Capital One 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

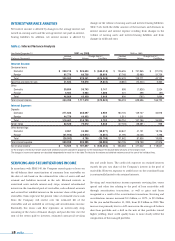

Changes in the rates of delinquency and credit losses can also result

from a shift in the product mix. As discussed in “Risk Adjusted

Revenue and Margin,” certain customized card products have, in some

cases, higher delinquency and higher charge-off rates. In the case of

secured card loans, collateral, in the form of cash deposits, reduces any

ultimate charge-offs. The costs associated with higher delinquency and

charge-off rates are considered in the pricing of individual products.

During 2001, general economic conditions for consumer credit

deteriorated slightly as industry levels of charge-offs (including

bankruptcies) and delinquencies both increased. These trends did not

have a material impact on the Company’s 2001 results.

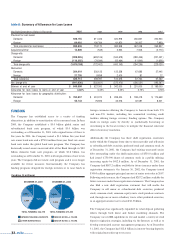

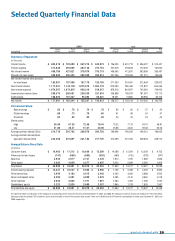

DELINQUENCIES

Table 6 shows the Company’s consumer loan delinquency trends for

the years presented on a reported and managed basis. The entire

balance of an account is contractually delinquent if the minimum

payment is not received by the payment due date. Delinquencies not

only have the potential to impact earnings if the account charges off,

but they also result in additional costs in terms of the personnel and

other resources dedicated to resolving the delinquencies.

NET CHARGE-OFFS

Net charge-offs include the principal amount of losses (excluding

accrued and unpaid finance charges, fees and fraud losses) less current

period recoveries. The Company charges off credit card loans (net of

any collateral) at 180 days past the due date and generally charges off

other consumer loans at 120 days past the due date. All amounts

collected on previously charged-off accounts are included in

recoveries. Costs to recover previously charged-off accounts are

recorded as collections expense in non-interest expenses.

The 30-plus day delinquency rate for

the managed consumer loan portfolio

was 4.95% as of December 31, 2001,

down 28 basis points from 5.23% as of

December 31, 2000. The 30-plus day

delinquency rate for the reported

consumer loan portfolio decreased to

4.84% as of December 31, 2001, from

7.26% as of December 31, 2000. Both

reported and managed consumer

loan delinquency rate decreases as

of December 31, 2001, as compared

to December 31, 2000. principally

reflected improvements in customer

credit performance including enhanced

payment activity. The decrease in the

reported consumer loan delinquency

rate was also a result of a shift in the

mix of the composition of the reported

portfolio towards lower yielding, higher

credit quality loans.

30 md&a

table 6: Delinquencies

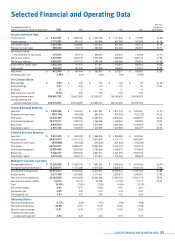

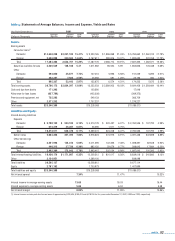

As of December 31 2001 2000 1999 1998 1997

% of % of % of % of % of

Total Total Total Total Total

(Dollars in Thousands) Loans Loans Loans Loans Loans Loans Loans Loans Loans Loans

Reported:

Loans outstanding $20,921,014 100.00% $ 15,112,712 100.00% $ 9,913,549 100.00% $ 6,157,111 100.00% $ 4,861,687 100.00%

Loans delinquent:

30–59 days 494,871 2.37 418,967 2.77 236,868 2.39 123,162 2.00 104,216 2.14

60–89 days 233,206 1.11 242,770 1.61 129,251 1.30 67,504 1.10 64,217 1.32

90 or more days 284,480 1.36 435,574 2.88 220,513 2.23 98,798 1.60 99,667 2.05

Total $1,012,557 4.84% $ 1,097,311 7.26% $ 586,632 5.92% $ 289,464 4.70% $ 268,100 5.51%

Loans delinquent by geographic area:

Domestic 930,077 5.02% 1,034,995 8.23% 533,081 6.85% 264,966 5.80% 264,942 5.96%

Foreign 82,480 3.47% 62,316 2.46% 53,551 2.51% 24,498 1.54% 3,158 0.75%

Managed:

Loans outstanding $45,263,963 100.00% $ 29,524,026 100.00% $20,236,588 100.00% $17,395,126 100.00% $ 14,231,015 100.00%

Loans delinquent:

30–59 days 934,681 2.06 605,040 2.05 416,829 2.06 329,239 1.89 327,407 2.30

60–89 days 502,959 1.11 349,250 1.18 238,476 1.18 182,982 1.05 213,726 1.50

90 or more days 804,007 1.78 590,364 2.00 403,464 1.99 305,589 1.76 340,887 2.40

Total $2,241,647 4.95% $ 1,544,654 5.23% $ 1,058,769 5.23% $ 817,810 4.70% $ 882,020 6.20%