Capital One 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If these assumptions are not met or change, the interest-only strip and

related servicing and securitizations income would be affected. The

following adverse changes to the key assumptions and estimates,

presented in accordance with SFAS 140, are hypothetical and should be

used with caution. As the figures indicate, any change in fair value

based on a 10% or 20% variation in assumptions cannot be

extrapolated because the relationship of change in assumption to the

change in fair value may not be linear. Also, the effect of a variation in a

particular assumption on the fair value of the interest-only strip is

calculated independently from any change in another assumption.

However, changes in one factor may result in changes in other factors,

which might magnify or counteract the sensitivities.

Static pool credit losses are calculated by summing the actual and

projected future credit losses and dividing them by the original balance of

each pool of asset. Due to the short-term revolving nature of consumer

loan receivables, the weighted average percentage of static pool credit

losses is not considered to be materially different from the assumed

charge-off rates used to determine the fair value of retained interests.

In addition to the interest-only strip, the Company maintains other

residual interests to enhance the credit quality of the pool of

receivables. The other residual interests may be in various forms,

including subordinated interests in the transferred receivables, cash

collateral accounts and accrued but unbilled interest on the transferred

receivables. These other residual interests are carried at cost, which

approximates fair value. The credit risk exposure on residual interests

exceeds the pro rata share of the Company’s interest in the pool of

receivables. Residual interests are recorded in accounts receivable from

securitizations and totaled $934,305 and $479,123 at December 31,

2001 and 2000, respectively.

The Company acts as a servicing agent and receives contractual

servicing fees of approximately 2% of the investor principal

outstanding. The servicing revenues associated with transferred

receivables adequately compensate the Company for servicing the

accounts. Accordingly, no servicing asset or liability has been recorded.

The Company’s residual interests are generally restricted or

subordinated to investors’ interests and their value is subject to

substantial credit, repayment and interest rate risks on the transferred

financial assets. The investors and the trusts have no recourse to the

Company’s assets if the securitized loans are not paid when due.

For the year ended December 31, 2001 and 2000, the Company

recognized $68,135 and $30,466, respectively, in gains related to the

new transfer of receivables accounted for as sales, net of transaction

costs. These gains are recorded in servicing and securitizations income.

