Cigna 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

Key factors affecting the Company’s results from ongoing operations include:

• the ability to profitably price products and services at competitive levels;

• the volume of customers served and the mix of products and services purchased by those customers;

• the ability to cross sell its various health and related benefit products;

• the relationship between other operating expenses and revenue; and

• the effectiveness of the Company’s capital deployment initiatives.

Run-off Operations

Effectively managing the various exposures of its run-off operations is important to the Company’s ongoing profitability, operating

cash flows and available capital. The results are influenced by a range of economic factors, especially movements in equity markets

and interest rates. Results are also influenced by behavioral factors, including partial surrender election rates for GMDB contracts and

annuity election rates for GMIB contracts, as well as the collection of amounts recoverable from retrocessionaires. In order to manage

these risks, the Company operates a GMDB equity hedge program to substantially reduce the impact of equity market movements.

The Company actively monitors the performance of the hedge program, and evaluates the cost/benefit of hedging other risks. The

Company also actively studies policyholder behavior experience and adjusts future expectations based on the results of the studies, as

warranted. We also perform regular audits of the ceding companies to ensure treaty compliance that premiums received and claims

paid are properly reflective of the underlying risks and to maximize the probability of subsequent collection of claims from

retrocessionaires. Finally, the Company monitors the credit standing of the retrocessionaires.

Summary

The Company’s overall results are influenced by a range of economic and other factors, especially:

• cost trends and inflation for medical and related services;

• utilization patterns of medical and other services;

• employment levels;

• the tort liability system;

• developments in the political environment both domestically and internationally;

• interest rates, equity market returns, foreign currency fluctuations and credit market volatility, including the availability and cost

of credit in the future; and

• federal and state regulation.

The Company regularly monitors the trends impacting operating results from the above mentioned key factors and economic and other

factors affecting its operations. The Company develops strategic and tactical plans designed to improve performance and maximize its

competitive position in the markets it serves. The Company’s ability to achieve its financial objectives is dependent upon its ability to

effectively execute these plans and to appropriately respond to emerging economic and company-specific trends.

The Company is continuing to improve the performance of and profitably grow its ongoing businesses and manage the risks

associated with the run-off reinsurance operations.

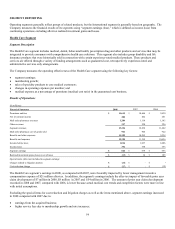

Acquisition of Great-West Healthcare

On April 1, 2008, the Company acquired the Healthcare division of Great-West Life and Annuity, Inc. (“Great-West Healthcare” or

the “acquired business”) through 100% indemnity reinsurance agreements and the acquisition of certain affiliates and other assets and

liabilities of Great-West Healthcare. The purchase price was approximately $1.5 billion and consisted of a payment to the seller of

approximately $1.4 billion for the net assets acquired and the assumption of net liabilities under the reinsurance agreement of

approximately $0.1 billion. Great-West Healthcare primarily sells medical plans on a self-funded basis with stop-loss coverage to

select and regional employer groups. Great-West Healthcare’s offerings also include the following specialty products: stop-loss, life,

disability, medical, dental, vision, prescription drug coverage, and accidental death and dismemberment insurance. The acquisition,

which was accounted for as a purchase, was financed through a combination of cash and the issuance of both short and long-term debt.

See Note 3 to the Consolidated Financial Statements for additional information.