Capital One 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

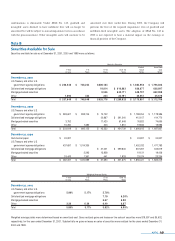

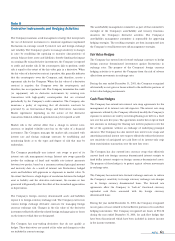

Note I

Cumulative Other Comprehensive Income and

Earnings Per Share

The following table presents the cumulative balances of the

components of other comprehensive income, net of tax:

Unrealized gains (losses) on securities included gross unrealized gains

of $44,568 and $17,075, and gross unrealized losses of $30,224 and

$18,332, as of December 31, 2001 and 2000, respectively.

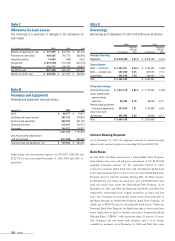

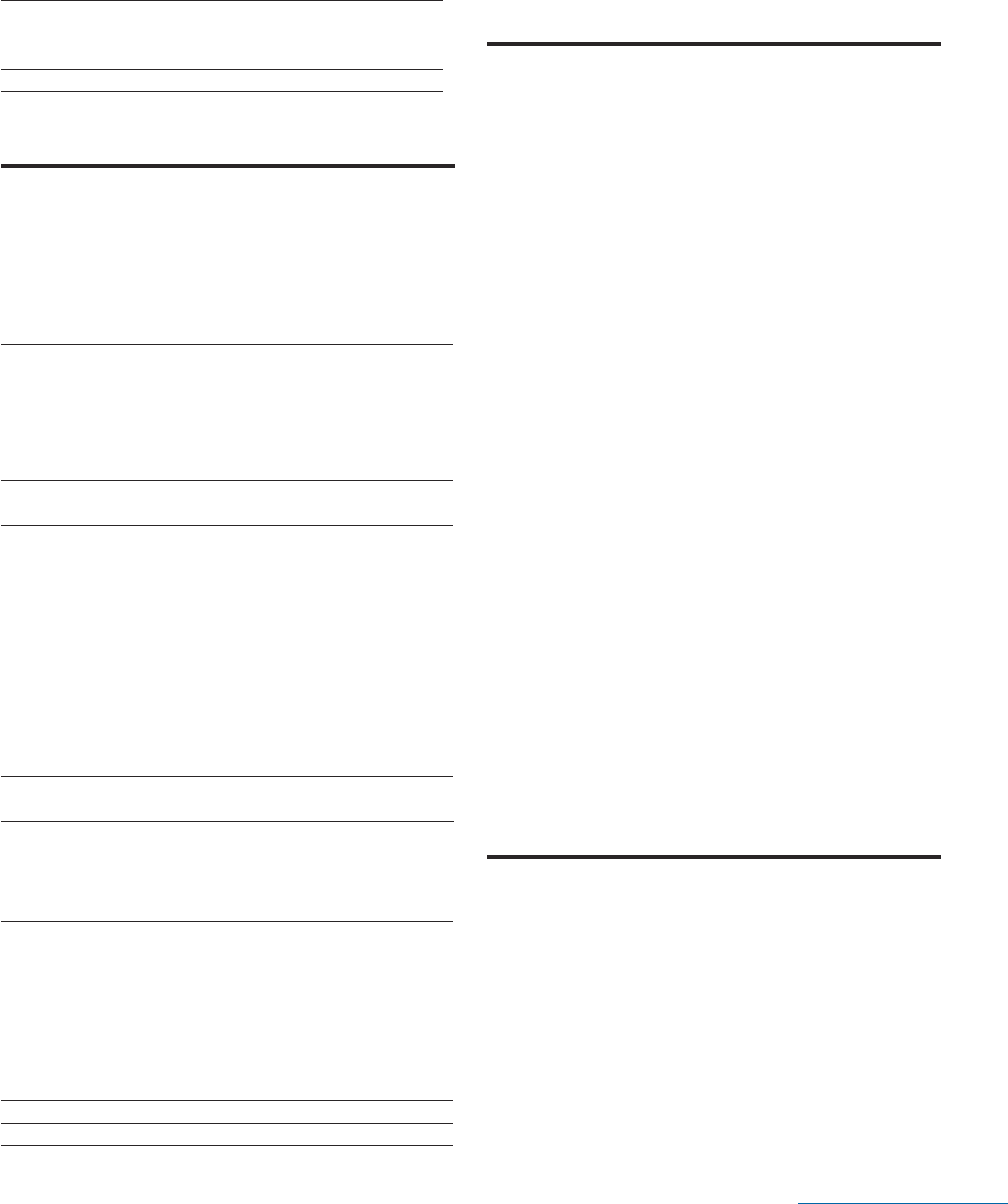

The following table sets forth the computation of basic and diluted

earnings per share:

