Berkshire Hathaway 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

"Wherever feasible, I believe in maintaining such a partnership frame of mind, even though we

operate through a large, fairly widely-held corporation. Our Treasury ruling will allow such partnership-

like behavior in this area . . .

"I am pleased that Berkshire donations can become owner-directed. It is ironic, but understandable,

that a large and growing number of major corporations have charitable policies pursuant to which they will

match gifts made by their employees (and — brace yourself for this one — many even match gifts made by

directors) but none, to my knowledge, has a plan matching charitable gifts by owners. I say "understandable"

because much of the stock of many large corporations is owned on a "revolving door" basis by institutions

that have short-term investment horizons, and that lack a long-term owner's perspective . . .

"Our own shareholders are a different breed. As I mentioned in the 1979 annual report, at the end of

each year more than 98% of our shares are owned by people who were shareholders at the beginning of the

year. This long-term commitment to the business reflects an owner mentality which, as your manager, I

intend to acknowledge in all feasible ways. The designated contributions policy is an example of that intent."

* * *

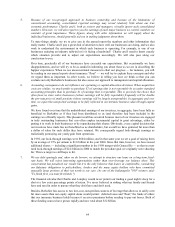

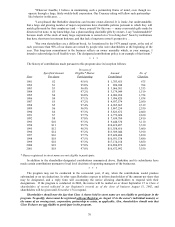

The history of contributions made pursuant to this program since its inception follows:

Percent of

Specified Amount Eligible* Shares Amount No. of

Year Per share Participating Contributed Charities

1981 $2 95.6% $ 1,783,655 675

1982 $1 95.8% $ 890,948 704

1983 $3 96.4% $ 3,066,501 1,353

1984 $3 97.2% $ 3,179,049 1,519

1985 $4 96.8% $ 4,006,260 1,724

1986 $4 97.1% $ 3,996,820 1,934

1987 $5 97.2% $ 4,937,574 2,050

1988 $5 97.4% $ 4,965,665 2,319

1989 $6 96.9% $ 5,867,254 2,550

1990 $6 97.3% $ 5,823,672 2,600

1991 $7 97.7% $ 6,772,024 2,630

1992 $8 97.0% $ 7,634,784 2,810

1993 $10 97.3% $ 9,448,370 3,110

1994 $11 95.7% $10,419,497 3,330

1995 $12 96.3% $11,558,616 3,600

1996 $14 97.2% $13,309,044 3,910

1997 $16 97.7% $15,424,480 3,830

1998 $18 97.5% $16,931,538 3,880

1999 $18 97.3% $17,174,158 3,850

2000 $18 97.0% $16,894,872 3,660

2001 $18 97.8% $16,672,992 3,550

* Shares registered in street name are not eligible to participate.

In addition to the shareholder-designated contributions summarized above, Berkshire and its subsidiaries have

made certain contributions pursuant to local level decisions of operating managers of the businesses.

* * *

The program may not be conducted in the occasional year, if any, when the contributions would produce

substandard or no tax deductions. In other years Berkshire expects to inform shareholders of the amount per share that

may be designated, and a reply form will accompany the notice allowing shareholders to respond with their

designations. If the program is conducted in 2002, the notice will be mailed on or about September 15 to Class A

shareholders of record reflected in our Registrar's records as of the close of business August 31, 2002, and

shareholders will be given until November 15 to respond.

Shareholders should note the fact that Class A shares held in street name are not eligible to participate in the

program. To qualify, shares must be registered with our Registrar on August 31 in the owner's individual name(s) or

the name of an owning trust, corporation, partnership or estate, as applicable. Also, shareholders should note that

Class B shares are not eligible to participate in the program.