Capital One 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2001 Annual Report

Growing

43,800,000

accounts

33,800,000

23,700,000

16,700,000

11,700,000

8,600,000

6,100,000

accounts

Table of contents

-

Page 1

Growing 43,800,000 accounts 33,800,000 23,700,000 16,700,000 11,700,000 8,600,000 2001 Annual Report 6,100,000 accounts -

Page 2

-

Page 3

Capital One is a leader in the direct marketing of credit cards, auto loans and other consumer ï¬nancial services. It has 43 million accounts and is one of the world's largest consumer franchises. Capital One has grown by pursuing an information-based strategy (IBS) that enables it to test ideas ... -

Page 4

..., and our credit quality is the best in the industry. We've strengthened our position in the market. Our new "No-Hassle" Platinum Card with a single low, ï¬xed rate on everything, including cash advances, is proving to be a strong attraction to customers. Outside the U.S., Capital One is laying the... -

Page 5

30% earnings growth 30% 30% 42% 21% 21% 30% earnings growth Capital One's IPO Richard D. Fairbank Chairman and Chief Executive Officer Nigel W. Morris President and Chief Operating Officer -

Page 6

...100 Best Places to Work in America™" list published in FORTUNE® magazine. After taking the full measure of our strengths-associates, strategy, brand, products and markets-we are as optimistic as ever about the future of Capital One. Richard D. Fairbank Chairman and Chief Executive Officer Nigel... -

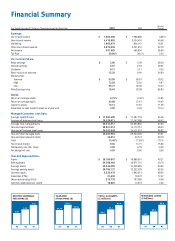

Page 7

... loans Year-end off-balance sheet loans Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate (30+ days) Net charge-off rate Year-End Reported Data: Assets Earning assets Average assets Average earning assets Common equity Associates (FTEs) Shares... -

Page 8

...rate on cash advances as well as purchases, is a big hit in the affluent superprime market. Capital One's lifestyle and lifestage cards tap numerous micro-markets, from sci-ï¬ buffs to newlyweds. Our MilesOne frequent ï¬,yer card continues to win customers by offering the best value: low annual fee... -

Page 9

Capital One continues to revolutionize the card indust ry. The latest example: the No-Hassle Platinum Card. -

Page 10

... customers in the U.K., South Africa, Canada and France. After only a few years in the U.K., Capital One is the country's eighth largest credit card issuer and is adding customers faster than any of its competitors. We have also been recognized as one of Britain's best employers and an outstanding... -

Page 11

Capital One is now operating in the U.K., France, Canada and South Africa-and customers throughout the world are using our products. -

Page 12

Last year our television campaign reached more than 95% of all American households. -

Page 13

... year our new ad campaign was seen by 95% of American households. And that was just one part of a marketing effort that made 19 million see Capital One Bowl Week on ESPNTM millions of impressions on consumers in 2001. But at Capital One, we ask our ad "Best Television Ad Campaign" CIMA Awards Card... -

Page 14

In 2001 Capital One acquired two new lending subsidiaries: Amerifee and PeopleFirst. -

Page 15

... trillion auto ï¬nance market three years ago with an acquisition that brought us $300 million in loans. In October 2001 we added $710 million with the acquisition of PeopleFirst, the Internet's largest originator of auto acquired PeopleFirst loans. Capital One now has an auto ï¬nance portfolio... -

Page 16

... telethon scheduled to air on September 20. The people slated to manage the phone banks during the broadcast had dropped out. Could we help? In a matter of hours after a single company-wide e-mail, thousands of Capital One associates had volunteered their personal time to help in any way they... -

Page 17

-

Page 18

... "100 Best Places to Work in IT" -Computerworld FORTUNE,® Computerworld® and a growing number of other publications. FORTUNE named us to its America's Most Admired Companies list in 2001, and The Sunday Times of London ranks us as one of the three best employers in the U.K. In annual employee... -

Page 19

-

Page 20

... among U.S. companies and 356th in the Global 1,000. ® ® Business Excellence Award Business in the Community (U.K.) Card Marketing magazine 2001 CIMA awards, Best Television Ad Campaign CIO 100, for innovation in IT Computerworld, 100 Best Places to Work in IT Credit Card Management, Issuer of... -

