Cigna 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

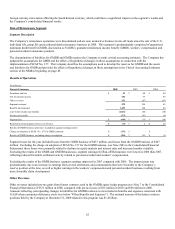

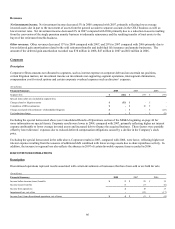

Benefits and Expenses

Benefits and expenses were comprised of the following:

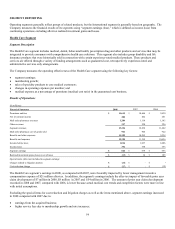

(In millions)

For the years ended December 31, 2008 2007 2006

GMIB expense $ 690 $ 147 $ 7

Other benefits and expenses 809 13 73

Benefits and expenses $ 1,499 $ 160 $ 80

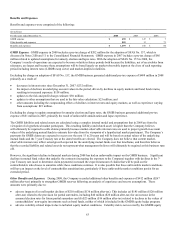

GMIB Expense. GMIB expense in 2008 includes a pre-tax charge of $202 million for the adoption of SFAS No. 157, which is

discussed in Notes 2(B) and 11 to the Consolidated Financial Statements. GMIB expense in 2007 includes a pre-tax charge of $86

million related to updated assumptions for annuity election and lapse rates. With the adoption of SFAS No. 157 in 2008, the

Company’s results of operations are expected to be more volatile in future periods both because the liabilities, net of receivables from

reinsurers, are larger and because these assumptions will be based largely on market-observable inputs at the close of each reporting

period including interest rates (LIBOR swap curve) and market-implied volatilities.

Excluding the charge on adoption of SFAS No. 157, the GMIB business generated additional pre-tax expense of $488 million in 2008

primarily as a result of:

• decreases in interest rates since December 31, 2007: $232 million;

• the impact of declines in underlying account values in the period, driven by declines in equity markets and bond fund returns,

resulting in increased exposure: $158 million;

• updates to the risk and profit charge estimate: $50 million;

• updates to other assumptions that are used in the fair value calculation: $25 million; and

• other amounts including the compounding effects of declines in interest rates and equity markets, as well as experience varying

from assumptions: $23 million.

Excluding the charge to update assumptions for annuity election and lapse rates, the GMIB business generated additional pre-tax

expense of $61 million in 2007, primarily the result of unfavorable annuitization and lapse experience.

The GMIB liabilities and related assets are calculated using a complex internal model and assumptions that in 2008 are from the

viewpoint of a hypothetical market participant. This resulting liability (and related asset) is higher than the Company believes

will ultimately be required to settle claims primarily because market-observable interest rates are used to project growth in account

values of the underlying mutual funds to estimate fair value from the viewpoint of a hypothetical market participant. The Company’s

payments for GMIB claims are expected to occur over the next 15 to 20 years and will be based on actual values of the underlying

mutual funds and the 7-year Treasury rate at the dates benefits are elected. The Company does not believe that current market-

observable interest rates reflect actual growth expected for the underlying mutual funds over that timeframe, and therefore believes

that the recorded liability and related asset do not represent what management believes will ultimately be required as this business runs

off.

However, the significant decline in financial markets during 2008 has had an unfavorable impact on the GMIB business. Significant

declines in mutual fund values that underlie the contracts (increasing the exposure to the Company) together with declines in the 7-

year Treasury rate (used to determine claim payments) increased the expected amount of claims that will be paid out for

contractholders who choose to annuitize while these conditions continue. It is also possible that these unfavorable market conditions

will have an impact on the level of contractholder annuitizations, particularly if these unfavorable market conditions persist for an

extended period.

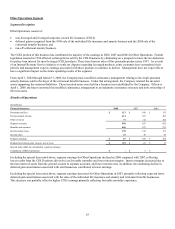

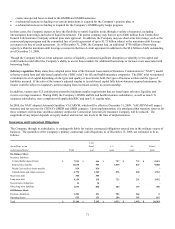

Other Benefits and Expenses. During 2008, the Company recorded additional other benefits and expenses of $412 million ($267

million after-tax) primarily to strengthen GMDB reserves following an analysis of experience and reserve assumptions. These

amounts were primarily due to:

• adverse impacts of overall market declines of $210 million ($136 million after-tax). This includes (a) $185 million ($120 million

after-tax) related to the provision for partial surrenders, including $40 million ($26 million after-tax) for an increase in the

assumed election rates for future partial surrenders and (b) $25 million ($16 million after-tax) related to declines in the values of

contractholders’ non-equity investments such as bond funds, neither of which is included in the GMDB equity hedge program;

• adverse volatility-related impacts due to turbulent equity market conditions. Volatility risk is not covered by the GMDB equity