Capital One 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

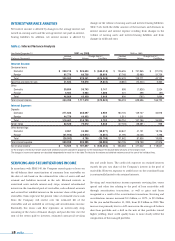

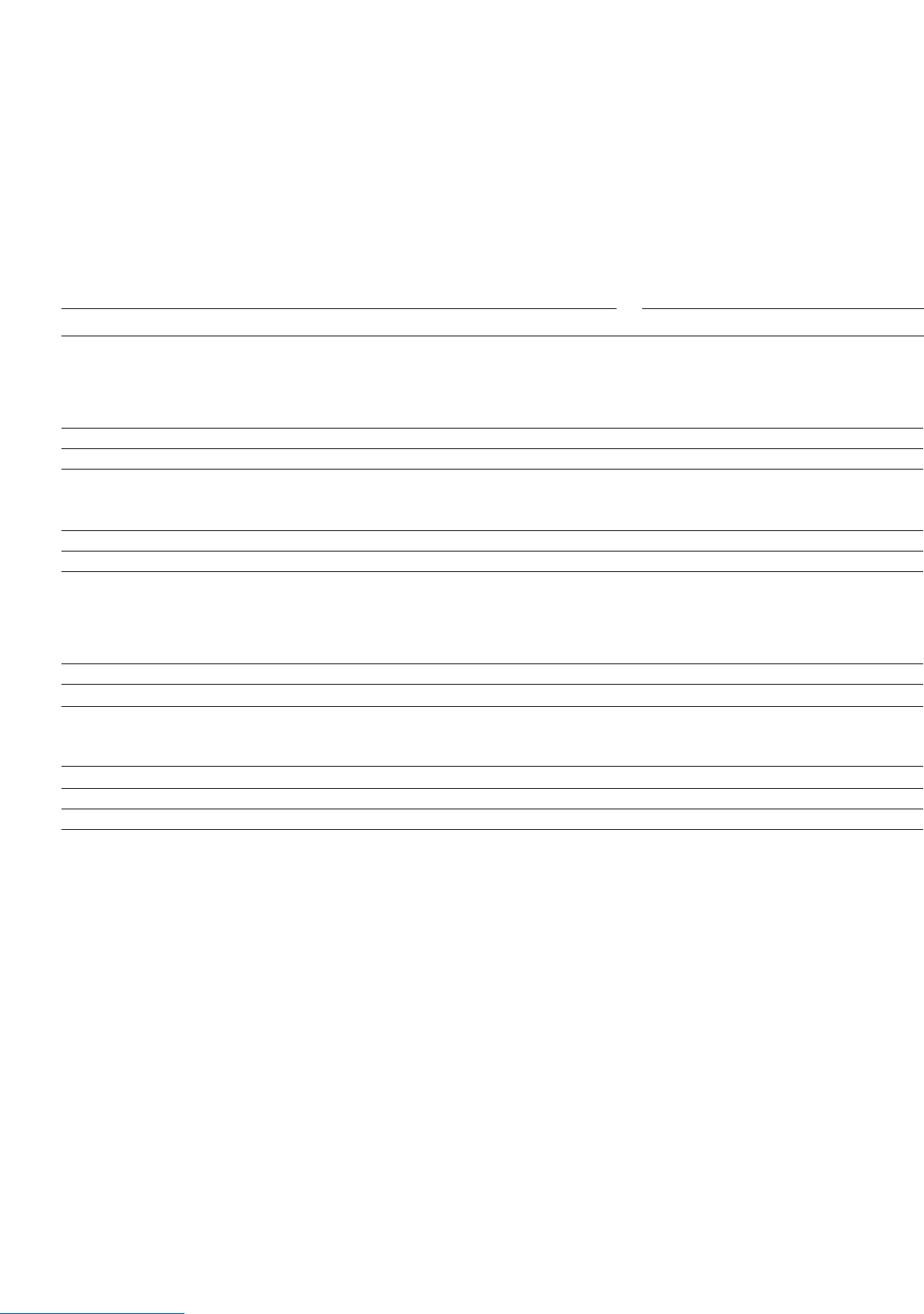

INTEREST VARIANCE ANALYSIS

Net interest income is affected by changes in the average interest rate

earned on earning assets and the average interest rate paid on interest-

bearing liabilities. In addition, net interest income is affected by

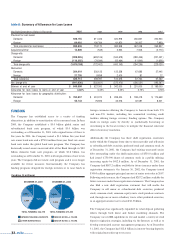

SERVICING AND SECURITIZATIONS INCOME

In accordance with SFAS 140, the Company records gains or losses on

the off-balance sheet securitizations of consumer loan receivables on

the date of sale based on the estimated fair value of assets sold and

retained and liabilities incurred in the sale. Retained interests in

securitized assets include interest-only strips, retained subordinated

interests in the transferred pool of receivables, cash collateral accounts

and accrued but unbilled interest on the investors’share of the pool of

receivables. Gains represent the present value of estimated excess cash

flows the Company will receive over the estimated life of the

receivables and are included in servicing and securitizations income.

Essentially, this excess cash flow represents an interest-only strip,

consisting of the excess of finance charges and past-due fees over the

sum of the return paid to investors, estimated contractual servicing

fees and credit losses. The credit risk exposure on retained interests

exceeds the pro rata share of the Company’s interest in the pool of

receivables. However, exposure to credit losses on the securitized loans

is contractually limited to the retained interests.

Servicing and securitizations income represents servicing fees, excess

spread and other fees relating to the pool of loan receivables sold

through securitization transactions, as well as gains and losses

recognized as a result of the securitization transactions. Servicing and

securitizations income increased $1.3 billion, or 112%, to $2.4 billion

for the year ended December 31, 2001, from $1.2 billion in 2000. This

increase was primarily due to a 64% increase in the average off-balance

