Capital One 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

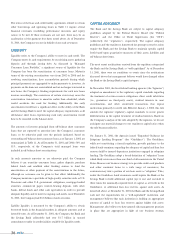

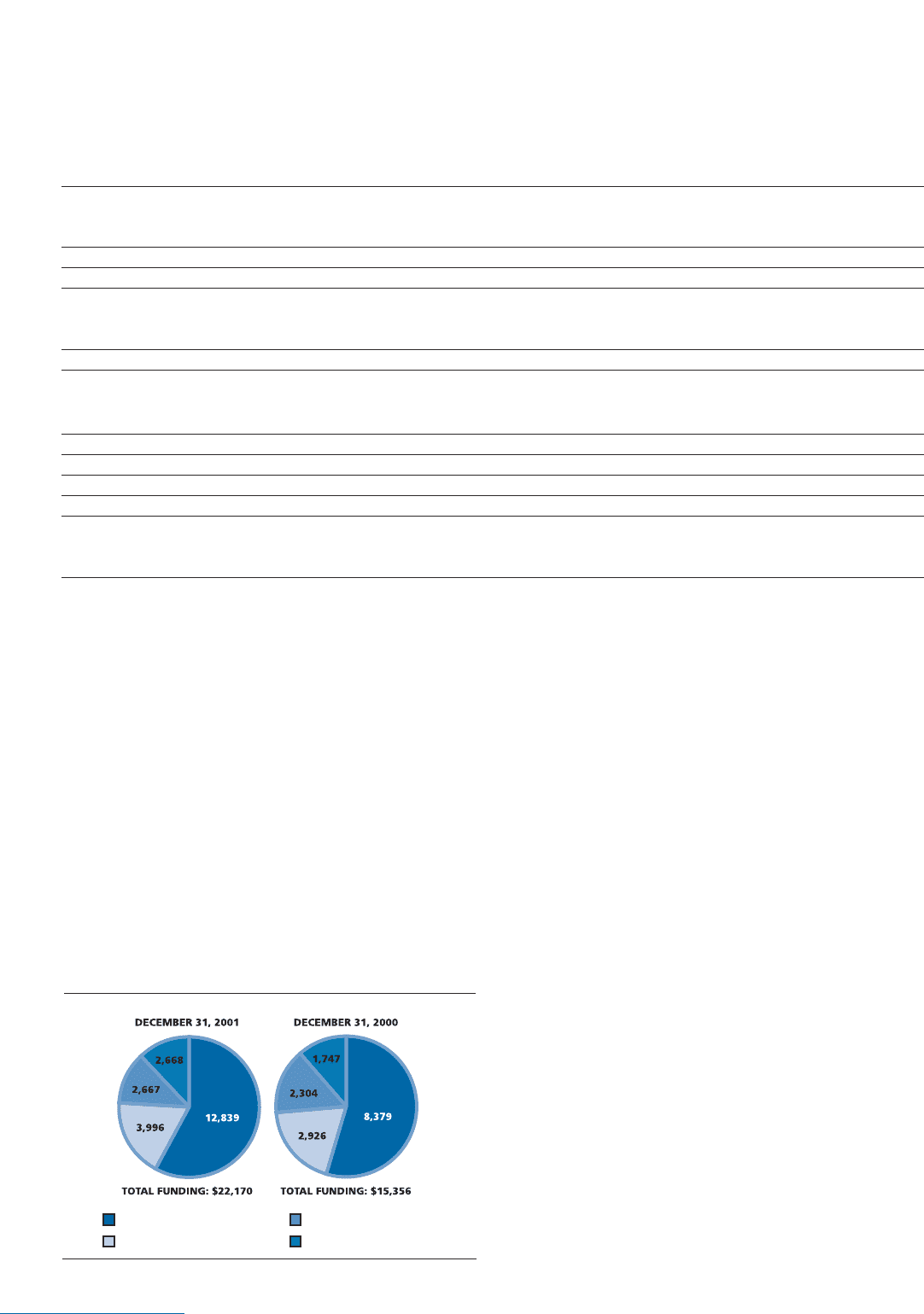

FUNDING

The Company has established access to a variety of funding

alternatives, in addition to securitization of its consumer loans. In June

2000, the Company established a $5.0 billion global senior and

subordinated bank note program, of which $3.0 billion was

outstanding as of December 31, 2001 with original terms of three to

five years. In 2001, the Company issued a $1.3 billion five-year fixed

rate senior bank note and a $750.0 million three-year fixed rate senior

bank note under the global bank note program. The Company has

historically issued senior unsecured debt of the Bank through its $8.0

billion domestic bank note program, of which $1.8 billion was

outstanding as of December 31, 2001, with original terms of one to ten

years. The Company did not renew such program and it is no longer

available for future issuances. Internationally, the Company has

funding programs designed for foreign investors or to raise funds in

foreign currencies allowing the Company to borrow from both U.S.

and non-U.S. lenders, including two committed revolving credit

facilities offering foreign currency funding options. The Company

funds its foreign assets by directly or synthetically borrowing or

securitizing in the local currency to mitigate the financial statement

effect of currency translation.

Additionally, the Company has three shelf registration statements

under which the Company from time to time may offer and sell senior

or subordinated debt securities, preferred stock and common stock. As

of December 31, 2001, the Company had existing unsecured senior

debt outstanding under the shelf registrations of $550.0 million and

had issued 6,750,390 shares of common stock in a public offering,

increasing equity by $412.8 million. As of December 31, 2001, the

Company had $587.2 million available for future issuance under these

registration statements. On January 30, 2002, the Company issued

$300.0 million aggregate principal amount of senior notes due in 2007.

