Cigna 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

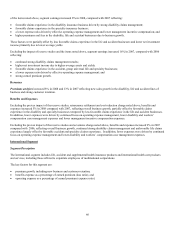

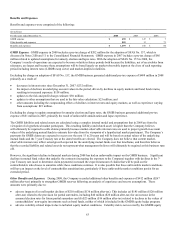

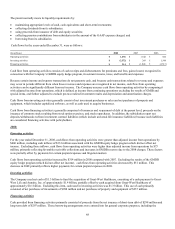

hedge program. Also, the equity market volatility, particularly during the second half of the year, impacted the effectiveness of

the hedge program. In aggregate, these volatility-related impacts totaled $182 million ($118 million after-tax). The GMDB equity

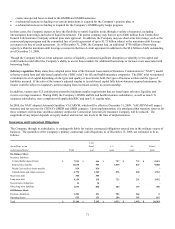

hedge program is designed so that changes in the value of a portfolio of actively managed futures contracts will offset changes in

the liability resulting from equity market movements. In periods of equity market declines, the liability will increase; the program

is designed to produce gains on the futures contracts to offset the increase in the liability. However, the program will not

perfectly offset the change in the liability, in part because the market does not offer futures contracts that exactly match the

diverse mix of equity fund investments held by contractholders, and because there is a time lag between changes in underlying

contractholder mutual funds, and corresponding changes in the hedge position. In 2008, the impact of this mismatch was higher

than most prior periods due to the relatively large changes in market indices from day to day. In addition, the number of futures

contracts used in the program is adjusted only when certain tolerances are exceeded and in periods of highly volatile equity

markets when actual volatility exceeds the expected volatility assumed in the liability calculation, losses will result. These

conditions have had an adverse impact on earnings, and during 2008, the increase in the liability due to equity market movements

was only partially offset by the results of the futures contracts; and

• adverse interest rate impacts. Interest rate risk is not covered by the GMDB equity hedge program, and the interest rate returns on

the futures contracts were less than the Company’s long-term assumption for mean investment performance generating an

additional $14 million ($9 million after-tax).

In addition to the reserve strengthening discussed above, other benefits and expenses were higher in 2008 than 2007 due to the impact

of changes in the equity markets on GMDB contracts. Equity markets decreased significantly in 2008 while they increased in 2007

leading to higher benefits expense in 2008. Equity market declines result in decreases in underlying annuity account values, which

increases the exposure under the contracts. These changes in benefits expense are partially offset by futures gains and losses,

discussed in Other Revenues above. In addition, benefits expense related to personal accident and workers’ compensation was

higher in 2008 than 2007, as a result of reduced favorable settlement activity in 2008.

Other benefits and expenses were lower in 2007, compared with 2006, due to lower expense in the workers’ compensation and

personal accident businesses, due to the impact of favorable claim experience and settlements and commutations that were favorable

to the Company’s reserved position. This was partially offset by higher benefits expense for the guaranteed minimum death benefit

business, as improvements in equity markets for 2007 were smaller than in 2006.

See Note 7 to the Consolidated Financial Statements for additional information about assumptions and reserve balances related to

GMDB.

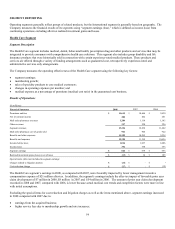

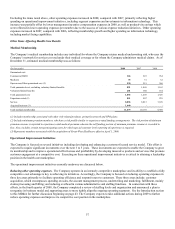

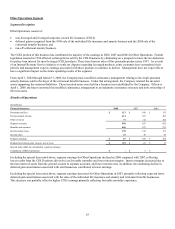

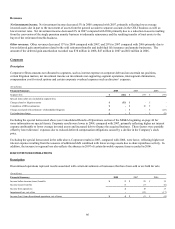

Segment Summary

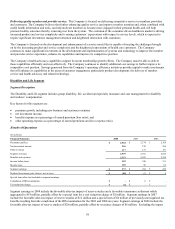

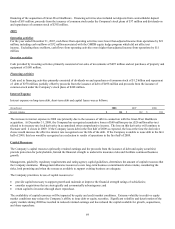

The Company's payment obligations for underlying reinsurance exposures assumed by the Company under these contracts are based

on ceding companies’ claim payments. For GMDB and GMIB, claim payments vary because of changes in equity markets and

interest rates, as well as mortality and policyholder behavior. For workers’ compensation and personal accident, the claim payments

relate to accidents and injuries. Any of these claim payments can extend many years into the future, and the amount of the ceding

companies’ ultimate claims, and therefore the amount of the Company's ultimate payment obligations and corresponding ultimate

collection from retrocessionaires may not be known with certainty for some time.

The Company’s reserves for underlying reinsurance exposures assumed by the Company, as well as for amounts recoverable from

retrocessionaires, are considered appropriate as of December 31, 2008, based on current information. However, it is possible that

future developments, which could include but are not limited to worse than expected claim experience and higher than expected

volatility, could have a material adverse effect on the Company’s consolidated results of operations and could have a material adverse

effect on the Company’s financial condition. The Company bears the risk of loss if its payment obligations to cedents increase or if its

retrocessionaires are unable to meet, or successfully challenge, their reinsurance obligations to the Company.