Cigna 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114

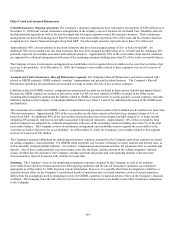

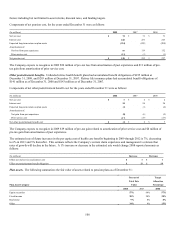

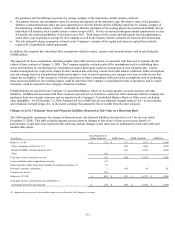

As noted in the table above, total gains and losses included in net income are reflected in the following captions in the Consolidated

Statements of Income:

• Realized investment gains (losses) and net investment income for amounts related to fixed maturities and equity securities; and

• Guaranteed minimum income benefits expense for amounts related to GMIB assets and liabilities.

Reclassifications impacting Level 3 financial instruments are reported as transfers in or out of the Level 3 category as of the beginning

of the quarter in which the transfer occurs. Therefore gains and losses in income only reflect activity for the period the instrument was

classified in Level 3. Typically, investments that transfer out of Level 3 are classified in Level 2 as market data on the securities

becomes more readily available.

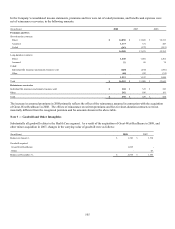

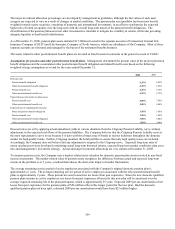

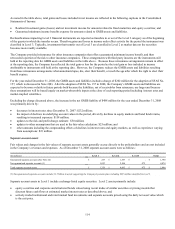

The Company provided reinsurance for other insurance companies that offer a guaranteed minimum income benefit, and then

retroceded a portion of the risk to other insurance companies. These arrangements with third party insurers are the instruments still

held at the reporting date for GMIB assets and liabilities in the table above. Because these reinsurance arrangements remain in effect

at the reporting date, the Company has reflected the total gain or loss for the period as the total gain or loss included in income

attributable to instruments still held at the reporting date. However, the Company reduces the GMIB assets and liabilities resulting

from these reinsurance arrangements when annuitants lapse, die, elect their benefit, or reach the age after which the right to elect their

benefit expires.

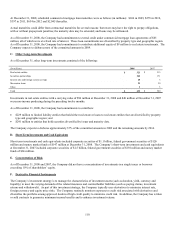

For the year ended December 31, 2008, the GMIB assets and liabilities include a charge of $202 million for the adoption of SFAS No.

157, which is discussed in Note 2(B). After the adoption of SFAS No. 157 in 2008, the Company’s GMIB assets and liabilities are

expected to be more volatile in future periods both because the liabilities, net of receivables from reinsurers, are larger and because

these assumptions will be based largely on market-observable inputs at the close of each reporting period including interest rates and

market-implied volatilities.

Excluding the charge discussed above, the increase in the net GMIB liability of $488 million for the year ended December 31, 2008

was primarily driven by:

• decreases in interest rates since December 31, 2007: $232 million;

• the impact of declines in underlying account values in the period, driven by declines in equity markets and bond fund returns,

resulting in increased exposure: $158 million;

• updates to the risk and profit charge estimate: $50 million;

• updates to other assumptions that are used in the fair value calculation: $25 million; and

• other amounts including the compounding effects of declines in interest rates and equity markets, as well as experience varying

from assumptions: $23 million.

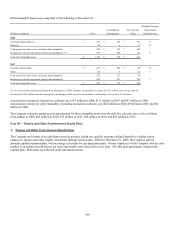

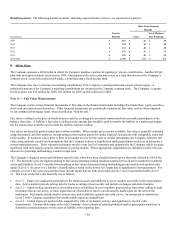

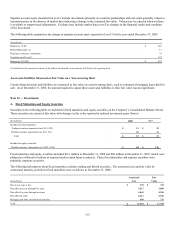

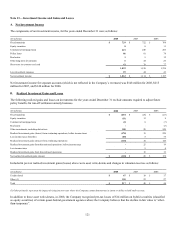

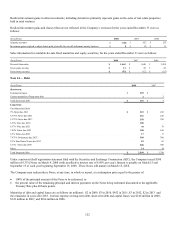

Separate account assets

Fair values and changes in the fair values of separate account assets generally accrue directly to the policyholders and are not included

in the Company’s revenues and expenses. As of December 31, 2008 separate account assets were as follows:

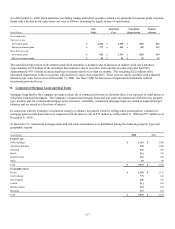

(In millions) Level 1 Level 2 Level 3 Total

Guaranteed separate accounts (See Note 22) $ 233 $ 1,557 $ - $ 1,790

Non-guaranteed separate accounts (1) 1,093 2,506 475 4,074

Total separate account assets $ 1,326 $ 4,063 $ 475 $ 5,864

(1) Non-guaranteed separate accounts include $1.5 billion in assets supporting the Company's pension plan, including $435 million classified in Level 3.

Separate account assets in Level 1 include exchange-listed equity securities. Level 2 assets primarily include:

• equity securities and corporate and structured bonds valued using recent trades of similar securities or pricing models that

discount future cash flows at estimated market interest rates as described above; and

• actively-traded institutional and retail mutual fund investments and separate accounts priced using the daily net asset value which

is the exit price.