Capital One 2001 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

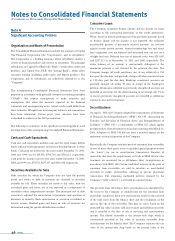

Note A

Significant Accounting Policies

Organization and Basis of Presentation

The Consolidated Financial Statements include the accounts of Capital

One Financial Corporation (the “Corporation”) and its subsidiaries.

The Corporation is a holding company whose subsidiaries market a

variety of financial products and services to consumers. The principal

subsidiaries are Capital One Bank (the “Bank”), which offers credit card

products, and Capital One, F.S.B. (the “Savings Bank”), which offers

consumer lending (including credit cards) and deposit products. The

Corporation and its subsidiaries are collectively referred to as the

“Company.”

The accompanying Consolidated Financial Statements have been

prepared in accordance with generally accepted accounting principles

(“GAAP”) that require management to make estimates and

assumptions that affect the amounts reported in the financial

statements and accompanying notes. Actual results could differ from

these estimates. All significant intercompany balances and transactions

have been eliminated. Certain prior years' amounts have been

reclassified to conform to the 2001 presentation.

The following is a summary of the significant accounting policies used

in preparation of the accompanying Consolidated Financial Statements.

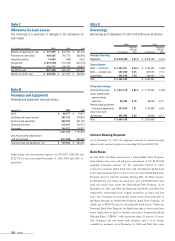

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal

funds sold and resale agreements and interest-bearing deposits at other

banks. Cash paid for interest for the years ended December 31, 2001,

2000 and 1999, was $1,105,505, $794,764 and $516,114, respectively.

Cash paid for income taxes for the years ended December 31, 2001,

2000 and 1999, was $70,754, $237,217 and $216,438, respectively.

Securities Available for Sale

Debt securities for which the Company does not have the positive

intent and ability to hold to maturity are classified as securities

available for sale. These securities are stated at fair value, with the

unrealized gains and losses, net of tax, reported as a component of

cumulative other comprehensive income. The amortized cost of debt

securities is adjusted for amortization of premiums and accretion of

discounts to maturity. Such amortization or accretion is included in

interest income. Realized gains and losses on sales of securities are

determined using the specific identification method.

Consumer Loans

The Company recognizes finance charges and fee income on loans

according to the contractual provisions of the credit agreements.

When, based on historic performance of the portfolio, payment in full

of finance charge and fee income is not expected, the estimated

uncollectible portion of previously accrued amounts are reversed

against current period income. Annual membership fees and direct

loan origination costs are deferred and amortized over one year on a

straight-line basis. Deferred fees (net of deferred costs) were $291,647

and $237,513 as of December 31, 2001 and 2000, respectively. The

entire balance of an account is contractually delinquent if the

minimum payment is not received by the payment due date. The

Company charges off credit card loans (net of any collateral) at 180

days past the due date, and generally charges off other consumer loans

at 120 days past the due date. Bankrupt consumers’ accounts are

generally charged off within 30 days of receipt of the bankruptcy

petition. All amounts collected on previously charged-off accounts are

included in recoveries for the determination of net charge-offs. Costs

to recover previously charged-off accounts are recorded as collections

expense in non-interest expenses.

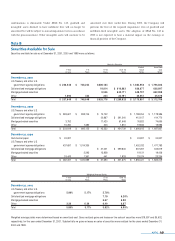

Securitizations

On April 1, 2001, the Company adopted the requirements of Statement

of Financial Accounting Standards (“SFAS”) No. 140, “Accounting for

Tr ansfers and Servicing of Financial Assets and Extinguishment of

Liabilities,” (“SFAS 140”), a replacement of SFAS 125, which applies

prospectively to all securitization transactions occurring after March 31,

2001. Adoption of SFAS 140 did not have a material impact on the

operations or financial position of the Company.

Periodically, the Company transfers pools of consumer loan receivables

to one or more third-party trusts or qualified special purpose entities

(the “trusts”) for use in securitization transactions. Transfers of

receivables that meet the requirements set forth in SFAS 140 for sales

treatment are accounted for as off-balance sheet securitizations in

accordance with SFAS 140. Certain undivided interests in the pool of

consumer loan receivables are sold to investors as asset-backed

securities in public underwritten offerings or private placement

transactions. The remaining undivided interests retained by the

Company (“seller's interest”) is recorded in consumer loans.

The proceeds from off-balance sheet securitizations are distributed by

the trusts to the Company as consideration for the consumer loan

receivables transferred. Each new securitization results in the removal

of the sold assets from the balance sheet and the recognition of the

gain on the sale of the receivables. This gain on sale is based on the

estimated fair value of assets sold and retained and liabilities incurred,

and is recorded at the time of sale in servicing and securitizations

income. The related receivable is the interest-only strip, which is

concurrently recorded at fair value in accounts receivable from

securitizations on the balance sheet. The Company estimates the fair

value of the interest-only strip based on the present value of the

46 notes

Notes to Consolidated Financial Statements

(Currencies in Thousands, Except Per Share Data)