Securities of approximately 5,217,000, 5,496,000 and 5,200,000 during

2001, 2000 and 1999, respectively, were not included in the

computation of diluted earnings per share because their inclusion

would be antidilutive.

Note J

Purchase of PeopleFirst, Inc. and

AmeriFee Corporation

In October 2001, the Company acquired PeopleFirst Inc.

(“PeopleFirst”). Based in San Diego, California, PeopleFirst is the

largest online provider of direct motor vehicle loans. The acquisition

price for PeopleFirst was approximately $174,000, paid primarily

through the issuance of approximately 3,746,000 shares of the

Company’s common stock. This purchase combination created

approximately $166,000 in goodwill, as approximately $763,000 of

assets was acquired and $755,000 of liabilities was assumed. The

Company will perform impairment tests on the goodwill purchased

each year in accordance with SFAS No. 142.

In May 2001, the Company acquired AmeriFee Corporation

(“AmeriFee”). AmeriFee is a financial services firm based in

Southborough, Massachusetts that provides financing solutions for

consumers seeking elective medical and dental procedures. The

acquisition was accounted for as a purchase business combination. The

initial acquisition price for AmeriFee was $81,500, paid through

approximately $64,500 of cash and approximately 257,000 shares of the

Company’s common stock. This purchase combination created

approximately $80,000 in goodwill. The goodwill prior to December 31,

2001 was amortized on a straight-line basis over 20 years. After

December 31, 2001, the Company will cease amortization and perform

impairment tests on the book value of the remaining goodwill in

accordance with SFAS No. 142. The terms of the acquisition agreement

provide for additional consideration to be paid annually if AmeriFee’s

results of operations exceed certain targeted levels over the next three

years. The additional consideration, up to a maximum of $454,500, may

be paid either in cash or with shares of the Company’s common stock.

Note K

Regulatory Matters

The Bank and the Savings Bank are subject to capital adequacy

guidelines adopted by the Federal Reserve Board (the “Federal

Reserve”) and the Office of Thrift Supervision (the “OTS”)

(collectively, the “regulators”), respectively. The capital adequacy

guidelines and the regulatory framework for prompt corrective action

require the Bank and the Savings Bank to maintain specific capital

levels based upon quantitative measures of their assets, liabilities and

off-balance sheet items. The inability to meet and maintain minimum

capital adequacy levels could result in the regulators taking actions that

notes 57

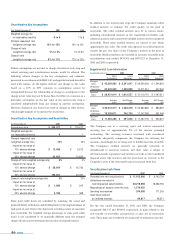

The reconciliation of income tax attributable to continuing operations

computed at the U.S. federal statutory tax rate to income tax expense was:

Year Ended December 31 2001 2000 1999

Income tax at statutory

federal tax rate 35.00% 35.00% 35.00%

Other, primarily state taxes 3.00 3.00 2.07

Income taxes 38.00% 38.00% 37.07%

As of December 31 2001 2000 1999

Unrealized gains (losses)

on securities $8,894 $(777) $ (32,608)

Foreign currency translation

adjustments (19,466) 3,695 1,346

Unrealized losses on cash flow

hedging instruments (74,026)

Total cumulative other

comprehensive income (loss) $(84,598) $2,918 $ (31,262)

Year Ended December 31

(Shares in Thousands) 2001 2000 1999

Numerator:

Net income $641,965 $ 469,634 $ 363,091

Denominator:

Denominator for basic

earnings per share —

Weighted average shares 209,867 196,478 197,594

Effect of dilutive securities:

Stock options 10,709 12,971 13,089

Dilutive potential

common shares 10,709 12,971 13,089

Denominator for diluted

earnings per share —

Adjusted weighted

average shares 220,576 209,449 210,683

Basic earnings per share $3.06 $ 2.39 $ 1.84

Diluted earnings per share $2.91 $ 2.24 $ 1.72