Capital One 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

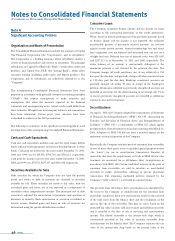

value. The accounting for changes in the fair value (i.e., gains and

losses) of a derivative instrument depends on whether it has been

designated and qualifies as part of a hedging relationship and, further,

on the type of hedging relationship. For those derivative instruments

that are designated and qualify as hedging instruments, a company

must designate the hedging instrument, based upon the exposure

being hedged, as a fair value hedge, a cash flow hedge or a hedge of a

net investment in a foreign operation. The adoption of SFAS 133

resulted in a cumulative-effect adjustment decreasing other

comprehensive income by $27,222, net of an income tax benefit of

$16,685.

For derivative instruments that are designated and qualify as fair value

hedges (i.e., hedging the exposure to changes in the fair value of an

asset or a liability or an identified portion thereof that is attributable to

a particular risk), the gain or loss on the derivative instrument as well

as the offsetting loss or gain on the hedged item attributable to the

hedged risk is recognized in current earnings during the period of the

change in fair values. For derivative instruments that are designated

and qualify as cash flow hedges (i.e., hedging the exposure to

variability in expected future cash flows that is attributable to a

particular risk), the effective portion of the gain or loss on the

derivative instrument is reported as a component of other

comprehensive income and reclassified into earnings in the same

period or periods during which the hedged transaction affects

earnings. The remaining gain or loss on the derivative instrument in

excess of the cumulative change in the present value of future cash

flows of the hedged item, if any, is recognized in current earnings

during the period of change. For derivative instruments that are

designated and qualify as hedges of a net investment in a foreign

operation, the gain or loss is reported in other comprehensive income

as part of the cumulative translation adjustment to the extent that it is

effective. For derivative instruments not designated as hedging

instruments, the gain or loss is recognized in current earnings during

the period of change.

The Company formally documents all hedging relationships, as well as

its risk management objective and strategy for undertaking the hedge

transaction. At inception and at least quarterly, the Company also

formally assesses whether the derivatives that are used in hedging

transactions have been highly effective in offsetting changes in the

hedged items to which they are designated and whether those derivatives

may be expected to remain highly effective in future periods. The

Company will discontinue hedge accounting prospectively when it is

determined that a derivative has ceased to be highly effective as a hedge.

Prior to January 1, 2001, the Company also used interest rate swap

contracts and foreign exchange contracts for hedging purposes.

Amounts paid or received on interest rate and currency swaps were

recorded on an accrual basis as an adjustment to the related income or

expense of the item to which the agreements were designated. At

December 31, 2000, the related amounts payable to counterparties was

$26,727. Changes in the fair value of interest rate swaps were not

reflected in the financial statements. Changes in the fair value of

foreign currency contracts and currency swaps were recorded in the

period in which they occurred as foreign currency gains or losses in

other non-interest income, effectively offsetting the related gains or

losses on the items to which they were designated. Realized gains and

losses at the time of termination, sale or repayment of a derivative

financial instrument are recorded in a manner consistent with its

original designation. Amounts were deferred and amortized as an

adjustment to the related income or expense over the original period

of exposure, provided the designated asset or liability continued to

exist, or in the case of anticipated transactions, was probable of

occurring. Realized and unrealized changes in the fair value of swaps

or foreign exchange contracts, designated with items that no longer

exist or are no longer probable of occurring, were recorded as a

component of the gain or loss arising from the disposition of the

designated item. At December 31, 2000, the gross unrealized gains in

the portfolio were $23,890. Under the terms of certain swaps, each

party may be required to pledge collateral if the market value of the

swaps exceeds an amount set forth in the agreement or in the event of

a change in its credit rating. At December 31, 2000, the Company had

pledged $55,364 of such collateral.

Recent Accounting Pronouncements

In August 2001, the Financial Accounting Standards Board (“FASB”)

issued SFAS No. 144, “Accounting for the Impairment or Disposal

of Long-Lived Assets.” SFAS No. 144 supersedes SFAS No. 121,

“Accounting for the Impairment of Long-Lived Assets and for Long-

Lived Assets to Be Disposed Of,” but retains the requirements of SFAS

No. 121 to test long-lived assets for impairment and removes goodwill

from its scope. In addition, the changes presented in SFAS No. 144

require that one accounting model be used for long-lived assets to be

disposed of by sale and broadens the presentation of discontinued

operations to include more disposal transactions. Under SFAS No. 144,

discontinued operations are no longer measured on a net realizable

value basis, and future operating losses are no longer recognized before

they occur. The provisions of this Statement are effective for financial

statements issued for fiscal years beginning after December 15, 2001.

The implementation of SFAS No. 144 is not expected to have a

material impact on the earnings or financial position of the Company.

In June 2001, the FASB issued SFAS No. 141,“Business Combinations,”

effective for business combinations initiated after June 30, 2001, and

SFAS No. 142, “Goodwill and Other Intangible Assets,” effective for

fiscal years beginning after December 15, 2001. Under SFAS No. 141,

the pooling of interests method of accounting for business

48 notes