Capital One 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Consumer lending is a natural extension of the credit card business and

a huge long-term growth opportunity for Capital One. Of the $7 trillion in U.S.

consumer loans on the books in 2000, only $555 billion—less than 10%—was in

credit card balances. The rest was in auto loans, installment loans, financing for

elective medical procedures, home equity loans and mortgages.

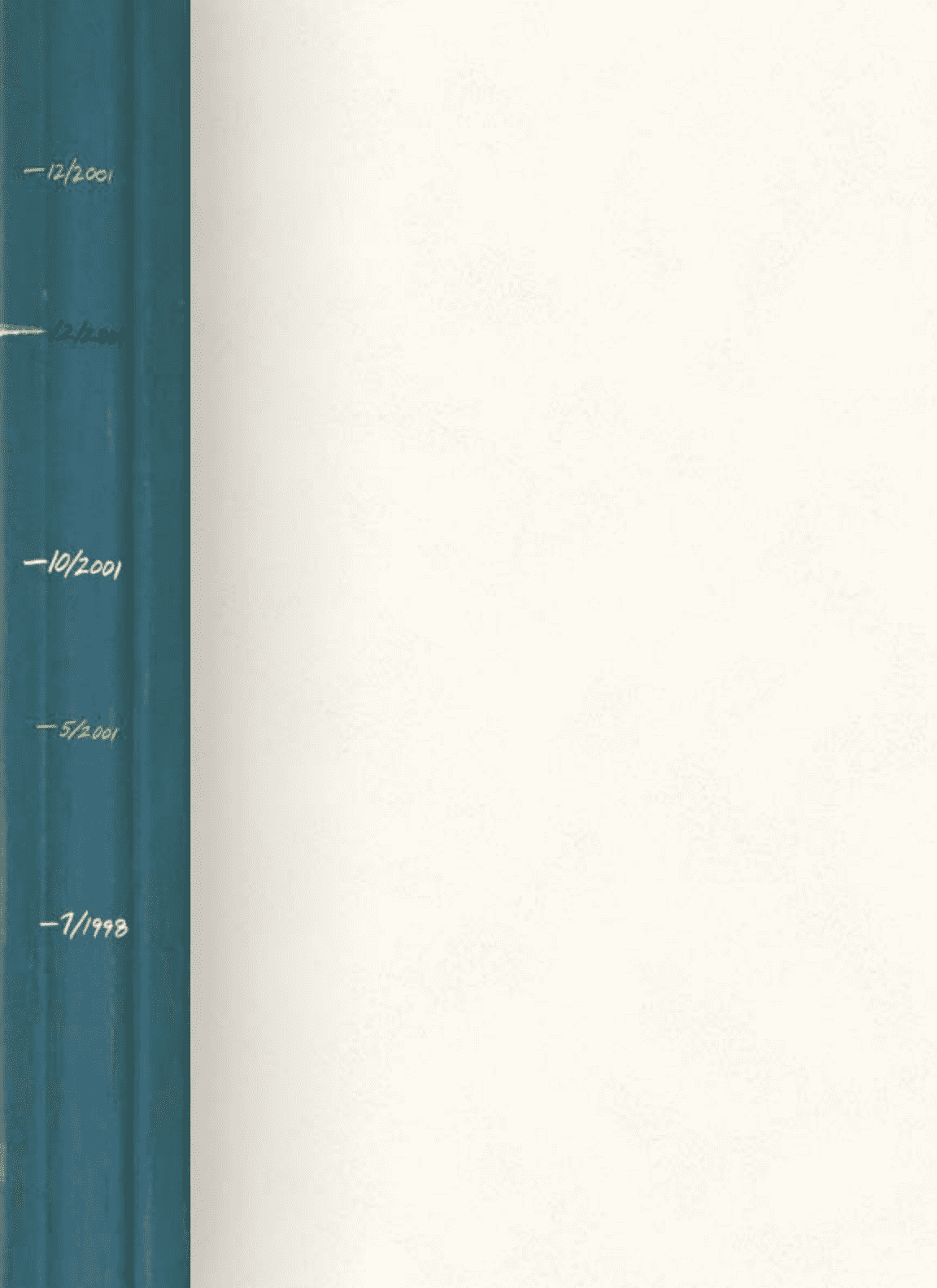

We entered the $1 trillion auto finance market three years ago with an

acquisition that brought us $300 million in loans. In October 2001 we added $710

million with the acquisition of PeopleFirst, the Internet’s largest originator of auto

loans. Capital One now has an auto finance portfolio of $4 billion.

With installment loans, we’re building from the ground up. We target low-risk

borrowers and provide them with a very competitive rate. Our loan volume has tripled

in three years. In other installment loan sectors we are selectively acquiring small, well-

managed companies that we see as growth platforms. The most recent is Amerifee, the

nation's leading provider of patient financing solutions for elective dental, orthodontic,

vision and cosmetic procedures.

We believe we can succeed in consumer lending because it plays to our strengths in

mass customization and direct marketing. These capabilities, combined with our

information-based strategy (IBS), give us an advantage over most of our competitors,

who still rely on a one-size-fits-all strategy. With these strengths and IBS, Capital One

can grow profitably in consumer lending markets while cutting prices, just as it did in

credit cards.

With the addition of new lending

businesses, we didn’t just grow,

we multiplied.

Capital One

auto loans

reach $4.0 billion

Capital One

installment

loans reach

$2.9 billion

acquired

PeopleFirst

acquired

Amerifee

acquired

Summit

Acceptance

Corp.