Capital One 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

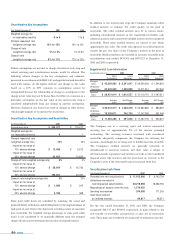

$1,827,974 and $2,501,761, respectively, outstanding under the

Domestic Bank Note Program, with no subordinated bank notes

issued or outstanding.

The Corporation has three shelf registration statements under which

the Corporation from time to time may offer and sell (i) senior or

subordinated debt securities, consisting of debentures, notes and/or

other unsecured evidences, (ii) preferred stock, which may be issued in

the form of depository shares evidenced by depository receipts and

(iii) common stock. The amount of securities registered is limited to a

$1,550,000 aggregate public offering price or its equivalent (based on

the applicable exchange rate at the time of sale) in one or more foreign

currencies, currency units or composite currencies as shall be

designated by the Corporation. At December 31, 2001, the

Corporation had existing unsecured senior debt outstanding under the

shelf registrations of $550,000, including $125,000 maturing in 2003,

$225,000 maturing in 2006, and $200,000 maturing in 2008. During

2001, the Corporation issued 6,750,390 shares of common stock in a

public offering under the shelf registration statement that resulted in

proceeds of $412,800. At December 31, 2001, remaining availability

under the shelf registration statements was $587,200. On January 30,

2002, the Company issued $300,000 aggregate principal amount of

senior notes due 2007, which reduced the availability under the shelf

registration statements to $287,200. The Company has also filed a new

shelf registration statement that will enable the Company to sell senior

or subordinated debt securities, preferred stock, common stock,

common equity units, stock purchase contracts and, through one or

more subsidiary trusts, other preferred securities, in an aggregate

amount not to exceed $1,500,000.

Secured Borrowings

Capital One Auto Finance, Inc., a subsidiary of the Company, currently

maintains five agreements to transfer pools of consumer loans

accounted for as secured borrowings. The agreements were entered

into in December 2001, July 2001, December 2000, May 2000 and May

1999, relating to the transfer of pools of consumer loans totaling

$1,300,000, $910,000, $425,000, $325,000 and $350,000, respectively.

Principal payments on the borrowings are based on principal

collections, net of losses, on the transferred consumer loans. The

secured borrowings accrue interest predominantly at fixed rates and

mature between June 2006 and September 2008, or earlier depending

upon the repayment of the underlying consumer loans. At December

31, 2001 and 2000, $2,536,168 and $870,185, respectively, of the

secured borrowings were outstanding.

PeopleFirst Inc. (“PeopleFirst”), a subsidiary of Capital One Auto

Finance, Inc., currently maintains four agreements to transfer pools of

consumer loans accounted for as secured borrowings. The agreements

were entered into between 1998 and 2000 relating to the transfer of

pools of consumer loans totaling approximately $910,000. Principal

payments on the borrowings are based on principal collections, net of

losses, on the transferred consumer loans. The secured borrowings

accrue interest at fixed rates and mature between September 2003 and

September 2007, or earlier depending upon the repayment of the

underlying consumer loans. At December 31, 2001, $477,250 of the

secured borrowings was outstanding.

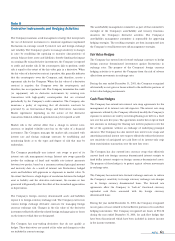

In 1999, the Bank entered into a £750,000 revolving credit facility

collateralized by a security interest in certain consumer loan assets of

the Company. Interest on the facility is based on commercial paper rates

or LIBOR. The facility matured in August 2001. At December 31, 2000,

£600,000 ($895,800 equivalent) was outstanding under the facility.

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank

created as a Delaware statutory business trust, issued $100,000

aggregate amount of Floating Rate Junior Subordinated Capital

Income Securities that mature on February 1, 2027. The securities

represent a preferred beneficial interest in the assets of the trust.

Other Short-Term Borrowings

In October 2001, PeopleFirst entered into a $500,000 revolving credit

facility collateralized by a security interest in certain consumer loan

assets. Interest on the facility is based on LIBOR. The facility matures

in March 2002. At December 31, 2001, $443,110 was outstanding

under the facility.

During 2000, the Bank entered into a multicurrency revolving credit

facility (the “Multicurrency Facility”). The Multicurrency Facility is

intended to finance the Company’s business in the United Kingdom

and was initially comprised of two Tranches, each in the amount of

Euro 300,000 ($270,800 equivalent based on the exchange rate at

closing). The Tranche A facility was intended for general corporate

purposes and terminated on August 9, 2001. The Tranche B facility is

intended to replace and extend the Corporation’s prior credit facility

for U.K. pounds sterling and Canadian dollars, which matured on

August 29, 2000. The Tranche B facility terminates August 9, 2004. The

Corporation serves as guarantor of all borrowings under the

Multicurrency Facility. In October 2000, the Bank’s subsidiary, Capital

One Bank Europe plc, replaced the Bank as a borrower under the

Bank’s guarantee. As of December 31, 2001 and 2000, the Company

had no outstandings under the Multicurrency Facility.

During 2000, the Company entered into four bilateral revolving credit

facilities with different lenders (the “Bilateral Facilities”). The Bilateral

Facilities were used to finance the Company's business in Canada and

for general corporate purposes. Two of the Bilateral Facilities each for

Capital One Inc., guaranteed by the Corporation, in the amount of

C$100,000 ($67,400 equivalent based on exchange rate at closing),

notes 51