Cigna 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

• The reserves include an estimate for partial surrenders that essentially lock in the death benefit for a particular policy based on

annual election rates that vary from 0-24% depending on the net amount at risk for each policy and whether surrender charges

apply.

• The mean investment performance assumption is 5% considering the Company’s GMDB equity hedge program using futures

contracts. This is reduced by fund fees ranging from 1-3% across all funds. The results of futures contracts are reflected in the

liability calculation as a component of investment returns.

• The volatility assumption is based on a review of historical monthly returns for each key index (e.g. S&P 500) over a period of at

least ten years. Volatility represents the dispersion of historical returns compared to the average historical return (standard

deviation) for each index. The assumption is 16-30%, varying by equity fund type; 4-10%, varying by bond fund type; and 2%

for money market funds. These volatility assumptions are used along with the mean investment performance assumption to

project future return scenarios.

• The discount rate is 5.75%.

• The mortality assumption is 70-75% of the 1994 Group Annuity Mortality table, with 1% annual improvement beginning January

1, 2000.

• The lapse rate assumption is 0-15%, depending on contract type, policy duration and the ratio of the net amount at risk to account

value.

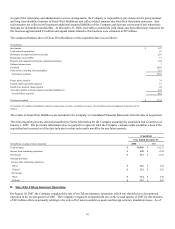

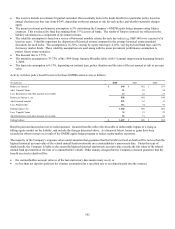

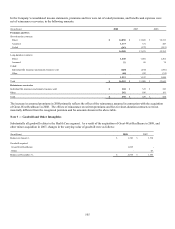

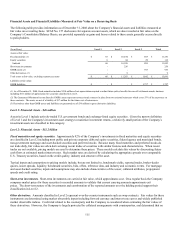

Activity in future policy benefit reserves for these GMDB contracts was as follows:

(In millions) 2008 2007 2006

Balance at January 1 $ 848 $ 862 $ 951

Add: Unpaid Claims 21 22 24

Less: Reinsurance and other amounts recoverable 19 22 27

Balance at January 1, net 850 862 948

Add: Incurred benefits 822 62 11

Less: Paid benefits 112 74 97

Ending balance, net 1,560 850 862

Less: Unpaid Claims 34 21 22

Add: Reinsurance and other amounts recoverable 83 19 22

Ending balance $ 1,609 $ 848 $ 862

Benefits paid and incurred are net of ceded amounts. Incurred benefits reflect the favorable or unfavorable impact of a rising or

falling equity market on the liability, and include the charges discussed above. As discussed below, losses or gains have been

recorded in other revenues as a result of the GMDB equity hedge program to reduce equity market exposures.

The majority of the Company’s exposure arises under annuities that guarantee that the benefit received at death will be no less than the

highest historical account value of the related mutual fund investments on a contractholder’s anniversary date. Under this type of

death benefit, the Company is liable to the extent the highest historical anniversary account value exceeds the fair value of the related

mutual fund investments at the time of a contractholder’s death. Other annuity designs that the Company reinsured guarantee that the

benefit received at death will be:

• the contractholders account value as of the last anniversary date (anniversary reset); or

• no less than net deposits paid into the contract accumulated at a specified rate or net deposits paid into the contract.