Page 21

ï¬nancial presentation 2001 -

Page 22

... Condition and Results of Operations Selected Quarterly Financial Data Management's Report on Consolidated Financial Statements and Internal Controls Over Financial Reporting Report of Independent Auditors Consolidated Financial Statements Notes to Consolidated Financial Statements 21 22 39 40... -

Page 23

...deposits Borrowings Stockholders' equity Average reported loans Average off-balance sheet loans Average total managed loans Interest income Year-end total managed loans Year-end total accounts (000s) Yield Net interest margin Delinquency rate Net charge-off rate $ $ $ $ $ Managed Consumer Loan... -

Page 24

...opportunities. Salaries and associate beneï¬ts expense increased $368.7 million, or 36%, to $1.4 billion as a direct result of the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 57% for the year ended December 31, 2001, to... -

Page 25

....2 million, or 31%, reï¬,ect the increase in marketing investment in existing and new product opportunities and the cost of operations to manage the growth in the Company's accounts and products offered. Average managed consumer loans grew 25% for the year ended December 31, 2000, to $22.6 billion... -

Page 26

... and cause early amortization. At December 31, 2001, the annualized portfolio yields on the Company's off-balance sheet securitizations sufficiently exceeded the sum of the related security rate payable to investors, loan servicing fees and net credit losses, and as such, early amortizations of... -

Page 27

... they typically consist of lower credit limit accounts and balances that build over time. The terms of these customized card products tend to include membership fees and higher annual ï¬nance charge rates. The proï¬le of the consumer populations that these products are marketed to, in some cases... -

Page 28

... and past-due fees earned from the Company's consumer loans and securities less interest expense on borrowings, which include interest-bearing deposits, borrowings from senior notes and other borrowings. Reported net interest income for the year ended December 31, 2001, was $1.7 billion compared... -

Page 29

... and Rates Year Ended December 31 (Dollars in Thousands) Average Balance 2001 Income/ Expense Yield/ Rate Average Balance 2000 Income/ Expense 1999 Yield/ Rate Average Balance Income/ Expense Yield/ Rate Assets: Earning assets Consumer loans Domestic Foreign Total Securities available for sale... -

Page 30

... Year Ended December 31 (Dollars in Thousands) Increase (Decrease) 2001 vs. 2000 Change Due to (1) Volume Yield/Rate Increase (Decrease) 2000 vs. 1999 Change Due to (1) Volume Yield/Rate Interest Income: Consumer loans Domestic Foreign Total Securities available for sale Other Domestic Foreign... -

Page 31

...increased purchase volume and new account growth for the year ended December 31, 2001. Service charges and other customer-related fees decreased by $45.3 million, or 3%, to $1.6 billion for the year ended December 31, 2001. This decrease was primarily due to the shift in the mix of the reported loan... -

Page 32

... rates. In the case of secured card loans, collateral, in the form of cash deposits, reduces any ultimate charge-offs. The costs associated with higher delinquency and charge-off rates are considered in the pricing of individual products. During 2001, general economic conditions for consumer credit... -

Page 33

... year ended December 31, 2001, the reported net charge-off rate decreased 64 basis points to 4.00%. The decrease in the reported net charge-off rate was the result of a shift in the overall mix of the reported portfolio towards lower yielding, higher credit quality loans. Table 7 shows the Company... -

Page 34

...available for future issuance under these registration statements. The Company has also ï¬led a new shelf registration statement that will enable the Company to sell senior or subordinated debt securities, preferred stock, common stock, common equity units, stock purchase contracts and, through one... -

Page 35

... of the years ended December 31, 2001, 2000 and 1999. table 9: Short-Term Borrowings (Dollars in Thousands) Maximum Outstanding as of any Month-End Outstanding as of Year-End Average Outstanding Average Interest Rate Year-End Interest Rate 2001 Federal funds purchased and resale agreements... -

Page 36

... business strategy is to provide credit card products and other consumer loans to a wide range of consumers, the examiners may view a portion of our loan assets as "subprime." Thus, under the Guidelines, bank examiners could require the Bank or the Savings Bank to hold additional capital (up to one... -

Page 37

...the management of its interest rate exposure. The Company also enters into forward foreign currency exchange contracts and currency swaps to reduce its sensitivity to changing foreign currency exchange rates. These derivative ï¬nancial instruments expose the Company to certain credit, market, legal... -