Following such issuance, the Company had $287.2 million available for

future issuance under these registration statements. The Company has

also filed a new shelf registration statement that will enable the

Company to sell senior or subordinated debt securities, preferred

stock, common stock, common equity units, stock purchase contracts

and, through one or more subsidiary trusts, other preferred securities,

in an aggregate amount not to exceed $1.5 billion.

The Company has significantly expanded its retail deposit gathering

efforts through both direct and broker marketing channels. The

Company uses its IBS capabilities to test and market a variety of retail

deposit origination strategies, including via the Internet, as well as to

develop customized account management programs. As of December

31, 2001, the Company had $12.8 billion in interest-bearing deposits,

with original maturities up to ten years.

32 md&a

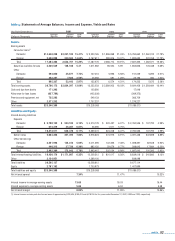

table 8: Summary of Allowance for Loan Losses

Year Ended December 31 (Dollars in Thousands) 2001 2000 1999 1998 1997

Provision for loan losses:

Domestic 920,155 611,406 320,978 230,821 254,904

Foreign 69,681 106,764 61,970 36,207 7,933

Total provisions for loan losses 989,836 718,170 382,948 267,028 262,837

Acquisitions/other 14,800 (549) 3,522 7,503 (2,770)

Charge-offs:

Domestic (908,065) (693,106) (344,679) (282,455) (221,401)

Foreign (110,285) (79,296) (55,464) (11,840) (1,628)

Total charge-offs (1,018,350) (772,402) (400,143) (294,295) (223,029)

Recoveries:

Domestic 304,919 230,123 122,258 67,683 27,445

Foreign 21,795 9,658 2,415 81 17

Total recoveries 326,714 239,781 124,673 67,764 27,462

Net charge-offs (691,636) (532,621) (275,470) (226,531) (195,567)

Balance at end of year $840,000 $ 527,000 $ 342,000 $ 231,000 $ 183,000

Allowance for loan losses to loans at end of year 4.02% 3.49% 3.45% 3.75% 3.76%

Allowance for loan losses by geographic distribution:

Domestic $784,857 $ 451,074 $ 299,424 $ 198,419 $ 174,659

Foreign 55,143 75,926 42,576 32,581 8,341

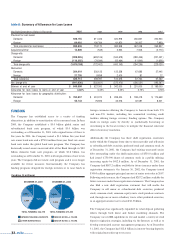

Funding ($ millions)

INTEREST BEARING DEPOSITS

OTHER BORROWINGS

SENIOR NOTES <3 YEARS

SENIOR NOTES >3 YEARS