Capital One 2001 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company actively engages in off-balance sheet consumer loan

securitization transactions. Securitizations involve the transfer of a

pool of loan receivables by the Company to an entity created for

securitizations, generally a trust or other special purpose entity (“the

trusts”). The credit quality of the receivables is supported by credit

enhancements, which may be in various forms including interest-only

strips, subordinated interests in the pool of receivables, cash collateral

accounts, and accrued but unbilled interest on the pool of receivables.

Securities ($24.3 billion outstanding as of December 31, 2001)

representing undivided interests in the pool of consumer loan

receivables are sold to the public through an underwritten offering or

to private investors in private placement transactions. The Company

receives the proceeds of the sale. In certain securitizations, the

Company retains an interest in the trust (“seller’s interest”) equal to the

amount of the outstanding receivables transferred to the trust in

excess of the principal balance of the securities outstanding. For

revolving securitizations, the Company’s undivided interest in the trusts

varies as the amount of the excess

receivables in the trusts fluctuates as

the accountholders make principal payments and incur new charges on

the selected accounts. A securitization of amortizing assets, such as auto

loans, generally does not include a seller’s interest. A securitization

accounted for as a sale

in accordance with SFAS

140 generally results

in the removal of the

receivables, other than any

applicable seller’s interest,

from the Company’s

balance sheet for financial

and regulatory accounting

purposes.

Collections received from securitized receivables are used to pay

interest to investors, servicing and other fees, and are available to

absorb the investors’ share of credit losses. For revolving

securitizations, amounts collected in excess of that needed to pay the

above amounts are remitted to the Company, as described in servicing

and securitizations income. For amortizing securitizations, amounts in

excess of the amount that is used to pay interest, fees and principal are

generally remitted to the Company, but may be paid to investors in

further reduction of their outstanding principal as described below.

Investors in the Company’s revolving securitization program are

generally entitled to receive principal payments either in one lump

sum after an accumulation period or through monthly payments

during an amortization period. Amortization may begin sooner in

certain circumstances, including the

possibility of the annualized portfolio

yield (generally consisting of interest

and fees) for a three-month period

dropping below the sum of the security

rate payable to investors, loan servicing

fees and net credit losses during the

period. Increases in net credit losses

and payment rates could significantly

decrease the spread and cause early

amortization. At December 31, 2001,

the annualized portfolio yields on

the Company’s off-balance sheet

securitizations sufficiently exceeded

the sum of the related security rate

payable to investors, loan servicing fees

and net credit losses, and as such,

early amortizations of its off-balance

sheet securitizations were not expected.

In revolving securitizations, prior

to the commencement of the amortization or accumulation period, the

investors’ share of the principal payments received on the trusts’

receivables are reinvested in new receivables to maintain the principal

balance of the securities. During the amortization period, the investors’

share of principal payments is paid to the security holders until the

securities are repaid. When the trust allocates principal payments to the

security holders, the Company’s reported consumer loans increase by

the new amount on any new activity on the accounts. During the

accumulation period, the investors’share of principal payments is paid

into a principal funding account designed to accumulate principal

collections so that the securities can be paid in full on the expected final

payment date.

