Cigna 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

factors including but not limited to asset returns, discount rates, and funding targets.

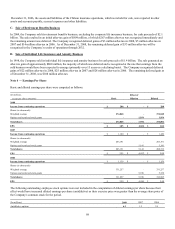

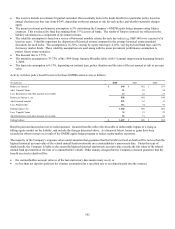

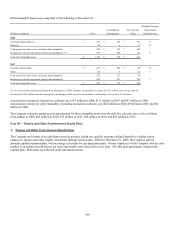

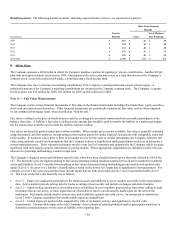

Components of net pension cost, for the years ended December 31 were as follows:

(In millions) 2008 2007 2006

Service cost $ 74 $ 73 $ 71

Interest cost 242 231 223

Expected long-term return on plan assets (234) (209) (208)

Amortization of:

Net loss from past experience 57 119 152

Prior service cost (11) (1) (1)

Net pension cost $ 128 $ 213 $ 237

The Company expects to recognize in 2009 $54 million of pre-tax loss from amortization of past experience and $11 million of pre-

tax gain from amortization of prior service cost.

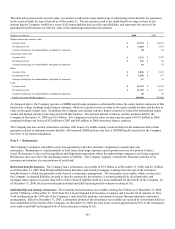

Other postretirement benefits. Unfunded retiree health benefit plans had accumulated benefit obligations of $235 million at

December 31, 2008, and $283 million at December 31, 2007. Retiree life insurance plans had accumulated benefit obligations of

$141 million as of December 31, 2008 and $143 million as of December 31, 2007.

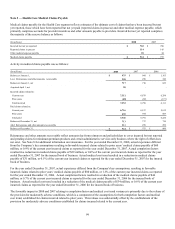

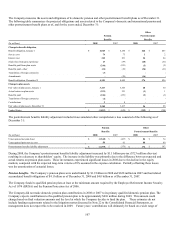

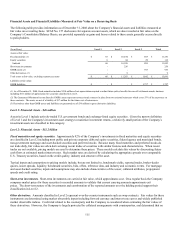

Components of net other postretirement benefit cost for the years ended December 31 were as follows:

(In millions) 2008 2007 2006

Service cost $ 1 $ 2 $ 2

Interest cost 24 24 26

Expected long-term return on plan assets (1) (1) (2)

Amortization of:

Net gain from past experience (8) (6) (2)

Prior service cost (17) (17) (17)

Net other postretirement benefit cost $ (1) $ 2 $ 7

The Company expects to recognize in 2009 $19 million of pre-tax gain related to amortization of prior service cost and $8 million of

pre-tax gain from amortization of past experience.

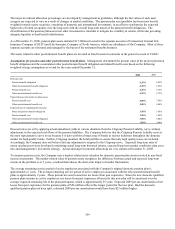

The estimated rate of future increases in the per capita cost of health care benefits beginning in 2009 through 2012 is 7%, decreasing

to 6% in 2013 and 5% thereafter. This estimate reflects the Company’s current claim experience and management’s estimate that

rates of growth will decline in the future. A 1% increase or decrease in the estimated rate would change 2008 reported amounts as

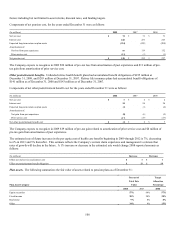

follows:

(In millions) Increase Decrease

Effect on total service and interest cost $ 1 $ 1

Effect on postretirement benefit obligation $ 11 $ 10

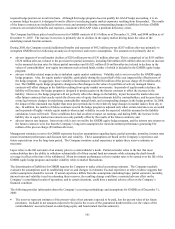

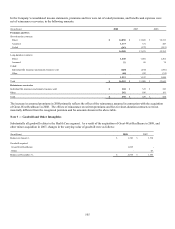

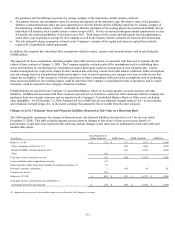

Plan assets. The following summarizes the fair value of assets related to pension plans as of December 31:

Percent of Target

Total Fair Allocation

Plan Asset Category Value Percentage

2008 2007 2008

Equity securities 57% 64% 57%

Fixed income 20% 20% 20%

Real estate 9% 8% 8%

Other 14% 8% 15%