Cigna 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

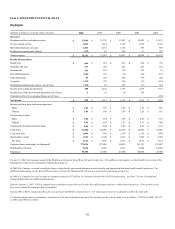

Balance Sheet Caption /

Nature of Critical Accounting Estimate

Assumptions / Approach Used

Effect if Different Assumptions Used

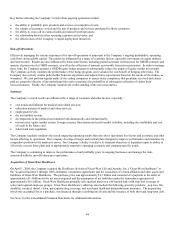

During 2007, the Company increased its

assumption related to annuity election rates and

decreased its lapse assumption resulting in a charge

(net of reinsurance) of $86 million pre-tax ($56

million after-tax).

Liabilities related to these contracts as of

December 31, were as follows (in millions):

• 2008 – $1,757

• 2007– $313

As of December 31, estimated amounts receivable

related to these contracts from two external

reinsurers, were as follows (in millions):

• 2008 – $953

• 2007– $173

The second group of assumptions consists of future

annuitant behavior including annuity election rates, lapse,

and mortality, retrocessionaire credit risk, and a risk and

profit charge.

Annuity election rates refer to the proportion of annuitants

who elect to receive their income benefit as an annuity.

Lapse refers to the full surrender of an annuity prior to

annuitization of the policy.

Credit risk refers to the ability of these reinsurers to pay.

Risk and profit charge refers to the amount that a

hypothetical market participant would include in the

valuation to cover the uncertainty of outcomes and the

desired return on capital.

• 10% decrease in mortality – $3 million

• 10% increase in annuity election rates – $5

million

• 10% decrease in lapse rates – $10 million

• 10% decrease in amounts receivable from

reinsurers (credit risk) – $60 million

• 10% increase to the risk and profit charge –

$5 million

Market declines which reduce annuitants’ account

values expose the Company to higher potential

claims which results in a larger net liability. If

annuitants' account values as of December 31, 2008

declined by 10% due to the performance of the

underlying mutual funds, the approximate after-tax

decrease in net income, net of estimated amounts

receivable from reinsurers, would be approximately

$25 million.

All of these estimated impacts due to unfavorable

changes in assumptions could vary from quarter to

quarter depending on actual reserve levels, the

actual market conditions or changes in the

anticipated view of a hypothetical market participant

as of any future valuation date.

The amounts would be reflected in the Run-off

Reinsurance segment.

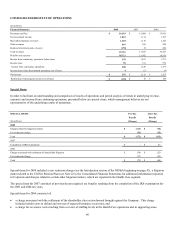

Reinsurance recoverables – Reinsurance

recoverables in Run-off Reinsurance

Collectibility of reinsurance recoverables requires

an assessment of risks that such amounts will not

be collected, including risks associated with

reinsurer default and disputes with reinsurers

regarding applicable coverage.

Gross and net reinsurance recoverables in the Run-

off Reinsurance segment as of December 31, were

as follows (in millions):

• 2008 – gross $180; net $169

• 2007 – gross $203; net $191

The amount of reinsurance recoverables in the Run-off

Reinsurance segment, net of reserves, represents

management’s best estimate of recoverability, including an

assessment of the financial strength of reinsurers.

A 10% reduction of net reinsurance recoverables

due to uncollectibility at December 31, 2008, would

reduce net income by approximately $11 million

after-tax.

The amounts would be reflected in the Run-off

Reinsurance segment.

See Note 8 to the Consolidated Financial Statements

for additional information.

Accounts payable, accrued expenses and other

liabilities--pension liabilities

These liabilities are estimates of the present value

of the qualified and nonqualified pension benefits

to be paid (attributed to employee service to date)

net of the fair value of plan assets. The accrued

pension benefit liability as of December 31 was as

follows (in millions):

• 2008 – $1,853

• 2007 – $628

See Note 10 to the Consolidated Financial

Statements for additional information.

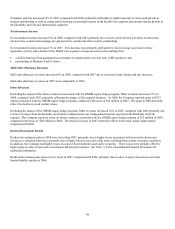

The Company estimates these liabilities with actuarial

models using various assumptions including discount rates

and an expected long-term return on plan assets.

Discount rates are set by applying actual annualized yields at

various durations from the Citigroup Pension Liability curve,

without adjustment, to the expected cash flows of the

pension liabilities.

The expected long-term return on plan assets for the

domestic qualified pension plan is developed considering

actual historical returns, expected long-term market

conditions, plan asset mix and management’s investment

strategy. In addition, to measure pension costs the Company

uses a market-related asset value method for domestic

qualified pension plan assets invested in non-fixed income

investments, which are approximately 80% of total plan

assets. This method recognizes the difference between

actual and expected returns in the non-fixed income

portfolio over 5 years, a method that reduces the short-term

impact of market fluctuations on pension cost.

Using past experience, the Company expects that it

is reasonably possible that a favorable or

unfavorable change in these key assumptions of 50

basis points could occur. An unfavorable change is

a decrease in these key assumptions with resulting

impacts as discussed below.

If discount rates for the qualified and nonqualified

pension plans decreased by 50 basis points:

• annual pension costs for 2009 would increase

by approximately $15 million, after-tax; and

• the accrued pension benefit liability would

increase by approximately $180 million as of

December 31, 2008 resulting in an after-tax

decrease to shareholders’ equity of

approximately $120 million as of December

31, 2008.

If the expected long-term return on domestic

qualified pension plan assets decreased by 50 basis

points, annual pension costs for 2009 would