60 notes

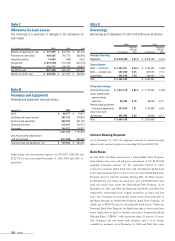

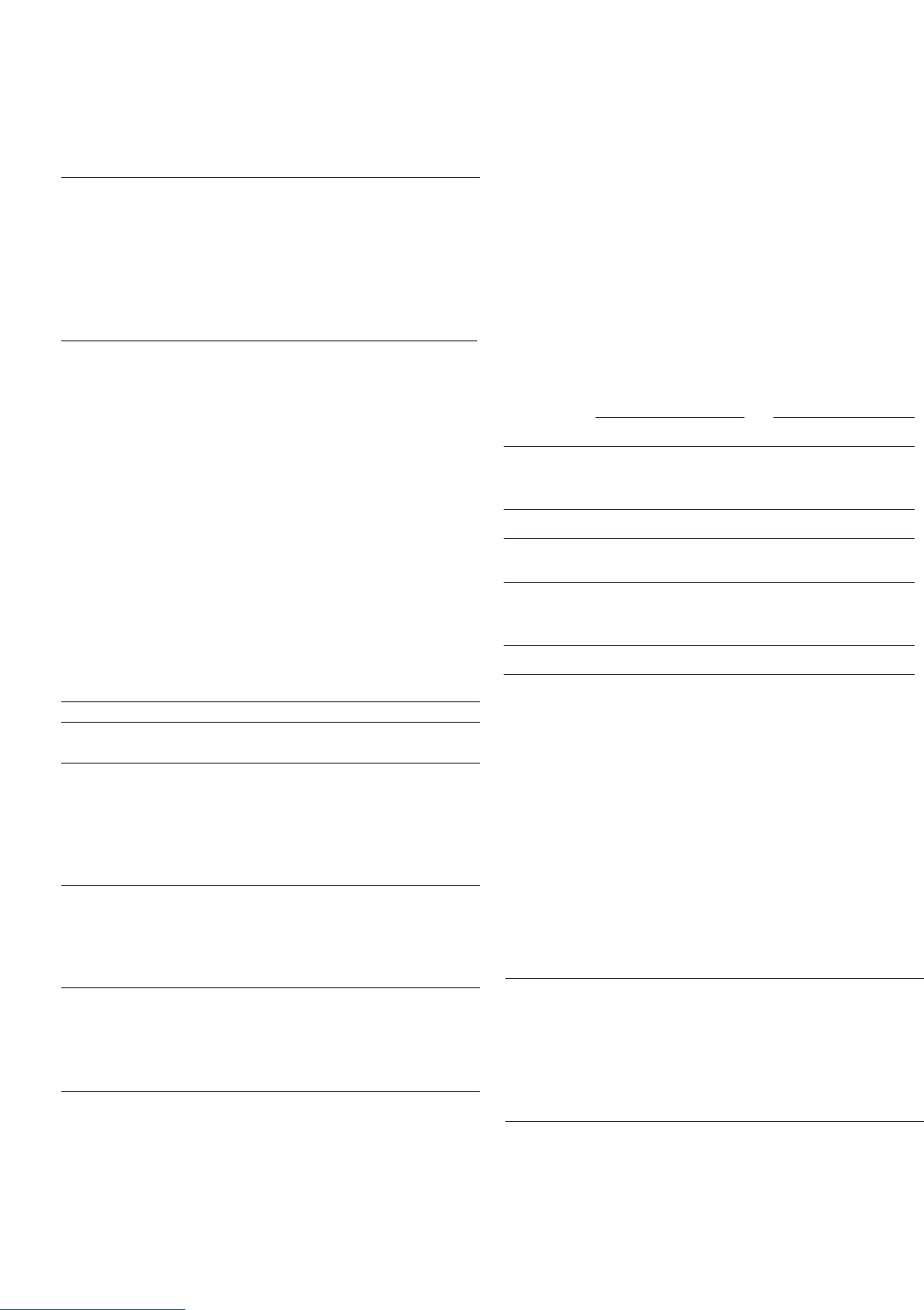

Securitization Key Assumptions and Sensitivities

As of December 31 2001 2000

Interest-only strip $269,527 $ 119,412

Weighted average life

for receivables (months) 97

Principal repayment rate

(weighted average rate) 13% 16 %

Impact on fair value of

10% adverse change $12,496 $ 5,912

Impact on fair value of

20% adverse change 23,652 10,626

Charge-off rate (weighted average rate) 6% 4%

Impact on fair value of

10% adverse change $50,844 $ 16,733

Impact on fair value of

20% adverse change 100,854 33,467

Discount rate (weighted average rate) 9% 12 %

Impact on fair value of

10% adverse change $1,889 $ 245

Impact on fair value of

20% adverse change 3,706 488

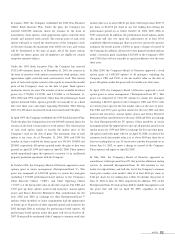

Supplemental Loan Information

Year Ended December 31 2001 2000

Loans Loans Loans Loans

Outstanding Delinquent Outstanding Delinquent

Managed

loans $45,263,963 $ 2,241,647 $ 29,524,026 $ 1,544,654

Off-balance

sheet loans 24,342,949 1,229,090 14,411,314 447,343

Consumer

loans $20,921,014 $ 1,012,557 $ 15,112,712 $ 1,097,311

Average Net Charge- Average Net Charge-

Loans Offs Loans Offs

Managed

loans $ 35,612,317 $ 1,438,370 $ 22,634,862 $ 883,667

Off-balance

sheet loans 18,328,011 746,734 11,147,086 351,046

Consumer

loans $17,284,306 $ 691,636 $ 11,487,776 $ 532,621

Securitization Cash Flows

Year Ended December 31 2001 2000

Proceeds from new securitizations $11,915,990 $ 6,142,709

Collections reinvested in

revolving-period securitizations 30,218,660 18,566,784

Repurchases of accounts from the trust 1,579,455

Servicing fees received 330,350 171,245

Cash flows received

on retained interests 84,817 48,211

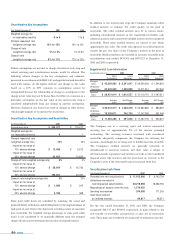

Securitization Key Assumptions

Year Ended December 31 2001 2000

Weighted average life

for receivables (months) 6 to 9 7 to 8

Principal repayment rate

(weighted average rate) 13% to 15% 13% to 16%

Charge-off rate

(weighted average rate) 4% to 6% 4% to 6%

Discount rate

(weighted average rate) 9% to 11% 11% to 13%