Capital One 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2001, the Company expects to reclassify $58,946 of net

losses after tax on derivative instruments from cumulative other

comprehensive income to earnings during the next 12 months as interest

payments and receipts on the related derivative instruments occur.

Hedge of Net Investment in Foreign Operations

The Company uses cross-currency swaps to protect the value of its

investment in its foreign subsidiaries. Realized and unrealized gains

and losses from these hedges are not included in the income statement,

but are shown in the cumulative translation adjustment account

included in other comprehensive income. The purpose of these hedges

is to protect against adverse movements in exchange rates.

For the year ended December 31, 2001, net losses of $605 related to

these derivatives was included in the cumulative translation adjustment.

Non-Trading Derivatives

The Company uses interest rate swaps to manage interest rate

sensitivity related to loan securitizations. The Company enters into

interest rate swaps with its securitization trust and essentially offsets

the derivative with separate interest rate swaps with third parties. These

derivatives do not qualify as hedges and are recorded on the balance

sheet at fair value with changes in value included in current earnings.

During the year ended December 31, 2001, the Company recognized

substantially no net gains or losses related to these derivatives.

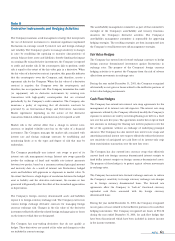

Derivative Instruments and Hedging Activities—

Pre-SFAS 133

The Company has entered into interest rate swaps to effectively convert

certain interest rates on bank notes from variable to fixed. The pay-

fixed, receive-variable swaps, which had a notional amount totaling

$157,000 as of December 31, 2000, will mature from 2001 to 2007 to

coincide with maturities of the variable bank notes to which they are

designated. The Company has also entered into interest rate swaps and

amortizing notional interest rate swaps to effectively reduce the interest

rate sensitivity of loan securitizations. These pay-fixed, receive-variable

interest rate swaps had notional amounts totaling $2,050,000 as of

December 31, 2000. The interest rate swaps will mature from 2002 to

2005, and the amortizing notional interest rate swaps will fully

amortize between 2004 and 2006 to coincide with the estimated

paydown of the securitizations to which they are designated. The

Company also had a pay-fixed, receive-variable interest rate swap with

an amortizing notional amount of $545,000, which will amortize

through 2003 to coincide with the estimated attrition of the fixed rate

Canadian dollar consumer loans to which it is designated.

The Company has also entered into currency swaps that effectively

convert fixed rate pound sterling interest receipts to fixed rate U.S.

dollar interest receipts on pound sterling denominated assets. These

currency swaps had notional amounts totaling $261,000 as of

December 31, 2000, and mature from 2001 to 2005, coinciding with

the repayment of the assets to which they are designated.

The Company has entered into foreign exchange contracts to reduce

the Company's sensitivity to foreign currency exchange rate changes

on its foreign currency denominated assets and liabilities. As of

December 31, 2000, the Company had foreign exchange contracts with

notional amounts totaling $665,284 that mature in 2001 to coincide

with the repayment of the assets to which they are designated.

Note P

Significant Concentration of Credit Risk

The Company is active in originating consumer loans, primarily in the

United States. The Company reviews each potential customer's credit

application and evaluates the applicant's financial history and ability

and willingness to repay. Loans are made primarily on an unsecured

basis; however, certain loans require collateral in the form of cash

deposits. International consumer loans are originated primarily in

Canada and the United Kingdom. The geographic distribution of the

Company's consumer loans was as follows:

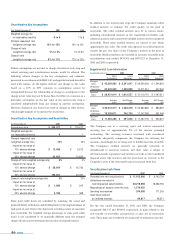

Note Q

Disclosures About Fair Value of Financial

Instruments

The following discloses the fair value of financial instruments whether

or not recognized in the balance sheets as of December 31, 2001 and

2000. In cases where quoted market prices are not available, fair values

are based on estimates using present value or other valuation

techniques. Those techniques are significantly affected by the

assumptions used, including the discount rate and estimates of future

cash flows. In that regard, the derived fair value estimates cannot be

substantiated by comparison to independent markets and, in many

cases, could not be realized in immediate settlement of the instrument.

As required under GAAP, these disclosures exclude certain financial

62 notes

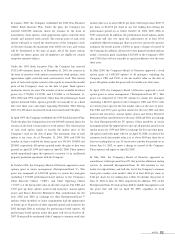

December 31 2001 2000

Percentage Percentage

Geographic Region: Loans of Total Loans of Total

South $15,400,081 34.02% $ 9,869,290 33.43%

West 9,354,934 20.67 5,962,360 20.19

Midwest 8,855,719 19.56 5,694,318 19.29

Northeast 7,678,378 16.97 5,016,719 16.99

International 3,974,851 8.78 2,981,339 10.10

45,263,963 100.00% 29,524,026 100.00%

Less securitized

balances (24,342,949) (14,411,314)

Total $20,921,014 $ 15,112,712