Capital One 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

voted to increase this amount by 4,500,000 and 10,000,000 shares,

respectively, of the Company's common stock. For the year ended

December 31, 2001, the Company did not repurchase shares, under

this program. For the years ended December 31, 2000 and 1999, the

Company repurchased 3,028,600 and 2,250,000 shares, respectively,

under this program. Certain treasury shares have been reissued in

connection with the Company's benefit plans.

In 1997, the Company implemented its dividend reinvestment and

stock purchase plan (“DRP”), which allows participating stockholders

to purchase additional shares of the Company’s common stock

through automatic reinvestment of dividends or optional cash

investments. In 2001, the Company issued 659,182 shares of new

common stock under the DRP.

Note H

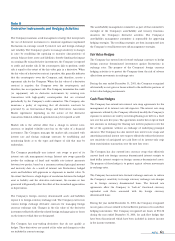

Income Taxes

Deferred income taxes reflect the net tax effects of temporary

differences between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for income tax

purposes. Significant components of the Company’s deferred tax assets

and liabilities as of December 31, 2001 and 2000 were as follows:

During 2001, the Company increased its valuation allowance by $5,717

for certain state and international loss carryforwards generated during

the year.

At December 31, 2001, the Company had net operating losses available

for federal income tax purposes of $66,054 that are subject to certain

annual limitations under the Internal Revenue Code, and expire at

various dates from 2018 to 2020. Also, foreign net operation losses of

$71 (net of related valuation allowances) are without expiration

limitations.

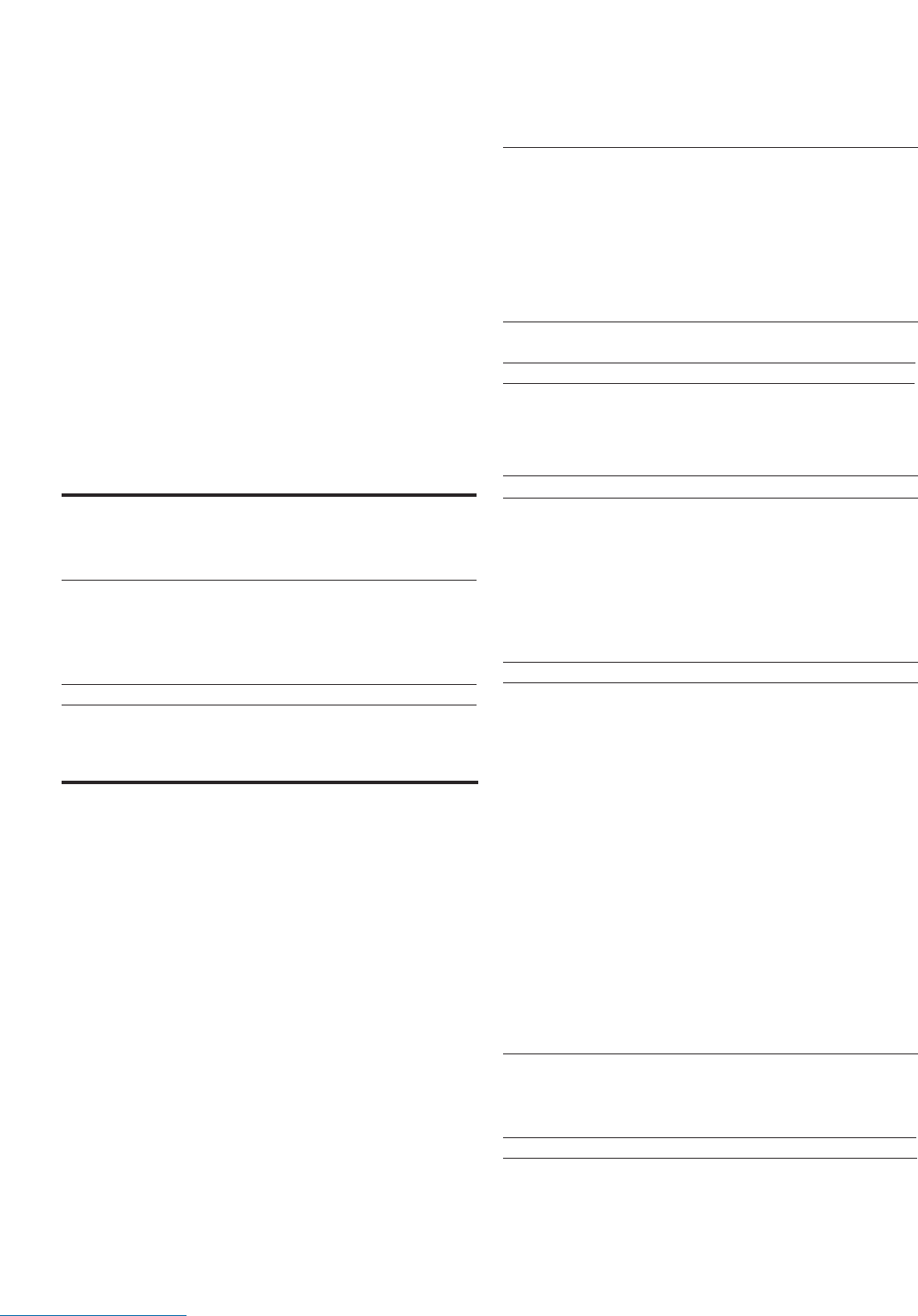

Significant components of the provision for income taxes attributable

to continuing operations were as follows:

56 notes

Note G

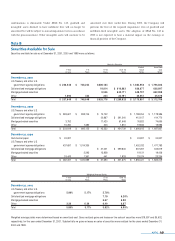

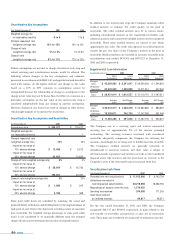

Other Non-Interest Expense

Year Ended December 31 2001 2000 1999

Professional services $ 230,502 $ 163,905 $ 145,398

Collections 253,728 156,592 101,000

Fraud losses 65,707 53,929 22,476

Bankcard association assessments 83,255 51,726 33,301

Other 174,757 130,132 131,928

Total $807,949 $ 556,284 $ 434,103

December 31 2001 2000

Deferred tax assets:

Allowance for loan losses $ 107,389 $ 155,218

Unearned income 260,208 171,516

Stock incentive plan 48,117 56,615

Foreign 4,203 12,366

Net operating losses 23,119 4,198

State taxes, net of federal benefit 39,212 18,560

Other 89,831 75,181

Subtotal 572,079 493,654

Valuation allowance (41,359) (35,642)

Total deferred tax assets 530,720 458,012

Deferred tax liabilities:

Securitizations 75,084 38,307

Deferred revenue 624,254 222,106

Other 44,322 39,591

Total deferred tax liabilities 743,660 300,004

Net deferred tax assets (liabilities) before

unrealized (gains) losses (212,940) 158,008

Cumulative effect of change in accounting

principle 16,685

Unrealized losses on cash flow hedging

instruments 28,686

Unrealized (gains) losses on securities

available for sale (5,453) 478

Net deferred tax assets (liabilities) $(173,022) $ 158,486

Year Ended December 31 2001 2000 1999

Federal taxes $138 $ 284,661 $ 232,910

State taxes 2,214 578 754

International taxes 555 1,156

Deferred income taxes 390,548 1,445 (19,738)

Income taxes $393,455 $ 287,840 $ 213,926