Capital One 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

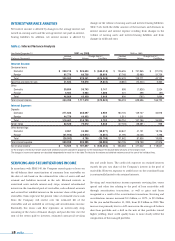

RISK ADJUSTED REVENUE

AND MARGIN

The Company’s products are designed

with the objective of maximizing

customer value while optimizing

revenue for the level of risk

undertaken. Management believes that

comparable measures for external

analysis are the risk adjusted revenue

and risk adjusted margin of the

managed portfolio. Risk adjusted revenue is defined as net interest

income and non-interest income less net charge-offs. Risk adjusted

margin measures risk adjusted revenue as a percentage of average

earning assets. These measures consider not only the loan yield and net

interest margin, but also the fee income associated with these products.

By deducting net charge-offs, consideration is given to the risk

inherent in the Company’s portfolio.

The Company markets its card products to specific consumer

populations. The terms of each card product are actively managed to

achieve a balance between risk and expected performance, while

obtaining the expected return. For example, card product terms

typically include the ability to reprice individual accounts upwards or

downwards based on the consumer’s performance. In addition, since

1998, the Company has aggressively marketed low non-introductory

rate cards to consumers with the best established credit profiles to take

advantage of the favorable risk return characteristics of this consumer

type. Industry competitors have continuously solicited the Company’s

customers with similar interest rate strategies. Management believes

the competition has put, and will continue to put, additional pressure

on the Company’s pricing strategies.

By applying its IBS and in response

to dynamic competitive pressures,

the Company also concentrates a

significant amount of its marketing

expense to other credit card product

opportunities. Examples of such

products include secured cards, lifestyle

cards, co-branded cards, student

cards and other cards marketed to

certain consumer populations that the

Company feels are underserved by the

Company’s competitors. These products

do not have a significant, immediate

impact on managed loan balances;

rather they typically consist of lower

credit limit accounts and balances that

build over time. The terms of these

customized card products tend to

include membership fees and higher

annual finance charge rates. The profile

of the consumer populations that these

products are marketed to, in some cases, may also tend to result in

higher account delinquency rates and consequently higher past-due

and overlimit fees as a percentage of loan receivables outstanding than

the low non-introductory rate products.

Table 3 provides income statement data and ratios for the Company’s

managed consumer loan portfolio. The causes of increases and

decreases in the various components of risk adjusted revenue are

discussed in further detail in subsequent sections of this analysis.

md&a 25

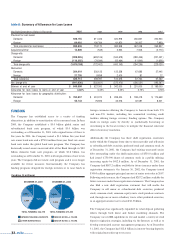

table 3: Managed Risk Adjusted Revenue

Year Ended December 31 (Dollars in Thousands) 2001 2000 1999

Managed Income Statement:

Net interest income $3,492,620 $ 2,614,321 $ 2,174,726

Non-interest income 3,337,397 2,360,111 1,668,381

Net charge-offs (1,438,370) (883,667) (694,073)

Risk adjusted revenue $5,391,647 $ 4,090,765 $ 3,149,034

Ratios:(1)

Net interest income 9.04% 10.71% 10.83%

Non-interest income 8.63 9.67 8.31

Net charge-offs (3.72) (3.62) (3.45)

Risk adjusted margin 13.95% 16.77% 15.69%

(1) As a percentage of average managed earning assets.