Capital One 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

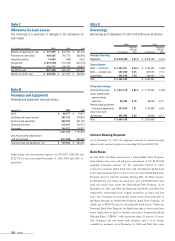

Certain premises and equipment are leased under agreements that

expire at various dates through 2011, without taking into

consideration available renewal options. Many of these leases provide

for payment by the lessee of property taxes, insurance premiums, cost

of maintenance and other costs. In some cases, rentals are subject to

increase in relation to a cost of living index. Total expenses amounted

to $64,745, $66,108, and $37,685 for the years ended December 31,

2001, 2000 and 1999, respectively.

Future minimum rental commitments as of December 31, 2001, for all

non-cancelable operating leases with initial or remaining terms of one

year or more are as follows:

The Company has entered into synthetic lease transactions to finance

several facilities. A synthetic lease structure typically involves establishing a

special purpose vehicle (“SPV”) that owns the properties to be leased. The

SPV is funded and its equity is held by outside investors, and as a result,

neither the debt of nor the properties owned by the SPV are included in

the Consolidated Financial Statements. These transactions, as described

below, are accounted for as operating leases in accordance with SFAS No.

13,“Accounting for Leases.”

In December 2000, the Company entered into a 10-year agreement for the

lease of a headquarters building being constructed in McLean, Virginia.

Monthly rent commences upon completion, which is expected in

December 2002, and is based on LIBOR rates applied to the cost of the

buildings funded. If, at the end of the lease term, the Company does not

purchase the property, the Company guarantees a residual value of up to

approximately 72% of the estimated $159,500 cost of the buildings in the

lease agreement. Upon a sale of the property at the end of the lease term,

the Company’s obligation is limited to any amount by which the

guaranteed residual value exceeds the selling price.

In 1999, the Company entered into two three-year agreements for the

construction and subsequent lease of four facilities located in Tampa,

Florida and Federal Way, Washington. At December 31, 2001, the

construction of all four of the facilities had been completed. The total cost

of the buildings was approximately $98,800. Monthly rent commenced

upon completion of each of the buildings and is based on LIBOR rates

applied to the cost of the facilities funded. The Company has a one-year

renewal option under the terms of the leases. If, at the end of the lease

term, the Company does not purchase all of the properties, the Company

guarantees a residual value to the lessor of up to approximately 85% of the

cost of the buildings in the lease agreement. Upon a sale of the property at

the end of the lease term, the Company’s obligation is limited to any

amount by which the guaranteed residual value exceeds the selling price.

In 1998, the Company entered into a five-year lease of five facilities in

Tampa, Florida and Richmond, Virginia. Monthly rent on the facilities is

based on a fixed interest rate of 6.87% per annum applied to the cost of

the buildings included in the lease of $86,800. The Company has two one-

year renewal options under the terms of the lease. If, at the end of the lease

term, the Company does not purchase all of the properties, the Company

guarantees a residual value to the lessor of up to approximately 84% of the

costs of the buildings. Upon a sale of the property at the end of the lease

term, the Company’s obligation is limited to any amount by which the

guaranteed residual value exceeds the selling price.

The Company is commonly subject to various pending and threatened

legal actions arising from the conduct of its normal business activities. In

the opinion of management, the ultimate aggregate liability, if any, arising

out of any pending or threatened action will not have a material adverse

effect on the consolidated financial condition of the Company. At the

present time, however, management is not in a position to determine

whether the resolution of pending or threatened litigation will have a

material effect on the Company’s results of operations in any future

reporting period.

Note M

Related Party Transactions

In the ordinary course of business, executive officers and directors of

the Company may have consumer loans issued by the Company.

Pursuant to the Company’s policy, such loans are issued on the same

terms as those prevailing at the time for comparable loans to unrelated

persons and do not involve more than the normal risk of collectibility.

Note N

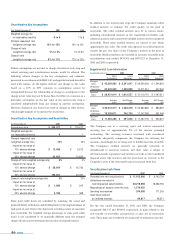

Off-Balance Sheet Securitizations

Off-balance sheet securitizations involve the transfer of pools of

consumer loan receivables by the Company to one or more third-

party trusts or qualified special purpose entities that are accounted for

as sales in accordance with SFAS 140. Certain undivided interests in

the pool of consumer loan receivables are sold to investors as asset-

backed securities in public underwritten offerings or private

placement transactions. The remaining undivided interests retained

by the Company (“seller's interest”) are recorded in consumer loans.

The amounts of the remaining undivided interests fluctuate as the

accountholders make principal payments and incur new charges on

the selected accounts. The amount of seller's interest was $5,675,078

and $3,270,839 as of December 31, 2001 and 2000, respectively.

The key assumptions used in determining the fair value of the

interest-only strip resulting from securitizations of consumer loan

receivables completed during the period included the weighted

average ranges for charge-off rates, principal repayment rates, lives of

receivables and discount rates included in the following table.

notes 59

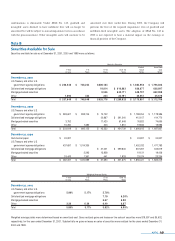

2002 $ 57,619

2003 51,667

2004 36,082

2005 30,366

2006 21,583

Thereafter 56,254

Total $ 253,571