Cigna 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

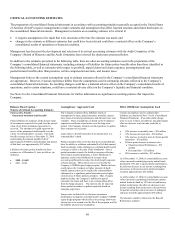

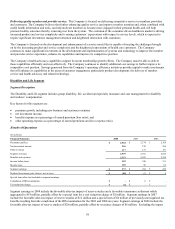

Balance Sheet Caption /

Nature of Critical Accounting Estimate

Assumptions / Approach Used Effect if Different Assumptions Used

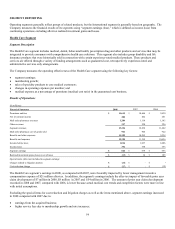

manage these factors through benefit design, underwriting,

provider contracting and the Company's medical

management initiatives. These factors are affected by

changes in the level and mix of medical benefits offered,

including inpatient, outpatient and pharmacy, the impact of

copays and deductibles, changes in provider practices and

changes in consumer demographics and consumption

behavior.

Because historical trend factors are often not representative

of current claim trends, the trend experienced for the most

recent history along with an analysis of emerging trends,

have been taken into consideration in establishing the

liability for medical claims payable at December 31, 2008

and 2007. It is possible that the actual medical trend for the

current period will develop differently from the expected,

which could have a material impact on the Company's

medical claims payable and net income.

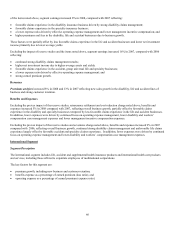

For each reporting period, the Company evaluates key

assumptions by comparing the assumptions used in

establishing the medical claims payable to actual experience.

When actual experience differs from the assumptions used in

establishing the liability, medical claims payable are

increased or decreased through current period net income.

Additionally, the Company evaluates expected future

developments and emerging trends which may impact key

assumptions. The estimation process involves considerable

judgment, reflecting the variability inherent in forecasting

future claim payments. The adequacy of these estimates is

highly sensitive to changes in the Company's key

assumptions, specifically completion factors, which are

impacted by actual or expected changes in the submission

and payment of medical claims, and medical cost trends,

which are impacted by actual or expected changes in the

utilization of medical services and unit costs.

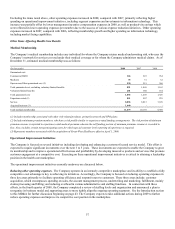

Accounts payable, accrued expenses and other

liabilities, and Other assets -

Guaranteed minimum income benefits

These liabilities are estimates of the present value

of net amounts expected to be paid, less the present

value of net future premiums expected to be

received. The amounts to be paid represent the

excess of the expected value of the income benefit

over the value of the annuitants’ accounts at the

time of annuitization.

The assets associated with these contracts represent

receivables in connection with reinsurance that the

Company has purchased from two external

reinsurers, which covers 55% of the exposures on

these contracts.

As discussed in Note 2(B) to the Consolidated

Financial Statements, the Company implemented

SFAS No. 157, “Fair Value Measurements,” on

January 1, 2008. At adoption, the Company was

required to change certain assumptions. As a

result, the Company recorded a charge of $131

million after-tax, net of reinsurance ($202 million

pre-tax).

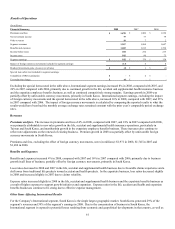

With the adoption of SFAS No. 157, the Company updated

assumptions to reflect those that the Company believes a

hypothetical market participant would use to determine a

current exit price. The Company estimates a hypothetical

market participant's view of these assumptions considering

market observable information, the actual and expected

experience of the Company, and other relevant and available

industry sources. Resulting changes in fair value are

reported in GMIB expense.

The Company considers the various assumptions used to

estimate the fair values of assets and liabilities associated

with those contracts in two categories. The first group of

assumptions used to estimate these fair values consist of

capital market inputs including market returns and discount

rates, claim interest rates and market volatility.

Interest rates include (a) market returns, (b) the liability

discount rate assumption and (c) the projected interest rates

used to calculate the reinsured income benefit at the time of

annuitization (claim interest rate).

Volatility refers to the degree of variation of future market

returns of the underlying mutual fund investments.

Current assumptions used to estimate these

liabilities are detailed in Note 11 to the Consolidated

Financial Statements. With the adoption of SFAS

No. 157, the Company's results of operations are

expected to be more volatile in future periods

because these assumptions will be based largely on

market-observable inputs at the close of each period

including interest rates and market implied

volatilities.

If an unfavorable change were to occur in these

assumptions, the approximate after-tax decrease in

net income, net of estimated amounts receivable

from reinsurers, would be as follows:

• 50 basis point decrease in interest rates

(which are aligned with LIBOR) used for

projecting market returns and discounting –

$25 million

• 50 basis point decrease in interest rates used

for projecting claim exposure (7-year

Treasury rates) – $20 million

• 20% increase in implied market volatility –

$5 million