Cigna 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

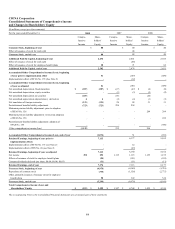

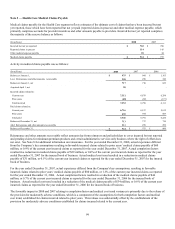

O. Health Care Medical Claims Payable

Medical claims payable for the Health Care segment include both reported claims and estimates for losses incurred but not yet

reported.

The Company develops these estimates using actuarial principles and assumptions based on historical and projected claim payment

patterns, medical cost trends, which are impacted by the utilization of medical services and the related costs of the services provided

(unit costs), benefit design, seasonality, and other relevant operational factors. The Company consistently applies these actuarial

principles and assumptions each reporting period, with consideration given to the variability of these factors, and recognizes the

actuarial best estimate of the ultimate liability within a level of confidence, as required by actuarial standards of practice, which

require that the liabilities be adequate under moderately adverse conditions.

The Company's estimate of the liability for medical claims incurred but not yet reported is primarily calculated using historical claim

payment patterns and expected medical cost trends. The Company analyzes the historical claim payment patterns by comparing the

dates claims were incurred, generally the dates services were provided, to the dates claims were paid to determine “completion

factors”, which are a measure of the time to process claims. A completion factor is calculated for each month of incurred claims. The

Company uses historical completion factors combined with an analysis of current trends and operational factors to develop current

estimates of completion factors. The Company estimates the ultimate liability for claims incurred in each month by applying the

current estimates of completion factors to the current paid claims data. The difference between this estimate of the ultimate liability

and the current paid claims data is the estimate of the remaining claims to be paid for each incurral month. These monthly estimates

are aggregated and included in the Company's Health Care medical claims payable at the end of each reporting period. Completion

factors are used to estimate the Health Care medical claims payable for all months where claims have not been completely resolved

and paid, except for the most recent month as described below.

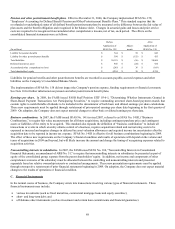

Completion factors are impacted by several key items including changes in the level of claims processed electronically versus

manually (auto-adjudication), changes in provider claims submission rates, membership changes and the mix of products. As noted,

the Company uses historical completion factors combined with an analysis of current trends and operational factors to develop current

estimates of completion factors. This approach implicitly assumes that historical completion rates will be a useful indicator for the

current period. It is possible that the actual completion rates for the current period will develop differently from historical patterns,

which could have a material impact on the Company's medical claims payable and net income.

Claims incurred in the most recent month have limited paid claims data, since a large portion of health care claims are not submitted to

the Company for payment in the month services have been provided. This makes the completion factor approach less reliable for

claims incurred in the most recent month. As a result, in any reporting period, for the estimates of the ultimate claims incurred in the

most recent month, the Company primarily relies on medical cost trend analysis, which reflects expected claim payment patterns and

other relevant operational considerations. Medical cost trend is impacted by several key factors including medical service utilization

and unit costs and the Company’s ability to manage these factors through benefit design, underwriting, provider contracting and the

Company's medical management initiatives. These factors are affected by changes in the level and mix of medical benefits offered,

including inpatient, outpatient and pharmacy, the impact of copays and deductibles, changes in provider practices and changes in

consumer demographics and consumption behavior.

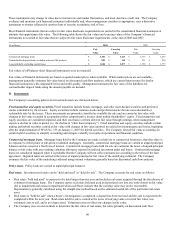

Because historical trend factors are often not representative of current claim trends, the trend experienced for the most recent history

along with an analysis of emerging trends, have been taken into consideration in establishing the liability for Health Care medical

claims payable at December 31, 2008 and 2007. It is possible that the actual medical trend for the current period will develop

differently from that expected, which could have a material impact on the Company's medical claims payable and net income.

For each reporting period, the Company evaluates key assumptions by comparing the assumptions used in establishing the medical

claims payable to actual experience. When actual experience differs from the assumptions used in establishing the liability, medical

claims payable are increased or decreased through current period net income. Additionally, the Company evaluates expected future

developments and emerging trends which may impact key assumptions. The estimation process involves considerable judgment,

reflecting the variability inherent in forecasting future claim payments. The adequacy of these estimates is highly sensitive to changes

in the Company's key assumptions, specifically completion factors, which are impacted by actual or expected changes in the

submission and payment of medical claims, and medical cost trends, which are impacted by actual or expected changes in the

utilization of medical services and unit costs.