Capital One 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

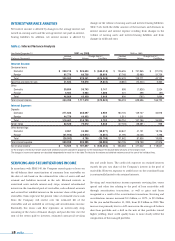

charge-off rate increase to 4.64% in 2000 from 3.59% in 1999. Non-

interest income increased $662.1 million, or 28%, primarily due to the

increase in average accounts of 41%. Increases in marketing expenses

of $174.2 million, or 24%, and salaries and benefits expense of $243.2

million, or 31%, reflect the increase in marketing investment in

existing and new product opportunities and the cost of operations to

manage the growth in the Company’s accounts and products offered.

Average managed consumer loans grew 25% for the year ended

December 31, 2000, to $22.6 billion from $18.0 billion for the year

ended December 31, 1999, and average accounts grew 41% for the

same period as a result of the continued success of the Company’s

marketing and account management strategies.

MANAGED CONSUMER LOAN PORTFOLIO

The Company analyzes its financial performance on a managed

consumer loan portfolio basis. Managed consumer loan data adds

back the effect of off-balance sheet consumer loans. The Company also

evaluates its interest rate exposure on a managed portfolio basis.

The Company’s managed consumer loan portfolio is comprised of

reported and off-balance sheet loans. Off-balance sheet loans are those

which have been securitized and accounted for as sales in accordance

with Statement of Financial Accounting Standards (“SFAS”) No. 140,

“Accounting for Transfers and Servicing of Financial Assets and

Extinguishments of Liabilities” (“SFAS 140”), and are not assets of the

Company. Therefore, those loans are not shown on the balance sheet.

SFAS 140 replaced SFAS 125 and was effective for securitization

transactions occurring after March 31, 2001. SFAS 140 revised the

standards for accounting for securitizations and other transfers of

financial assets and collateral and requires certain additional

disclosures; however, most of the provisions of SFAS 125 have been

carried forward without amendment. Accordingly, the Company has

modified or implemented several of its securitization trust agreements,

and may modify or implement others, to meet the new requirements

to continue recognizing transfers of consumer loans to special-purpose

entities as sales. The adoption of SFAS 140 did not have a material

effect on the results of the Company’s operations.

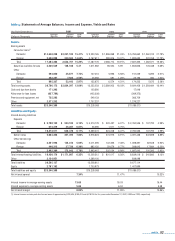

Table 1 summarizes the Company’s managed consumer loan portfolio.

md&a 23

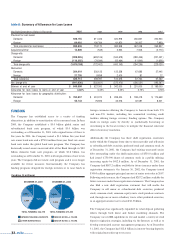

table 1: Managed Consumer Loan Portfolio

Year Ended December 31 (In Thousands) 2001 2000 1999 1998 1997

Year-End Balances:

Reported consumer loans:

Domestic $18,541,819 $ 12,580,973 $ 7,783,535 $ 4,569,664 $ 4,441,740

Foreign 2,379,195 2,531,739 2,130,014 1,587,447 419,947

Total 20,921,014 15,112,712 9,913,549 6,157,111 4,861,687

Off-balance sheet loans:

Domestic 22,747,293 13,961,714 10,013,424 10,933,984 9,369,328

Foreign 1,595,656 449,600 309,615 304,031

Total 24,342,949 14,411,314 10,323,039 11,238,015 9,369,328

Managed consumer loan portfolio:

Domestic 41,289,112 26,542,687 17,796,959 15,503,648 13,811,068

Foreign 3,974,851 2,981,339 2,439,629 1,891,478 419,947

Total $45,263,963 $ 29,524,026 $ 20,236,588 $ 1 7,395,126 $ 14,231,015

Average Balances:

Reported consumer loans:

Domestic $14,648,298 $ 9,320,165 $ 5,784,662 $ 4,336,757 $ 3,914,839

Foreign 2,636,008 2,167,611 1,882,693 1,011,802 188,197

Total 17,284,306 11,487,776 7,667,355 5,348,559 4,103,036

Off-balance sheet loans:

Domestic 17,718,683 10,804,845 10,062,771 9,773,284 8,904,146

Foreign 609,328 342,241 316,787 87,694

Total 18,328,011 11,147,086 10,379,558 9,860,978 8,904,146

Managed consumer loan portfolio:

Domestic 32,366,981 20,125,010 15,847,433 14,110,041 12,818,985

Foreign 3,245,336 2,509,852 2,199,480 1,099,496 188,197

Total $35,612,317 $ 22,634,862 $ 18,046,913 $ 15,209,537 $ 13,007,182