Capital One 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTRODUCTION

Capital One Financial Corporation (the “Corporation”) is a holding

company whose subsidiaries market a variety of financial products and

services to consumers using its Information-Based Strategy (“IBS”).

The principal subsidiaries are Capital One Bank (the “Bank”), which

offers credit card products, and Capital One, F.S.B. (the “Savings

Bank”), which offers consumer lending (including credit cards) and

deposit products. The Corporation and its subsidiaries are collectively

referred to as the “Company.” As of December 31, 2001, the Company

had 43.8 million accounts and $45.3 billion in managed consumer

loans outstanding and was one of the largest providers of MasterCard

and Visa credit cards in the world.

The Company’s profitability is affected by the net interest income and

non-interest income earned on earning assets, consumer usage

patterns, credit quality, the level of marketing expense and operating

efficiency. The Company’s revenues consist primarily of interest

income on consumer loans (including past-due fees) and securities,

and non-interest income consisting of servicing income on securitized

loans, fees (such as annual membership, cash advance, cross-sell,

interchange, overlimit and other fee income, collectively “fees”) and

gains on the securitizations of loans. The Company’s primary expenses

are the costs of funding assets, provision for loan losses, operating

expenses (including salaries and associate benefits), marketing

expenses and income taxes.

Significant marketing expenses (e.g., advertising, printing, credit

bureau costs and postage) to implement the Company’s new product

strategies are incurred and expensed prior to the acquisition of new

accounts while the resulting revenues are recognized over the life of the

acquired accounts. Revenues recognized are a function of the response

rate of the initial marketing program, usage and attrition patterns,

credit quality of accounts, product pricing and effectiveness of account

management programs.

EARNINGS SUMMARY

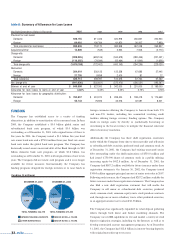

The following discussion provides a summary of 2001 results

compared to 2000 results and 2000 results compared to 1999 results.

Each component is discussed in further detail in subsequent sections

of this analysis.

