Cigna 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Cigna annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

122

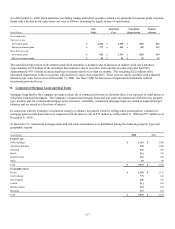

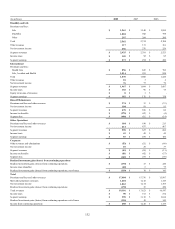

Realized investment gains in other investments, including derivatives primarily represent gains on the sales of real estate properties

held in joint ventures.

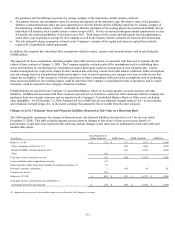

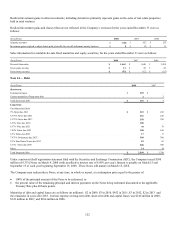

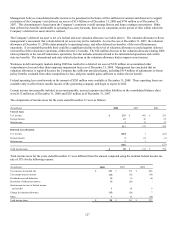

Realized investment gains and (losses) that are not reflected in the Company’s revenues for the years ended December 31 were as

follows:

(In millions) 2008 2007 2006

Separate accounts $ (146) $ 652 $ 207

Investment gains required to adjust future policy benefits for run-off settlement annuity business $ 8 $ 18 $ 11

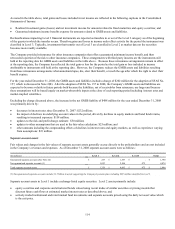

Sales information for available-for-sale fixed maturities and equity securities, for the years ended December 31 were as follows:

(In millions) 2008 2007 2006

Proceeds from sales $ 1,465 $ 1,040 $ 3,458

Gross gains on sales $ 13 $ 26 $ 49

Gross losses on sales $(53) $(12) $(55)

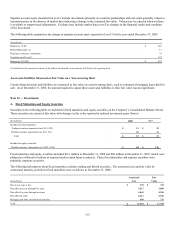

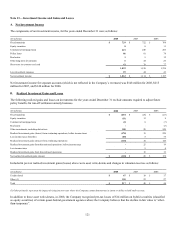

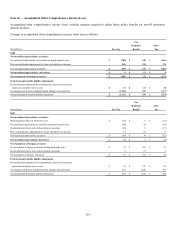

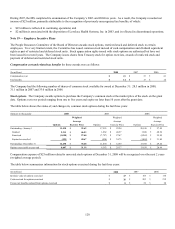

Note 14 ― Debt

(In millions) 2008 2007

Short-term:

Commercial paper $ 299 $ -

Current maturities of long-term debt 2 3

Total short-term debt $ 301 $ 3

Long-term:

Uncollateralized debt:

7% Notes due 2011 $ 222 $ 222

6.375% Notes due 2011 226 226

5.375% Notes due 2017 250 250

6.35% Note due 2018 300 -

6.37% Note due 2021 78 78

7.65% Notes due 2023 100 100

8.3% Notes due 2023 17 17

7.875% Debentures due 2027 300 300

8.3% Step Down Notes due 2033 83 83

6.15% Notes due 2036 500 500

Other 14 14

Total long-term debt $ 2,090 $ 1,790

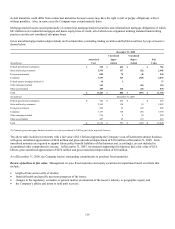

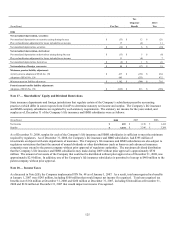

Under a universal shelf registration statement filed with the Securities and Exchange Commission (SEC), the Company issued $300

million of 6.35% Notes on March 4, 2008 (with an effective interest rate of 6.68% per year). Interest is payable on March 15 and

September 15 of each year beginning September 15, 2008. These Notes will mature on March 15, 2018.

The Company may redeem these Notes, at any time, in whole or in part, at a redemption price equal to the greater of:

• 100% of the principal amount of the Notes to be redeemed; or

• the present value of the remaining principal and interest payments on the Notes being redeemed discounted at the applicable

Treasury Rate plus 40 basis points.

Maturities of debt and capital leases are as follows (in millions): $2 in 2009, $3 in 2010, $452 in 2011, $3 in 2012, $2 in 2013 and

the remainder in years after 2013. Interest expense on long-term debt, short-term debt and capital leases was $146 million in 2008,

$122 million in 2007, and $104 million in 2006.