Capital One 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ADEQUACY

The Bank and the Savings Bank are subject to capital adequacy

guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) and the Office of Thrift Supervision (the “OTS”)

(collectively, the “regulators”), respectively. The capital adequacy

guidelines and the regulatory framework for prompt corrective action

require the Bank and the Savings Bank to maintain specific capital

levels based upon quantitative measures of their assets, liabilities and

off-balance sheet items.

The most recent notifications received from the regulators categorized

the Bank and the Savings Bank as “well-capitalized.” As of December

31, 2001, there were no conditions or events since the notifications

discussed above that management believes would have changed either

the Bank or the Savings Bank’s capital category.

In November 2001, the four federal banking agencies (the “Agencies”)

adopted an amendment to the regulatory capital standards regarding

the treatment of certain recourse obligations, direct credit substitutes

(i.e., guarantees on third-party assets), residual interests in asset

securitizations, and other securitized transactions that expose

institutions primarily to credit risk. Effective January 1, 2002, this rule

amends the Agencies’ regulatory capital standards to create greater

differentiation in the capital treatment of residual interests. Based on

the Company’s analysis of the rule adopted by the Agencies, we do not

anticipate any material changes to our regulatory capital ratios when

the rule becomes effective.

On January 31, 2001, the Agencies issued “Expanded Guidance for

Subprime Lending Programs” (the “Guidelines”). The Guidelines,

while not constituting a formal regulation, provide guidance to the

federal bank examiners regarding the adequacy of capital and loan loss

reserves held by insured depository institutions engaged in subprime

lending. The Guidelines adopt a broad definition of “subprime” loans

which likely covers more than one-third of all consumers in the United

States. Because our business strategy is to provide credit card products

and other consumer loans to a wide range of consumers, the

examiners may view a portion of our loan assets as “subprime.” Thus,

under the Guidelines, bank examiners could require the Bank or the

Savings Bank to hold additional capital (up to one and one-half to

three times the minimally required level of capital, as set forth in the

Guidelines), or additional loan loss reserves, against such assets. As

described above, at December 31, 2001 the Bank and the Savings Bank

each met the requirements for a “well-capitalized” institution, and

management believes that each institution is holding an appropriate

amount of capital or loan loss reserves against higher risk assets.

Management also believes we have general risk management practices

in place that are appropriate in light of our business strategy.

34 md&a

The terms of the lease and credit facility agreements related to certain

other borrowings and operating leases in Table 11 require several

financial covenants (including performance measures and equity

ratios) to be met. If these covenants are not met, there may be an

acceleration of the payment due dates noted above. As of December

31, 2001, the Company was not in default of any such covenants.

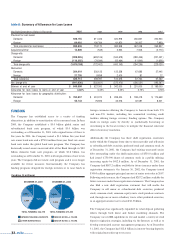

LIQUIDITY

Liquidity refers to the Company’s ability to meet its cash needs. The

Company meets its cash requirements by securitizing assets, gathering

deposits and through issuing debt. As discussed in “Managed

Consumer Loan Portfolio,” a significant source of liquidity for the

Company has been the securitization of consumer loans. Maturity

terms of the existing securitizations vary from 2002 to 2008 and for

revolving securitizations, have accumulation periods during which

principal payments are aggregated to make payments to investors. As

payments on the loans are accumulated and are no longer reinvested in

new loans, the Company’s funding requirements for such new loans

increase accordingly. The occurrence of certain events may cause the

securitization transactions to amortize earlier than scheduled, which

would accelerate the need for funding. Additionally, this early

amortization would have a significant effect on the ability of the Bank

and the Savings Bank to meet the capital adequacy requirements as all

off-balance sheet loans experiencing such early amortization would

have to be recorded on the balance sheet.

The amounts of investor principal from off-balance sheet consumer

loans that are expected to amortize into the Company’s consumer

loans, or be otherwise paid over the periods indicated, based on

outstanding off-balance sheet consumer loans as of January 1, 2002 are

summarized in Table 11. As of December 31, 2001 and 2000, 54% and

51%, respectively, of the Company’s total managed loans were

included in off-balance sheet securitizations.

As such amounts amortize or are otherwise paid, the Company

believes it can securitize consumer loans, gather deposits, purchase

federal funds and establish other funding sources to fund the

amortization or other payment of the securitizations in the future,

although no assurance can be given to that effect. Additionally, the

Company maintains a portfolio of high-quality securities such as U.S.

Treasuries and other U.S. government obligations, mortgage-backed

securities, commercial paper, interest-bearing deposits with other

banks, federal funds and other cash equivalents in order to provide

adequate liquidity and to meet its ongoing cash needs. As of December

31, 2001, the Company had $3.8 billion of such securities.

Liability liquidity is measured by the Company’s ability to obtain

borrowed funds in the financial markets in adequate amounts and at

favorable rates. As of December 31, 2001, the Company, the Bank and

the Savings Bank collectively had over $1.7 billion in unused

commitments under its credit facilities available for liquidity needs.