Berkshire Hathaway 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

owners: A gorgeous woman slinks up to a CEO at a party and through moist lips purrs, Ill do anything anything

you want. Just tell me what you would like. With no hesitation, he replies, Reprice my options.

One final thought about Berkshire: In the future we wont come close to replicating our past record. To be

sure, Charlie and I will strive for above-average performance and will not be satisfied with less. But two conditions

at Berkshire are far different from what they once were: Then, we could often buy businesses and securities at much

lower valuations than now prevail; and more important, we were then working with far less money than we now

have. Some years back, a good $10 million idea could do wonders for us (witness our investment in Washington

Post in 1973 or GEICO in 1976). Today, the combination of ten such ideas and a triple in the value of each would

increase the net worth of Berkshire by only ¼ of 1%. We need elephants to make significant gains now and

they are hard to find.

On the positive side, we have as fine an array of operating managers as exists at any company. (You can

read about many of them in a new book by Robert P. Miles: The Warren Buffett CEO.) In large part, moreover, they

are running businesses with economic characteristics ranging from good to superb. The ability, energy and loyalty

of these managers is simply extraordinary. We now have completed 37 Berkshire years without having a CEO of

an operating business elect to leave us to work elsewhere.

Our star-studded group grew in 2001. First, we completed the purchases of two businesses that we had

agreed to buy in 2000 Shaw and Johns Manville. Then we acquired two others, MiTek and XTRA, and

contracted to buy two more: Larson-Juhl, an acquisition that has just closed, and Fruit of the Loom, which will close

shortly if creditors approve our offer. All of these businesses are led by smart, seasoned and trustworthy CEOs.

Additionally, all of our purchases last year were for cash, which means our shareholders became owners of

these additional businesses without relinquishing any interest in the fine companies they already owned. We will

continue to follow our familiar formula, striving to increase the value of the excellent businesses we have, adding

new businesses of similar quality, and issuing shares only grudgingly.

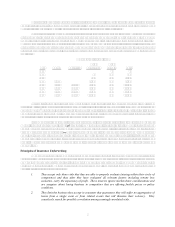

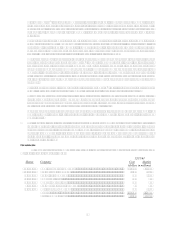

Acquisitions of 2001

A few days before last years annual meeting, I received a heavy package from St. Louis, containing an

unprepossessing chunk of metal whose function I couldnt imagine. There was a letter in the package, though, from

Gene Toombs, CEO of a company called MiTek. He explained that MiTek is the worlds leading producer of this

thing Id received, a connector plate, which is used in making roofing trusses. Gene also said that the U.K. parent

of MiTek wished to sell the company and that Berkshire seemed to him the ideal buyer. Liking the sound of his

letter, I gave Gene a call. It took me only a minute to realize that he was our kind of manager and MiTek our kind

of business. We made a cash offer to the U.K. owner and before long had a deal.

Genes managerial crew is exceptionally enthusiastic about the company and wanted to participate in the

purchase. Therefore, we arranged for 55 members of the MiTek team to buy 10% of the company, with each

putting up a minimum of $100,000 in cash. Many borrowed money so they could participate.

As they would not be if they had options, all of these managers are true owners. They face the downside of

decisions as well as the upside. They incur a cost of capital. And they cant reprice their stakes: What they paid

is what they live with.

Charlie and I love the high-grade, truly entrepreneurial attitude that exists at MiTek, and we predict it will

be a winner for all involved.

* * * * * * * * * * * *

In early 2000, my friend, Julian Robertson, announced that he would terminate his investment partnership,

Tiger Fund, and that he would liquidate it entirely except for four large holdings. One of these was XTRA, a

leading lessor of truck trailers. I then called Julian, asking whether he might consider selling his XTRA block or

whether, for that matter, the companys management might entertain an offer for the entire company. Julian

referred me to Lew Rubin, XTRAs CEO. He and I had a nice conversation, but it was apparent that no deal was to

be done.

Then in June 2001, Julian called to say that he had decided to sell his XTRA shares, and I resumed

conversations with Lew. The XTRA board accepted a proposal we made, which was to be effectuated through a

tender offer expiring on September 11th. The tender conditions included the usual out, allowing us to withdraw if