Capital One 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

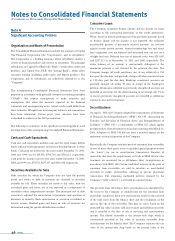

In June 1998, the Company's Board of Directors approved a grant to

executive officers (“EntrepreneurGrant III”). This grant consisted of

2,611,896 performance-based options granted to certain key managers

(including 2,000,040 options to the Company's CEO and COO),

which were approved by the stockholders in April 1999, at the then

market price of $33.77 per share. The Company's CEO and COO gave

up 300,000 and 200,010 vested options (valued at $8,760 in total),

respectively, in exchange for their EntrepreneurGrant III options.

Other executive officers gave up future cash compensation for each of

the next three years in exchange for the options. These options vested

in September 2000 when the market price of the Company's stock

remained at or above $58.33 for at least ten trading days in a 30

consecutive calendar day period.

In April 1998, upon stockholder approval, a 1997 stock option grant to

senior management (“EntrepreneurGrant II”) became effective at the

December 18, 1997 market price of $16.25 per share. This grant

included 3,429,663 performance-based options granted to certain key

managers (including 2,057,265 options to the Company's CEO and

COO), which vested in April 1998 when the market price of the

Company's stock remained at or above $28.00 for at least ten trading

days in a 30 consecutive calendar day period. The grant also included

671,700 options that vested in full on December 18, 2000.

In April 1999 and 1998, the Company granted 1,045,362 and 1,335,252

options, respectively, to all associates not granted options in

EntrepreneurGrant II or EntrepreneurGrant IV. Certain associates

were granted options in exchange for giving up future compensation.

Other associates were granted a set number of options. These options

were granted at the then-market price of $56.46 and $31.71 per share,

respectively, and vest, in full, on April 29, 2002 and April 30, 2001,

respectively, or immediately upon a change in control of the Company.

The Company maintains two non-associate directors stock incentive

plans: the 1995 Non-Employee Directors Stock Incentive Plan and the

1999 Non-Employee Directors Stock Incentive Plan. The 1995 plan

originally authorized 1,500,000 shares of the Company's common

stock for the automatic grant of restricted stock and stock options to

eligible members of the Company's Board of Directors. However, in

April 1999, the Company terminated the ability to make grants from

the 1995 plan. Options granted prior to termination vest after one year

and their maximum term is ten years. The exercise price of each option

equals the market price of the Company's stock on the date of grant.

As of December 31, 2001, there was no outstanding restricted stock

under this plan.

In April 1999, the Company established the 1999 Non-Employee

Directors Stock Incentive Plan. The plan authorizes a maximum of

825,000 shares of the Company's common stock for the grant of

nonstatutory stock options to eligible members of the Company's

Board of Directors. In April 1999, all non-employee directors of the

Company were given the option to receive performance-based options

under this plan in lieu of their annual cash retainer and their time-

vesting options for each of 1999, 2000 and 2001. As a result, 497,490

performance-based options were granted to certain non-employee

directors of the Company. The options vest in full if, on or before June

15, 2002, the market value of the Company's stock equals or exceeds

$100 per share for ten trading days in a 30 consecutive calendar day

period. All options vest immediately upon a change of control of the

Company on or before June 15, 2002. As of December 31, 2001 and

2000, 22,510 and 27,510 shares, respectively, were available for grant

under this plan. All options under this plan have a maximum term of

ten years. The exercise price of each option equals or exceeds the

market price of the Company's stock on the date of grant.

In October 2001, the Company granted 305,000 options to the non-

executive members of the Board of Directors for director

compensation for the years 2002, 2003 and 2004. These options were

granted at the fair market value on the date of grant and vest on

October 18, 2010. Vesting will be accelerated if the stock’s fair market

value is at or above $83.87 per share, $100.64 per share, $120.77 per

share, $144.92 per share, $173.91 per share, $208.70 per share or

$250.43 per share for at least five days during the performance period

on or before October 18, 2004, 2005, 2006, 2007, 2008, 2009 or 2010,

respectively. In addition, the options under this grant will vest upon

the achievement of at least $5.03 cumulative diluted earnings per share

for any four consecutive quarters ending in the fourth quarter 2004, or

upon a change in control of the Company.

54 notes