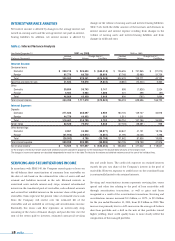

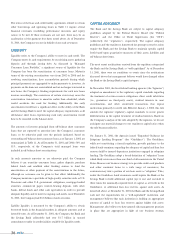

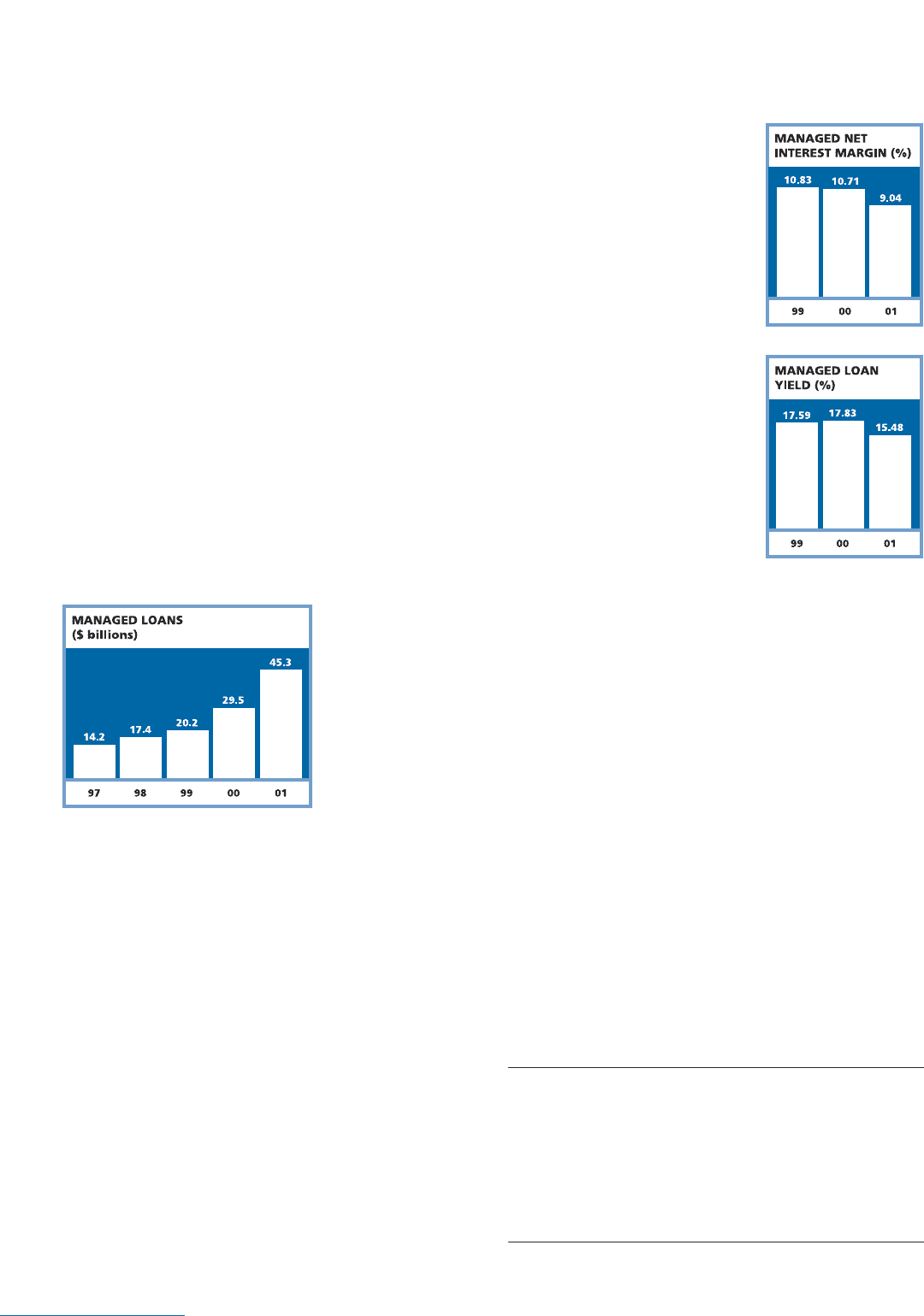

Table 2 indicates the impact of the consumer loan securitizations on

average earning assets, net interest margin and loan yield for the

periods presented. The Company intends to continue to securitize

consumer loans.

24 md&a

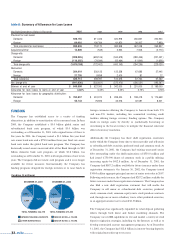

table 2: Operating Data and Ratios

Year Ended December 31

(Dollars in Thousands) 2001 2000 1999

Reported:

Average earning assets $20,706,172 $ 13,252,033 $ 9,694,406

Net interest margin 8.03% 11.99% 10.86%

Loan yield 15.29 19.91 19.33

Managed:

Average earning assets $38,650,677 $ 24,399,119 $20,073,964

Net interest margin 9.04% 10.71% 10.83%

Loan yield 15.48 17.83 17.59