Cigna 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

foreign currency movements affecting the South Korean currency, which could have a significant impact on the segment’s results and

the Company’s consolidated financial results.

Run-off Reinsurance Segment

Segment Description

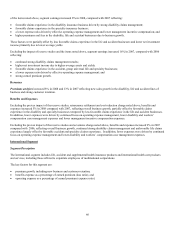

The Company’s reinsurance operations were discontinued and are now an inactive business in run-off mode since the sale of the U.S.

individual life, group life and accidental death reinsurance business in 2000. This segment is predominantly comprised of guaranteed

minimum death benefit (GMDB, also known as VADBe), guaranteed minimum income benefit (GMIB), workers’ compensation and

personal accident reinsurance products.

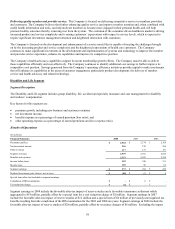

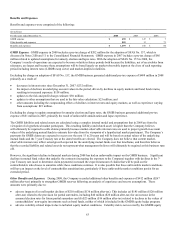

The determination of liabilities for GMDB and GMIB requires the Company to make critical accounting estimates. The Company has

updated the assumptions for GMIB and the effects of hypothetical changes in those assumptions in connection with the

implementation of SFAS No. 157. The Company describes the assumptions used to develop the reserves for GMDB and the assets

and liabilities for GMIB and provides the effects of hypothetical changes in those assumptions in the Critical Accounting Estimates

section of the MD&A beginning on page 49.

Results of Operations

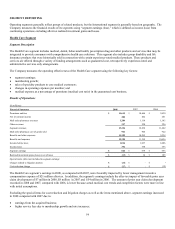

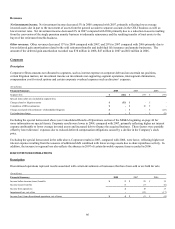

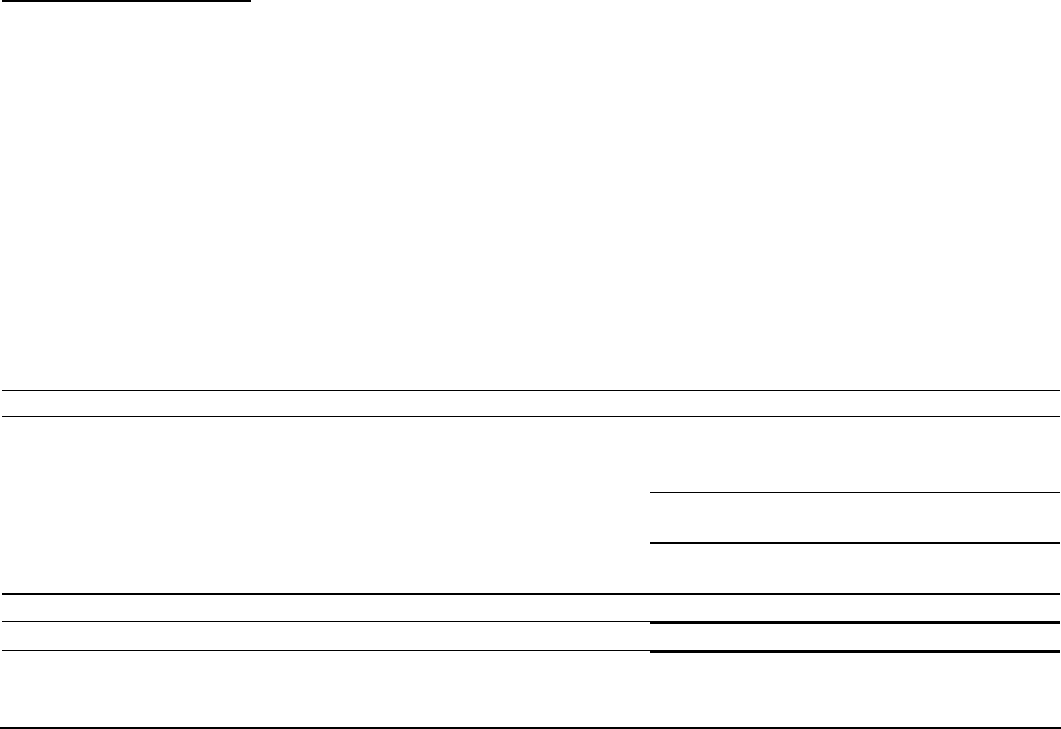

(In millions)

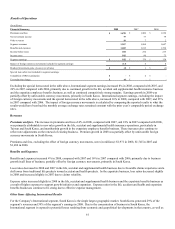

Financial Summary 2008 2007 2006

Premiums and fees $ 43 $ 60 $ 64

Net investment income 104 93 95

Other revenues 331 (47) (97)

Segment revenues 478 106 62

Benefits and expenses 1,499 160 80

Loss before income tax benefits (1,021) (54) (18)

Income tax benefits (375) (43) (4)

Segment loss $(646) $(11) $(14)

Realized investment gains (losses), net of taxes $(19) $ 2 $ 22

Results of GMIB business (after-tax) included in segment earnings (loss):

Charge on adoption of SFAS No. 157 for GMIB contracts $(131) $ - $ -

Results of GMIB business excluding charge on adoption $(306) $(91) $(1)

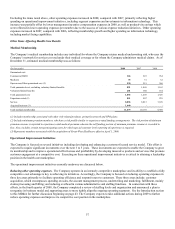

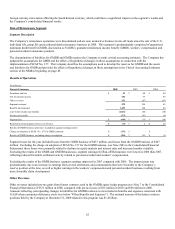

Segment losses for the year included losses from the GMIB business of $437 million, and losses from the GMDB business of $267

million. Excluding the charge on adoption of SFAS No. 157 for the GMIB business, (see Note 2(B) to the Consolidated Financial

Statements) these losses were primarily related to declines in equity markets and interest rates and increased market volatility.

Excluding the results of the GMIB and GMDB businesses, segment earnings for Run-off Reinsurance were lower in 2008 than 2007,

reflecting reduced favorable settlement activity related to personal accident and workers’ compensation.

Excluding the results of the GMIB business, segment earnings improved in 2007 compared with 2006. The improvement was

predominantly due to an increase in earnings from several settlements and commutations that were favorable to the Company’s

reserve position at the time, as well as higher earnings in the workers’ compensation and personal accident business, resulting from

more favorable claim development.

Other Revenues

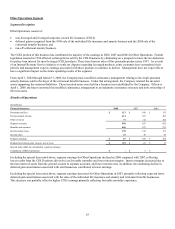

Other revenues included pre-tax gains from futures contracts used in the GMDB equity hedge program (see Note 7 to the Consolidated

Financial Statements) of $333 million in 2008, compared with pre-tax losses of $32 million in 2007 and $96 million in 2006.

Amounts reflecting corresponding changes in liabilities for GMDB contracts were included in benefits and expenses consistent with

GAAP when a premium deficiency exists (see below “Other Benefits and Expenses”). The notional amount of the futures contract

positions held by the Company at December 31, 2008 related to this program was $1.4 billion.