Cigna 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

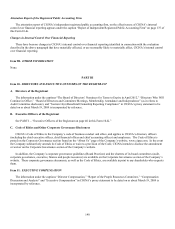

131

• run-off settlement annuity business.

Corporate reflects amounts not allocated to segments, such as interest expense on corporate debt and on uncertain tax positions, net

investment income on investments not supporting segment operations, intersegment eliminations, compensation cost for stock options

and certain corporate overhead expenses.

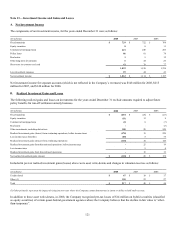

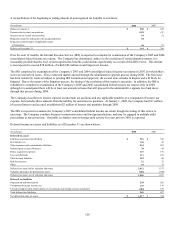

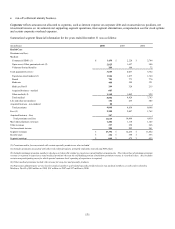

Summarized segment financial information for the years ended December 31 was as follows:

(In millions) 2008 2007 2006

Health Care

Premiums and fees:

Medical:

Commercial HMO (1) $ 1,430 $ 2,220 $ 2,744

Open access/Other guaranteed cost (2) 2,025 1,657 946

Voluntary/limited benefits 200 160 72

Total guaranteed cost (1) 3,655 4,037 3,762

Experience-rated medical (3) 1,946 1,877 1,760

Dental 785 773 776

Medicare 400 349 321

Medicare Part D 299 326 215

Acquired business - medical 603 - -

Other medical (4) 1,168 1,062 929

Total medical 8,856 8,424 7,763

Life and other non-medical 156 235 305

Acquired business - non-medical 28 - -

Total premiums 9,040 8,659 8,068

Fees (5) 2,208 2,007 1,762

Acquired business - Fees 367 - -

Total premiums and fees 11,615 10,666 9,830

Mail order pharmacy revenues 1,204 1,118 1,145

Other revenues 317 250 226

Net investment income 200 202 261

Segment revenues $ 13,336 $ 12,236 $ 11,462

Income taxes $ 352 $ 358 $ 353

Segment earnings $ 664 $ 679 $ 653

(1) Premiums and/or fees associated with certain specialty products are also included.

(2) Includes premiums associated with other risk-related products, primarily indemnity network and PPO plans.

(3) Includes minimum premium members who have a risk profile similar to experience-rated funding arrangements. The risk portion of minimum premium

revenue is reported in experience-rated medical premium whereas the self funding portion of minimum premium revenue is recorded in fees. Also includes

certain non-participating cases for which special customer level reporting of experience is required.

(4) Other medical premiums include risk revenue for stop-loss and specialty products.

(5) Represents administrative service fees for medical members and related specialty product fees for non-medical members as well as fees related to

Medicare Part D of $96 million in 2008, $61 million in 2007 and $27 million in 2006.