Cigna 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192

|

|

29

Debt ratings are assessments of the likelihood that a company will make timely payments of principal and interest. The principal

agencies that rate CIGNA’s senior debt characterize their rating scales as follows:

• Moody’s, Aaa to C (“Exceptional” to “Lowest”);

• S&P, AAA to D (“Extremely Strong” to “Default”); and

• Fitch, AAA to D (“Highest” to “Default”).

The commercial paper rating scales for those agencies are as follows:

• Moody’s, Prime-1 to Not Prime (“Superior” to “Not Prime”);

• S&P, A-1+ to D (“Extremely Strong” to “Default”); and

• Fitch, F-1+ to D (“Very Strong” to “Distressed”).

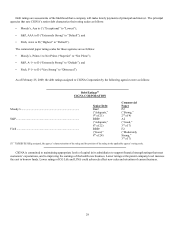

As of February 25, 2009, the debt ratings assigned to CIGNA Corporation by the following agencies were as follows:

Debt Ratings(1)

CIGNA CORPORATION

Commercial

Senior Debt Paper

Moody’s................................................................................. Baa2 P2

(“Adequate,” (“Strong,”

9

th of 21) 2nd of 4)

S&P........................................................................................ BBB+ A2

(“Adequate,” (“Good,”

8

th of 22) 3rd of 7)

Fitch ....................................................................................... BBB+ F2

(“Good,”

8th of 24)

(“Moderately

Strong,”

3rd of 7)

________________________

(1) Includes the rating assigned, the agency’s characterization of the rating and the position of the rating in the applicable agency’s rating scale.

CIGNA is committed to maintaining appropriate levels of capital in its subsidiaries to support financial strength ratings that meet

customers’ expectations, and to improving the earnings of the health care business. Lower ratings at the parent company level increase

the cost to borrow funds. Lower ratings of CG Life and LINA could adversely affect new sales and retention of current business.