Year Ended December 31, 2001 Compared to Year

Ended December 31, 2000

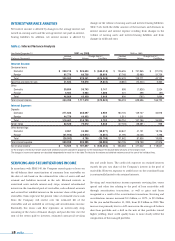

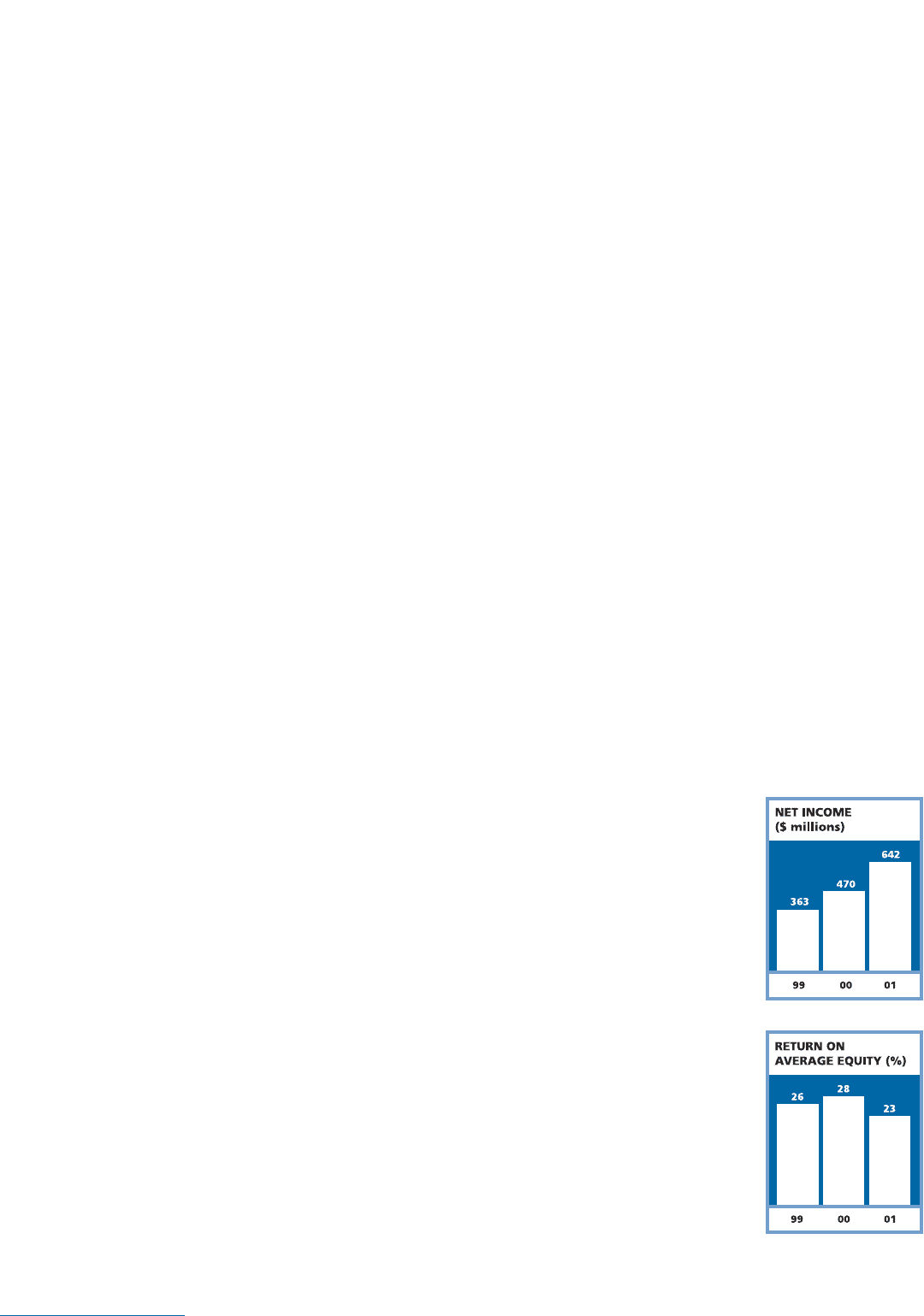

Net income of $642.0 million, or $2.91 per share, for the year ended

December 31, 2001, compares to net income of $469.6 million, or

$2.24 per share, in 2000. The $172.4 million, or 37%, increase in net

income is primarily the result of an increase in asset and account

volumes. Net interest income increased $74.5 million, or 5%, as the

average reported earning assets increased 56% while the net interest

margin decreased to 8.03% from 11.99%. The provision for loan losses

increased $271.6 million, or 38%, as average reported consumer loans

increased 50% and the reported net charge-off rate decreased 64 basis

points to 4.00% in 2001 from 4.64% in 2000. Non-interest income

increased $1.4 billion, or 46%, primarily due to an increase in the

average off-balance sheet loan portfolio (increasing servicing and

securitizations income), the increase in average accounts of 39%, as

well as a shift in the mix of the reported and off-balance sheet

portfolios. Marketing expenses increased $176.8 million, or 20%, to

$1.1 billion to reflect the increase in marketing investment in existing

and new product opportunities. Salaries and associate benefits expense

increased $368.7 million, or 36%, to $1.4 billion as a direct result of the

cost of operations to manage the growth in the Company’s accounts

and products offered. Average managed consumer loans grew 57% for

the year ended December 31, 2001, to $35.6 billion from $22.6 billion

for the year ended December 31, 2000, and average accounts grew 39%

for the same period as a result of the continued success of the

Company’s marketing and account management strategies.

Year Ended December 31,

2000 Compared to Year Ended

December 31, 1999

Net income of $469.6 million, or $2.24

per share, for the year ended December

31, 2000, compares to net income of

$363.1 million, or $1.72 per share, in

1999. The $106.5 million, or 29%,

increase in net income is primarily the

result of an increase in both asset and

account volumes and an increase in net

interest margin. Net interest income

increased $536.3 million, or 51%, as

average earning assets increased 37%

and the net interest margin increased

to 11.99% from 10.86%. The provision

for loan losses increased $335.2

million, or 88%, as the average

reported consumer loans increased

50% combined with the reported net

22 md&a

Management’s Discussion and Analysis of

Financial Condition and Results of Operations