Capital One 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest-Bearing Deposits

As of December 31, 2001, the aggregate amount of interest-bearing

deposits with accounts equal to or exceeding $100 was $4,622,996.

Bank Notes

In June 2000, the Bank entered into a Global Bank Note Program,

from which it may issue and sell up to a maximum of U.S. $5,000,000

aggregate principal amount (or the equivalent thereof in other

currencies) of senior global bank notes and subordinated global bank

notes with maturities from 30 days to 30 years. This Global Bank Note

Program must be renewed annually. During 2001, the Bank issued a

$1,250,000 five-year fixed rate bank note and a $750,000 three-year

fixed rate senior note under the Global Bank Note Program. As of

December 31, 2001 and 2000, the Bank had $2,958,067 and $994,794,

respectively, outstanding with original maturities of three and five

years. The Company has historically issued senior unsecured debt of

the Bank through its $8,000,000 Domestic Bank Note Program (of

which, up to $200,000 may be subordinated bank notes). Under the

Domestic Bank Note Program, the Bank from time to time could issue

senior bank notes at fixed or variable rates tied to London InterBank

Offering Rates (“LIBOR”) with maturities from 30 days to 30 years.

The Company did not renew such program and it is no longer

available for issuances. As of December 31, 2001 and 2000, there were

50 notes

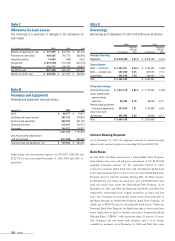

Note C

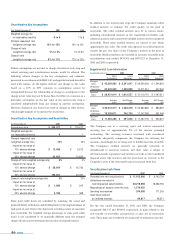

Allowance for Loan Losses

The following is a summary of changes in the allowance for

loan losses:

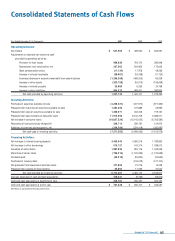

Year Ended December 31 2001 2000 1999

Balance at beginning of year $527,000 $ 342,000 $ 231,000

Provision for loan losses 989,836 718,170 382,948

Acquisitions/other 14,800 (549) 3,522

Charge-offs (1,018,350) (772,402) (400,143)

Recoveries 326,714 239,781 124,673

Net charge-offs (691,636) (532,621) (275,470)

Balance at end of year $840,000 $ 527,000 $ 342,000

Note D

Premises and Equipment

Premises and equipment were as follows:

December 31 2001 2000

Land $90,377 $ 10,917

Buildings and improvements 305,312 279,979

Furniture and equipment 680,942 621,404

Computer software 216,361 140,712

In process 144,527 104,911

1,437,519 1,157,923

Less:Accumulated depreciation

and amortization (677,836) (493,462)

Total premises and equipment, net $759,683 $ 664,461

Depreciation and amortization expense was $235,997, $180,289 and

$122,778, for the years ended December 31, 2001, 2000 and 1999, re-

spectively.

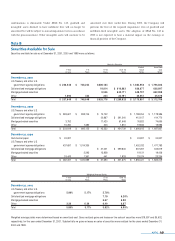

Note E

Borrowings

Borrowings as of December 31, 2001 and 2000 were as follows:

2001 2000

Weighted Weighted

Average Average

Outstanding Rate Outstanding Rate

Interest-Bearing

Deposits $12,838,968 5.34% $ 8,379,025 6.67%

Senior Notes

Bank — fixed rate $4,454,041 6.96% $ 3,154,555 6.98%

Bank — variable rate 332,000 3.45 347,000 7.41

Corporation 549,188 7.20 549,042 7.20

Total $5,335,229 $ 4,050,597

Other Borrowings

Secured borrowings $3,013,418 4.62% $ 1,773,450 6.76%

Junior subordinated

capital income

securities 98,693 3.78 98,436 8.31

Federal funds purchased

and resale agreements 434,024 1.91 1,010,693 6.58

Other short-term

borrowings 449,393 2.29 43,359 6.17

Total $3,995,528 $ 2,925,938