Capital One 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

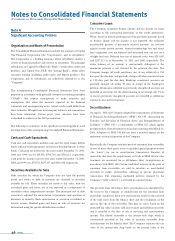

combinations is eliminated. Under SFAS No. 142, goodwill and

intangible assets deemed to have indefinite lives will no longer be

amortized but will be subject to annual impairment tests in accordance

with the pronouncement. Other intangible assets will continue to be

amortized over their useful lives. During 2002, the Company will

perform the first of the required impairment tests of goodwill and

indefinite-lived intangible assets. The adoption of SFAS No. 142 in

2002 is not expected to have a material impact on the earnings or

financial position of the Company.

notes 49

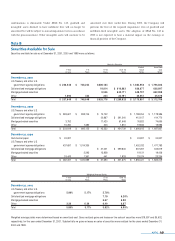

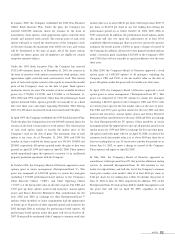

Note B

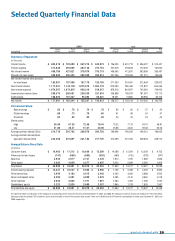

Securities Available for Sale

Securities available for sale as of December 31, 2001, 2000 and 1999 were as follows:

Maturity Schedule

Market Amortized

1 Year 1–5 5–10 Over 10 Value Cost

or Less Years Years Years Totals Totals

December 31, 2001

U.S. Treasury and other U.S.

government agency obligations $256,548 $ 748,224 $800,184 $ 1,804,956 $ 1,796,033

Collateralized mortgage obligations 19,814 $ 616,863 636,677 628,897

Mortgage-backed securities 8,536 640,171 648,707 662,098

Other 1,092 424 244 23,791 25,551 25,678

Total $257,640 $ 748,648 $828,778 $1,280,825 $ 3,115,891 $ 3,112,706

December 31, 2000

U.S. Treasury and other U.S.

government agency obligations $ 283,607 $ 893,745 $ 10,702 $ 1,188,054 $ 1,178,386

Collateralized mortgage obligations 20,867 $ 391,240 412,107 414,770

Mortgage-backed securities 3,752 11,420 61,648 76,820 74,695

Other 16,260 1,380 343 1,851 19,834 19,986

Total $ 303,619 $ 895,125 $ 43,332 $ 454,739 $ 1,696,815 $ 1,687,837

December 31, 1999

Commercial paper $ 24,927 $ 24,927 $ 24,927

U.S. Treasury and other U.S.

government agency obligations 437,697 $ 1,014,335 1,452,032 1,471,783

Collateralized mortgage obligations $ 37,421 $ 299,846 337,267 345,619

Mortgage-backed securities 5,293 13,828 19,121 19,426

Other 19,443 1,361 441 1,829 23,074 23,254

Total $ 482,067 $ 1,020,989 $ 51,690 $ 301,675 $ 1,856,421 $ 1,885,009

Weighted Average Yields

1 Year 1–5 5–10 Over 10

or Less Years Years Years

December 31, 2001

U.S. Treasury and other U.S.

government agency obligations 5.90% 5.17% 5.78%

Collateralized mortgage obligations 7.10 6.20%

Mortgage-backed securities 6.67 6.00

Other 3.26 6.36 6.49 6.07

Total 5.89% 5.17% 5.82% 6.09%

Weighted average yields were determined based on amortized cost. Gross realized gains and losses on the sales of securities were $19,097 and $5,602,

respectively, for the year ended December 31, 2001. Substantially no gains or losses on sales of securities were realized for the years ended December 31,

2000 and 1999.