Page 38

... Rate Sensitivity As of December 31, 2001 Subject to Repricing (Dollars in Millions) Within 180 Days > 180 Days- 1 Year > 1 Year- 5 Years Over 5 Years Earning assets: Federal funds sold and resale agreements Interest-bearing deposits at other banks Securities available for sale Consumer loans... -

Page 39

... of credit card products with other ï¬nancial products and services to optimize proï¬tability within the context of acceptable risk. We continually test new product offerings and pricing combinations, using IBS, to target different consumer groups. The number of tests we conduct has increased each... -

Page 40

... in the management and operations of new products and services; and other factors listed from time to time in the our SEC reports, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2001 (Part I, Item 1, Risk Factors). Impact of Delinquencies, Charge-Offs... -

Page 41

... The above schedule is a tabulation of the Company's unaudited quarterly results for the years ended December 31, 2001 and 2000. The Company's common shares are traded on the New York Stock Exchange under the symbol COF . In addition, shares may be traded in the over-the-counter stock market. There... -

Page 42

...Based on this assessment, the Company believes that as of December 31, 2001, in all material respects, the Company maintained effective internal controls over ï¬nancial reporting. Richard D. Fairbank Chairman and Chief Executive Officer Nigel W. Morris President and Chief Operating Officer David... -

Page 43

...Capital One Financial Corporation as of December 31, 2001 and 2000, and the related consolidated statements of income, changes in stockholders' equity, and cash ï¬,ows for each of the three years in the period ended December 31, 2001. These ï¬nancial statements are the responsibility of the Company... -

Page 44

... Thousands, Except Per Share Data) 2001 2000 Assets: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance for loan losses Net loans Accounts receivable from... -

Page 45

Consolidated Statements of Income Year Ended December 31 (In Thousands, Except Per Share Data) 2001 $ 2,642,767 138,188 53,442 2,834,397 $ 2000 1999 Interest Income: Consumer loans, including fees Securities available for sale Other Total interest income 2,286,774 96,554 6,574 2,389,902 $ 1,482... -

Page 46

... income tax: Unrealized gains on securities, net of income taxes of $19,510 Foreign currency translation adjustments Other comprehensive income Comprehensive income Cash dividends - $0.11 per share Purchases of treasury stock Issuances of common stock Exercise of stock options Common stock issuable... -

Page 47

... Statements of Cash Flows Year Ended December 31 (In Thousands) 2001 2000 1999 Operating Activities: Net income Adjustments to reconcile net income to cash provided by operating activities: Provision for loan losses Depreciation and amortization, net Stock compensation plans Increase... -

Page 48

...a holding company whose subsidiaries market a variety of ï¬nancial products and services to consumers. The principal subsidiaries are Capital One Bank (the "Bank"), which offers credit card products, and Capital One, F.S.B. (the "Savings Bank"), which offers consumer lending (including credit cards... -

Page 49

... international segment is comprised primarily of credit card lending activities in the United Kingdom and Canada. Consumer lending is the Company's only reportable business segment, based on the quantitative thresholds applied to the managed loan portfolio for reportable segments provided in SFAS No... -

Page 50

... be highly effective as a hedge. Prior to January 1, 2001, the Company also used interest rate swap contracts and foreign exchange contracts for hedging purposes. Amounts paid or received on interest rate and currency swaps were recorded on an accrual basis as an adjustment to the related income or... -

Page 51

... the earnings or ï¬nancial position of the Company. Note B Securities Available for Sale Securities available for sale as of December 31, 2001, 2000 and 1999 were as follows: Maturity Schedule 1 Year or Less 1-5 Years 5-10 Years Over 10 Years Market Value Totals Amortized Cost Totals December 31... -

Page 52

... Note Program, the Bank from time to time could issue senior bank notes at ï¬xed or variable rates tied to London InterBank Offering Rates ("LIBOR") with maturities from 30 days to 30 years. The Company did not renew such program and it is no longer available for issuances. As of December 31, 2001... -

Page 53

...depository shares evidenced by depository receipts and (iii) common stock. The amount of securities registered is limited to a $1,550,000 aggregate public offering price or its equivalent (based on the applicable exchange rate at the time of sale) in one or more foreign currencies, currency units or... -

