Capital One 2001 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

were terminated in February 2001. The other two Bilateral Facilities

were for the Corporation in the amount of $70,000 and $30,000 and

were terminated in March 2001.

During 1999, the Company entered into a four-year, $1,200,000

unsecured revolving credit arrangement (the “Credit Facility”). The

Credit Facility is comprised of two tranches: a $810,000 Tranche A

facility available to the Bank and the Savings Bank, including an option

for up to $250,000 in multicurrency availability; and a $390,000

Tr anche B facility available to the Corporation, the Bank and the

Savings Bank, including an option for up to $150,000 in multicurrency

availability. Each tranche under the facility is structured as a four-year

commitment and is available for general corporate purposes. All

borrowings under the Credit Facility are based on varying terms of

LIBOR. The Bank has irrevocably undertaken to honor any demand by

the lenders to repay any borrowings that are due and payable by the

Savings Bank but which have not been paid. Any borrowings under the

Credit Facility will mature on May 24, 2003; however, the final

maturity of each tranche may be extended for an additional one-year

period with the lenders’ consent. As of December 31, 2001 and 2000,

the Company had no outstandings under the Credit Facility.

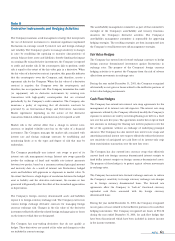

Interest-bearing deposits, senior notes and other borrowings as of

December 31, 2001, mature as follows:

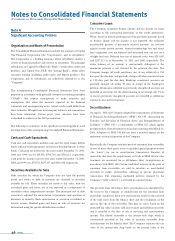

Note F

Associate Benefit and Stock Plans

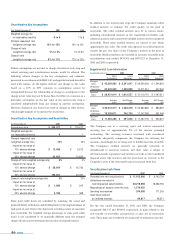

The Company sponsors a contributory Associate Savings Plan in

which substantially all full-time and certain part-time associates are

eligible to participate. The Company makes contributions to each

eligible employee's account, matches a portion of associate

contributions and makes discretionary contributions based upon the

Company meeting a certain earnings per share target. The Company's

contributions to this plan, all of which were in cash, amounted to

$64,299, $44,486 and $27,157 for the years ended December 31, 2001,

2000 and 1999, respectively.

The Company has five stock-based compensation plans. The Company

applies Accounting Principles Board Opinion No. 25, “Accounting for

Stock Issued to Employees” (“APB 25”) and related Interpretations in

accounting for its stock-based compensation plans. In accordance with

APB 25, no compensation cost has been recognized for the Company's

fixed stock options, since the exercise price of all such options equals or

exceeds the market price of the underlying stock on the date of grant,

nor for the Associate Stock Purchase Plan (the “Purchase Plan”), which

is considered to be noncompensatory. For the performance-based

option grants discussed below, compensation cost is measured as the

difference between the exercise price and the target stock price required

for vesting and is recognized over the estimated vesting period. The

Company recognized $1,768, $10,994 and $44,542 of compensation

cost relating to its associate stock plans for the years ended December

31, 2001, 2000 and 1999, respectively. Additionally, the Company

recognized $113,498, $47,025 and $1,046 of tax benefits from the

exercise of stock options by its associates during 2001, 2000 and 1999,

respectively.

SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS

123”) requires, for companies electing to continue to follow the

recognition provisions of APB 25, pro forma information regarding

net income and earnings per share, as if the recognition provisions of

SFAS 123 were adopted for stock options granted subsequent to

December 31, 1994. For purposes of pro forma disclosure, the fair

value of the options was estimated at the date of grant using a Black-

Scholes option-pricing model with the weighted average assumptions

described below and is amortized to expense over the options' vesting

period.

52 notes

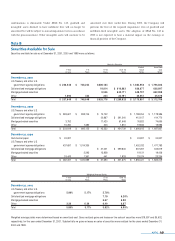

Interest-Bearing Senior Other

Deposits Notes Borrowings Total

2002 $ 3,723,143 $ 518,635 $ 1,691,436 $ 5,933,214

2003 2,611,507 1,105,861 326,287 4,043,655

2004 2,182,684 1,042,184 1,043,941 4,268,809

2005 1,701,675 812,462 415,000 2,929,137

2006 2,327,061 1,456,800 71,000 3,854,861

Thereafter 292,898 399,287 447,864 1,140,049

Total $ 12,838,968 $ 5,335,229 $ 3,995,528 $ 22,169,725

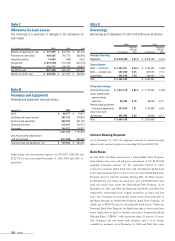

Year Ended December 31 2001 2000 1999

Assumptions

Dividend yield .19% .21% .24%

Volatility factors of expected

market price of stock 50% 49% 45%

Risk-free interest rate 4.15% 6.09% 5.29%

Expected option lives

(in years) 8.5 4.5 5.4

Pro Forma Information

Net income $ 597,313 $ 412,987 $ 325,701

Basic earnings per share $ 2.85 $ 2.10 $ 1.65

Diluted earnings per share $ 2.71 $ 1.97 $ 1.55