Capital One 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders and friends:

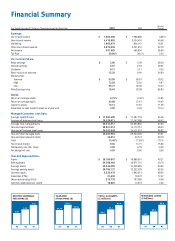

Capital One had an outstanding year. We added 10 million accounts, bringing our account base to

43 million. Managed loans grew by 53%.And with a 30% rise in earnings, we again fulfilled the bold promise we

made seven years ago: annual earnings growth of 20%-plus and a yearly return on equity of 20%-plus. Reaching

those goals seven times in a row puts Capital One in a league with only seven other publicly held U.S. companies.

A few measurements from our growth chart: Since 1995, managed loans and earnings have quadrupled, and

our customer population has multiplied sevenfold. Capital One now has more accounts than American Express®

.

We’ve become one of the country’s 16 largest consumer franchises and the sixth largest credit card issuer in the U.S.

The real significance of Capital One's performance in 2001 lies not in the numbers but in the fact that the

Company continued to set records despite the recession that began in the spring and the global turmoil that

followed the tragedy of September 11. Having prospered in the face of these challenges, we’re bullish about the

future of Capital One.

In 2002 we expect another earnings increase of 20%. Longer term, we’re optimistic for many reasons, all of

them fundamental. Capital One is a strong player in a growing industry: credit cards. Our U.S. card operations are

highly profitable, and our credit quality is the best in the industry.We’ve strengthened our position in the market.

Our new “No-Hassle” Platinum Card with a single low, fixed rate on everything, including cash advances,

is proving to be a strong attraction to customers.

Outside the U.S., Capital One is laying the foundation of a global financial services company. We now serve

three million customers in the U.K., South Africa, Canada and France.We see significant potential elsewhere in

Europe and in other countries where consumers are in the early stages of adopting the credit card as a medium of

exchange and a form of borrowing that is anonymous, convenient and comparatively inexpensive. Credit

card companies should also benefit from the introduction of the euro, which is expected to stimulate

cross-border trade and consumer spending by eliminating the risk and expense of currency conversions.

The Company’s recent diversification into other forms of consumer lending has been highly successful,

and the opportunities for profitable long-term growth are substantial. The markets are large and well-suited to

Capital One’s strategy and expertise. In three years, Capital One’s lending volume in auto and installment loans

has grown dramatically. We’ll continue growing these businesses internally and with selective acquisitions of

One year older.

Fifty-three percent bigger. And

still growing strong.