Cigna 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

December 31, 2006, the assets and liabilities of the Chilean insurance operations, which were held for sale, were reported in other

assets and accounts payable, accrued expenses and other liabilities.

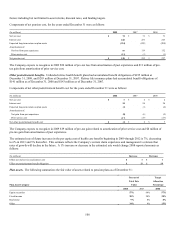

C. Sale of Retirement Benefits Business

In 2004, the Company sold its retirement benefits business, excluding the corporate life insurance business, for cash proceeds of $2.1

billion. The sale resulted in an initial after-tax gain of $809 million, of which $267 million after-tax was recognized immediately and

the remaining amount was deferred. The Company recognized deferred gains of $3 million after-tax in 2008, $5 million after-tax in

2007 and $14 million after-tax in 2006. As of December 31, 2008, the remaining deferred gain of $33 million after-tax will be

recognized in the Company’s results of operations through 2032.

D. Sale of Individual Life Insurance and Annuity Business

In 1998, the Company sold its individual life insurance and annuity business for cash proceeds of $1.4 billion. The sale generated an

after-tax gain of approximately $800 million, the majority of which was deferred and is recognized at the rate that earnings from the

sold business would have been expected to emerge (primarily over 15 years on a declining basis). The Company recognized deferred

gains of $22 million after-tax in 2008, $25 million after-tax in 2007 and $28 million after-tax in 2006. The remaining deferred gain as

of December 31, 2008, was $108 million after-tax.

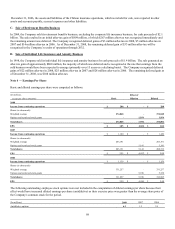

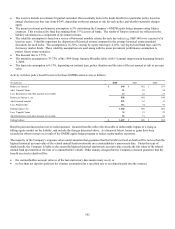

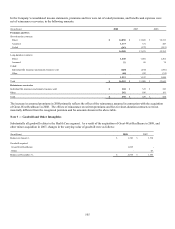

Note 4 — Earnings Per Share

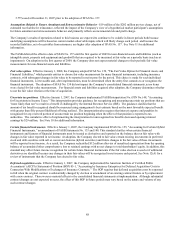

Basic and diluted earnings per share were computed as follows:

(In millions, Effect of

except per share amounts) Basic Dilution Diluted

2008

Income from continuing operations $ 288 $ - $ 288

Shares (in thousands):

Weighted average 274,848 - 274,848

Options and restricted stock grants - 1,954 1,954

Total shares 274,848 1,954 276,802

EPS $ 1.05 $ (0.01) $ 1.04

2007

Income from continuing operations $ 1,120 $ - $ 1,120

Shares (in thousands):

Weighted average 283,191 - 283,191

Options and restricted stock grants 5,141 5,141

Total shares 283,191 5,141 288,332

EPS $ 3.95 $ (0.07) $ 3.88

2006

Income from continuing operations $ 1,159 $ - $ 1,159

Shares (in thousands):

Weighted average 331,257 - 331,257

Options and restricted stock grants 5,728 5,728

Total shares 331,257 5,728 336,985

EPS $ 3.50 $ (0.06) $ 3.44

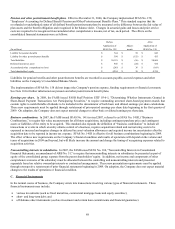

The following outstanding employee stock options were not included in the computation of diluted earnings per share because their

effect would have increased diluted earnings per share (antidilutive) as their exercise price was greater than the average share price of

the Company's common stock for the period.

(In millions) 2008 2007 2006

Antidilutive options 6.3 1.2 3.9