive (pay) the fair value of

the contract at the earliest of expiration or debt

issuance.

Using cash flow hedge accounting, fair values are

reported in short-term investments or other

liabilities, with changes in fair value reported in

accumulated other comprehensive income and

amortized to interest expense over the life of the

debt issued. These cash flows are reported in

operating activities.

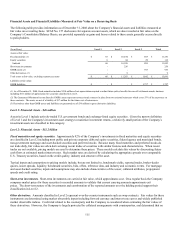

Swaps on

commercial loan

pools

Interest rate

and credit

risks

To obtain returns based on the performance of

underlying commercial loan pools.

The Company receives cash based on the

performance of underlying commercial loan

pools.

Fair values of the swaps are reported in other

long-term investments or other liabilities, with

changes in fair value reported in realized

investment gains and losses. These cash flows are

reported in investing activities.

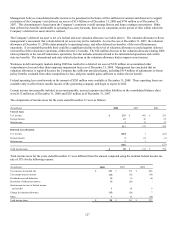

Written and

Purchased Options

Primarily

equity and

interest rate

risks

The Company has written certain reinsurance

contracts to guarantee minimum income benefits

resulting from the level of variable annuity

account values compared with a contractually

guaranteed amount. The actual payment by the

Company depends on the actual account value in

the underlying mutual funds and the level of

interest rates when account holders elect to

receive minimum income payments. The

Company purchased reinsurance contracts to

hedge the market risks assumed. These contracts

are accounted for as written and purchased

options.

The Company periodically receives (pays) fees

based on account values. The Company will also

pay (receive) cash depending on changes in

account values and interest rates when account

holders first elect to receive minimum income

payments.

Fair values are reported in other liabilities and

other assets. Changes in fair value are reported in

guaranteed minimum income benefits expense.

These cash flows are reported in operating

activities.

Purchased Options Interest rate

risk

To hedge the possibility of early policyholder

cash surrender when the amortized cost of

underlying invested assets is greater than their fair

values.

The Company pays a fee and may receive or pay

cash, based on the difference between the

amortized cost and fair values of underlying

invested assets at the time of policyholder

surrender.

Using cash flow hedge accounting, fair values are

reported in other assets or other liabilities, with

changes in fair value reported in accumulated

other comprehensive income and amortized to

benefits expense over the life of the underlying

invested assets. These cash flows will be reported

in financing activities.