Page 54

...the difference between the exercise price and the target stock price required for vesting and is recognized over the estimated vesting period. The Company recognized $1,768, $10,994 and $44,542 of compensation cost relating to its associate stock plans for the years ended December 31, 2001, 2000 and... -

Page 55

... options to certain key managers (including 1,884,435 options to the Company's CEO and COO) with an exercise price equal to the fair market value on the date of grant. The CEO and COO gave up their salaries for the year 2001 and their annual cash incentives, annual option grants and Senior Executive... -

Page 56

... then market price of $33.77 per share. The Company's CEO and COO gave up 300,000 and 200,010 vested options (valued at $8,760 in total), respectively, in exchange for their EntrepreneurGrant III options. Other executive officers gave up future cash compensation for each of the next three years in... -

Page 57

... for issuance under the Associate Stock Purchase Plan, of which 847,582 shares were available for issuance as of December 31, 2001. On November 16, 1995, the Board of Directors of the Company declared a dividend distribution of one Right for each outstanding share of common stock. As amended, each... -

Page 58

... dividends or optional cash investments. In 2001, the Company issued 659,182 shares of new common stock under the DRP. December 31 2001 2000 Deferred tax assets: Allowance for loan losses Unearned income Stock incentive plan Foreign Net operating losses State taxes, net of federal beneï¬t Other... -

Page 59

... medical and dental procedures. The acquisition was accounted for as a purchase business combination. The initial acquisition price for AmeriFee was $81,500, paid through approximately $64,500 of cash and approximately 257,000 shares of the Company's common stock. This purchase combination created... -

Page 60

... one-third of all consumers in the United States. Because the Company's business strategy is to provide credit card products and other consumer loans to a wide range of consumers, the examiners may view a portion of the Company's loan assets as "subprime." Thus, under the Guidelines, bank examiners... -

Page 61

.... Upon a sale of the property at the end of the lease term, the Company's obligation is limited to any amount by which the guaranteed residual value exceeds the selling price. Note M Related Party Transactions In the ordinary course of business, executive officers and directors of the Company may... -

Page 62

... 171,245 48,211 For the year ended December 31, 2001 and 2000, the Company recognized $68,135 and $30,466, respectively, in gains related to the new transfer of receivables accounted for as sales, net of transaction costs. These gains are recorded in servicing and securitizations income. 60 notes -

Page 63

... exchange rate changes on its foreign currency denominated loans. The forward rate agreements allow the Company to "lock-in" functional currency equivalent cash ï¬,ows associated with the foreign currency denominated loans. During the year ended December 31, 2001, the Company recognized no net gains... -

Page 64

... movements in exchange rates. For the year ended December 31, 2001, net losses of $605 related to these derivatives was included in the cumulative translation adjustment. The Company has also entered into currency swaps that effectively convert ï¬xed rate pound sterling interest receipts to ï¬xed... -

Page 65

... amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximated fair value. Senior notes The fair value of senior notes was determined based on quoted market prices. Interest payable Securities available for sale The fair... -

Page 66

... One Bank-Canada Branch, a foreign branch office of the Bank that provides consumer lending products in Canada. The total assets, revenue, income before income taxes and net income of the international operations are summarized below. 2001 2000 1999 Note S Capital One Financial Corporation (Parent... -

Page 67

... of senior notes Dividends paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options Net cash provided by ï¬nancing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash... -

Page 68

... and Officers Capital One Financial Corporation Board of Directors Richard D. Fairbank Chairman and Chief Executive Officer Capital One Financial Corporation Nigel W. Morris President and Chief Operating Officer Capital One Financial Corporation W. Ronald Dietz* Managing Partner Customer Contact... -

Page 69

... President, Investor Relations Capital One Financial Corporation 2980 Fairview Park Drive, Suite 1300 Falls Church, VA 22042-4525 (703) 205-1039 Common Stock Listed on New York Stock Exchange Stock Symbol COF Member of S&P 500 Corporate Registrar/Transfer Agent Equiserve Trust Company, N.A. Mail... -

Page 70

2980 Fairview Park Drive Suite 1300 Falls Church, VA 22042-4525 (703) 205-1000 w w w .capit alone.com