Cigna 2008 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126

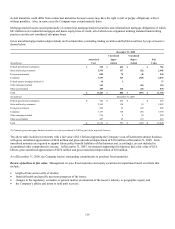

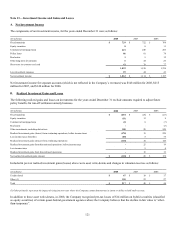

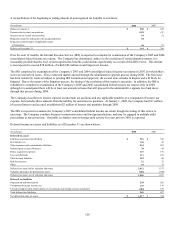

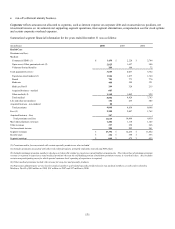

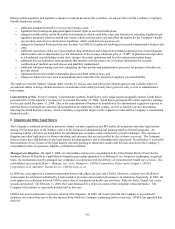

A reconciliation of the beginning to ending amount of unrecognized tax benefits is as follows:

(In millions) 2008 2007

Balance at January 1, $ 260 $ 245

Decrease due to prior year positions (119) (31)

Increase due to current year positions 34 51

Reduction related to settlements with taxing authorities (5) -

Reduction related to lapse of applicable statute

of limitations (6) (5)

Balance at December 31, $ 164 $ 260

Over the next 12 months, the Internal Revenue Service (IRS) is expected to complete its examination of the Company's 2005 and 2006

consolidated federal income tax returns. The Company has determined, subject to the resolution of certain disputed matters, it is

reasonably possible that the level of unrecognized tax benefits could decline significantly as a result of this IRS review. This decline

is not expected to exceed $38 million, of which $28 million would impact net income.

The IRS completed its examination of the Company’s 2003 and 2004 consolidated federal income tax returns in 2007, for which there

were two unresolved issues. These contested matters moved through the administrative appeals process during 2008. The first issue

has been tentatively resolved subject to pending IRS Commissioner approval; the second issue remains in dispute and will likely be

litigated. Due to the nature of the litigation process, the timing of the resolution of this matter is uncertain. In addition, the IRS is

scheduled to complete its examination of the Company’s 2005 and 2006 consolidated federal income tax returns early in 2009,

although it is anticipated there will be at least one unresolved issue that will proceed to the administrative appeals level and move

through that process during 2009.

The Company classifies net interest expense on uncertain tax positions and any applicable penalties as a component of income tax

expense, but excludes these amounts from the liability for uncertain tax positions. At January 1, 2008, the Company had $17 million

of accrued interest and accrued an additional $2 million of interest and penalties through 2008.

The IRS is expected to examine the Company’s 2007 consolidated federal income tax return though the timing of this review is

uncertain. The Company conducts business in numerous states and foreign jurisdictions, and may be engaged in multiple audit

proceedings at any given time. Generally, no further state or foreign audit activity for years prior to 2001 is expected.

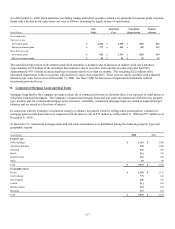

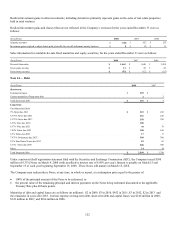

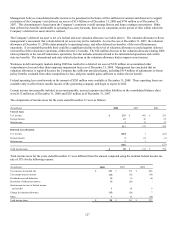

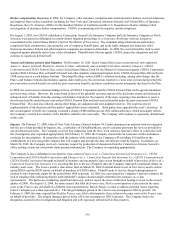

Deferred income tax assets and liabilities as of December 31 are shown below.

(In millions) 2008 2007

Deferred tax assets

Employee and retiree benefit plans $ 921 $ 546

Investments, net 130 26

Other insurance and contractholder liabilities 454 267

Deferred gain on sale of business 78 89

Policy acquisition expenses 147 170

Loss carryforwards 111 125

Other accrued liabilities 110 88

Bad debt expense 22 21

Other 39 39

Deferred tax assets before valuation allowance 2,012 1,371

Valuation allowance for deferred tax assets (126) (150)

Deferred tax assets, net of valuation allowance 1,886 1,221

Deferred tax liabilities

Depreciation and amortization 238 202

Unrepatriated foreign income, net 135 116

Unrealized appreciation (depreciation) on investments and foreign currency translation (104) 109

Total deferred tax liabilities 269 427

Net deferred income tax assets $ 1,617 $ 794