sheet loan portfolio and a shift in the mix of that portfolio toward

higher yielding, lower credit quality loans to more closely reflect the

composition of the managed portfolio.

changes in the volume of earning assets and interest-bearing liabilities.

Table 5 sets forth the dollar amount of the increases and decreases in

interest income and interest expense resulting from changes in the

volume of earning assets and interest-bearing liabilities and from

changes in yields and rates.

28 md&a

table 5: Interest Variance Analysis

Year Ended December 31 2001 vs. 2000 2000 vs. 1999

Increase Change Due to(1) Increase Change Due to(1)

(Dollars in Thousands) (Decrease) Volume Yield/Rate (Decrease) Volume Yield/Rate

Interest Income:

Consumer loans

Domestic $260,215 $ 926,633 $ (666,418) $ 736,655 $ 757,865 $ (21,210)

Foreign 95,778 66,728 29,050 67,748 35,989 31,759

Total 355,993 970,541 (614,548) 804,403 759,271 45,132

Securities available for sale 41,634 50,678 (9,044) (8,884) (14,244) 5,360

Other

Domestic 39,884 36,743 3,141 698 (1,826) 2,524

Foreign 6,984 5,984 1,000 201 298 (97)

Total 46,868 43,420 3,448 899 (765) 1,664

Total interest income 444,495 1,117,519 (673,024) 796,418 629,696 166,722

Interest Expense:

Deposits

Domestic 271,686 268,697 2,989 184,705 149,727 34,978

Foreign 44,776 44,422 354 1,511 1,511

Total 316,462 310,709 5,753 186,216 151,286 34,930

Senior notes 82,520 76,672 5,848 (27,723) (28,681) 958

Other borrowings

Domestic 2,961 33,938 (30,977) 59,847 41,121 18,726

Foreign (31,953) (28,072) (3,881) 41,795 40,006 1,798

Total (28,992) 6,708 (35,700) 101,642 81,806 19,836

Total interest expense 369,990 395,995 (26,005) 260,135 218,759 41,376

Net interest income(1) $74,505 $ 707,857 $ (633,352) $ 536,283 $ 417,642 $ 118,641

(1) The change in interest due to both volume and yield/rates has been allocated in proportion to the relationship of the absolute dollar amounts of the change in each.

The changes in income and expense are calculated independently for each line in the table.The totals for the volume and yield/rate columns are not the sum of the individual lines.