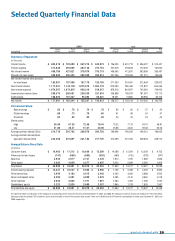

Capital One 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

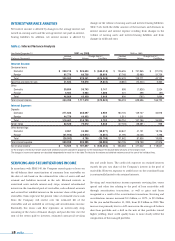

Servicing and securitizations income decreased $34.7 million, or 3%, to

$1.2 billion for the year ended December 31, 2000, compared to 1999.

This decrease was primarily due to an increase in net charge-offs on

such loans as a result of the seasoning of accounts combined with a

change in customer usage patterns,resulting in decreases of certain fees.

Certain estimates inherent in the determination of the fair value of the

retained interests are influenced by factors outside the Company’s

control, and as a result, such estimates could materially change in the

near term. Any future gains that will be recognized in accordance with

SFAS 140 will be dependent on the timing and amount of future

securitizations. The Company intends to continuously assess the

performance of new and existing securitization transactions as

estimates of future cash flows change.

OTHER NON-INTEREST INCOME

Interchange income increased $142.0 million, or 60%, to $379.8

million for the year ended December 31, 2001, from $237.8 million in

2000. This increase was primarily attributable to increased purchase

volume and new account growth for the year ended December 31,

2001. Service charges and other customer-related fees decreased by

$45.3 million, or 3%, to $1.6 billion for the year ended December 31,

2001. This decrease was primarily due to the shift in the mix of the

reported loan portfolio toward a greater composition of lower fee-

generating loans, offset by a 39% increase in the average number of

accounts in 2001.

Interchange income increased $93.5 million, or 65%, to $237.8 million

for the year ended December 31, 2000, from $144.3 million in 1999.

Service charges and other customer-related fees increased to $1.6

billion, or 58%, for the year ended December 31, 2000, compared to

$1.0 billion for the year ended December 31, 1999. These increases

were primarily due to a 41% increase in the average number of

accounts for the year ended December 31, 2000, from 1999, an increase

in purchase volume, customer usage patterns and increased purchases

of cross-sell products.

NON-INTEREST EXPENSE

Non-interest expense for the year ended December 31, 2001, increased

$910.4 million, or 29%, to $4.1 billion from $3.1 billion for the year

ended December 31, 2000. Contributing to the increase in non-interest

expense were marketing expenses, which increased $176.8 million, or

20%, to $1.1 billion in 2001, from $906.1 million in 2000. The increase

in marketing expenses during 2001 reflects the Company’s continued

identification of and investments in opportunities for growth, as well

as our marketing extension into television advertisements. Salaries and

associate benefits increased $368.7 million, or 36%, to $1.4 billion in

2001, from $1.0 billion in 2000, as the Company added approximately

2,400 net new associates to our staffing levels to manage the growth in

the Company’s accounts. All other non-interest expenses increased

$364.8 million, or 30%, to $1.6 billion for the year ended December 31,

2001, from $1.2 billion in 2000. The increase in other non-interest

expenses was primarily composed of

increased depreciation expense due to

premises and equipment growth,

increased collections costs as a result of

increased collection and recovery

efforts, and non-recurring expenses

such as the write-off of an investment

in an ancillary business as well as costs

associated with the mailing of

amendments to customer account

agreements. The increase was also driven by the 39% increase in

average accounts.

Non-interest expense for the year ended December 31, 2000, increased

$682.7 million, or 28%, to $3.1 billion from $2.5 billion for the year

ended December 31, 1999. Contributing to the increase in non-interest

expense were marketing expenses which increased $174.2 million, or

24%, to $906.1 million in 2000, from $731.9 million in 1999. The

increase in marketing expenses during 2000 reflects the Company’s

continued identification of and investments in opportunities for

growth. Salaries and associate benefits increased $243.2 million, or

31%, to $1.0 billion in 2000, from $780.2 million in 1999, as the

Company added approximately 3,800 net new associates to our staffing

levels to manage the growth in the Company’s accounts.All other non-

interest expenses increased $265.2 million, or 28%, to $1.2 billion for

the year ended December 31, 2000, from $952.9 million in 1999. The

increase in other non-interest expense, as well as the increase in salaries

and associate benefits, was primarily a result of a 41% increase in the

average number of accounts for the year ended December 31, 2000,

and the Company’s continued exploration and testing of new products

and markets.

INCOME TAXES

The Company’s income tax rate was 38%, 38% and 37%, for the years

ended December 31, 2001, 2000 and 1999, respectively. The effective

rate includes both state and federal income tax components.

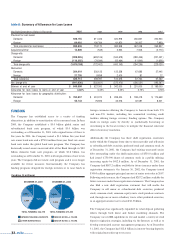

ASSET QUALITY

The asset quality of a portfolio is generally a function of the initial

underwriting criteria used, levels of competition, account management

activities and demographic concentration, as well as general economic

conditions. The seasoning of the accounts is also an important factor

in the delinquency and loss levels of the portfolio. Accounts tend to

exhibit a rising trend of delinquency and credit losses as they season.

As of December 31, 2001 and 2000, 58% and 60% of managed

accounts, respectively, representing 51% of the total managed loan

balance, were less than eighteen months old. Accordingly, it is likely

that the Company’s managed loan portfolio could experience

increased levels of delinquency and credit losses as the average age of

the Company’s accounts increases.

md&a 29