Cigna 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

121

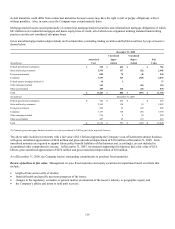

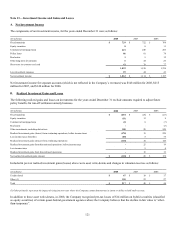

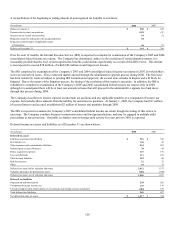

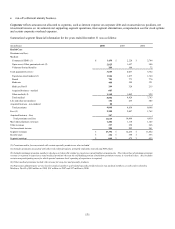

Note 13— Investment Income and Gains and Losses

A. Net Investment Income

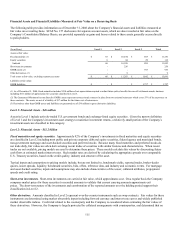

The components of net investment income, for the years ended December 31 were as follows:

(In millions) 2008 2007 2006

Fixed maturities $ 729 $ 722 $ 768

Equity securities 8 8 11

Commercial mortgage loans 219 240 266

Policy loans 86 81 78

Real estate 1 5 12

Other long-term investments 6 24 26

Short-term investments and cash 43 78 77

1,092 1,158 1,238

Less investment expenses 29 44 43

Net investment income $ 1,063 $ 1,114 $ 1,195

Net investment income for separate accounts (which is not reflected in the Company’s revenues) was $148 million for 2008, $215

million for 2007, and $140 million for 2006.

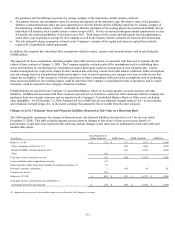

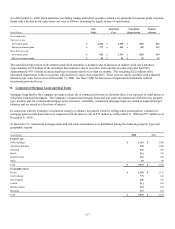

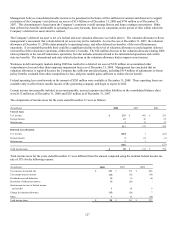

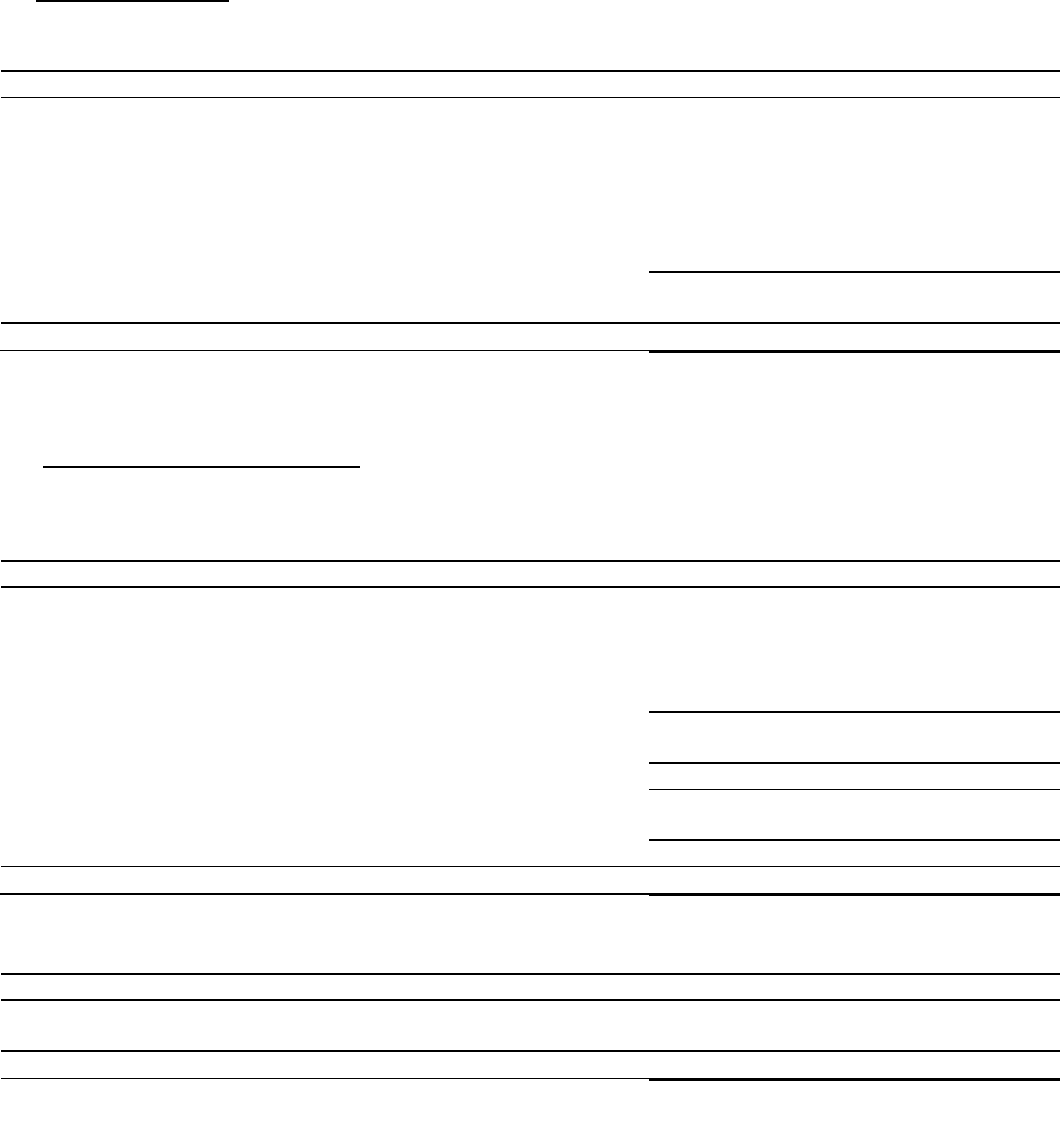

B. Realized Investment Gains and Losses

The following realized gains and losses on investments for the years ended December 31 exclude amounts required to adjust future

policy benefits for run-off settlement annuity business.

(In millions) 2008 2007 2006

Fixed maturities $(237) $(26) $(25)

Equity securities (31) 13 8

Commercial mortgage loans (2) 8 (7)

Real estate - - (5)

Other investments, including derivatives 100 20 249

Realized investment gains (losses) from continuing operations, before income taxes (170) 15 220

Less income taxes (benefits) (60) 5 75

Realized investment gains (losses) from continuing operations (110) 10 145

Realized investment gains from discontinued operations, before income taxes - 25 19

Less income taxes - 9 6

Realized investment gains from discontinued operations - 16 13

Net realized investment gains (losses) $(110) $ 26 $ 158

Included in pre-tax realized investment gains (losses) above were asset write-downs and changes in valuation reserves as follows:

(in millions) 2008 2007 2006

Credit related $ 67 $ 18 $ 17

Other (1) 150 22 27

Total $ 217 $ 40 $ 44

(1) Other primarily represents the impact of rising interest rates where the Company cannot demonstrate its intent or ability to hold until recovery.

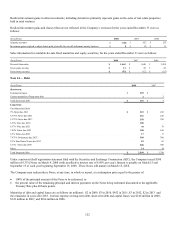

In addition to these asset write-downs, in 2008, the Company recognized pre-tax losses of $14 million on hybrid securities (classified

as equity securities) of certain quasi-federal government agencies where the Company believes that the decline in fair value is “other-

than-temporary”.