Berkshire Hathaway 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

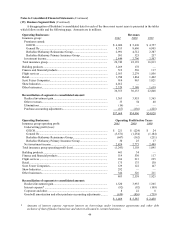

Notes to Consolidated Financial Statements (Continued)

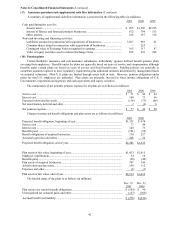

(17) Insurance premium and supplemental cash flow information (Continued)

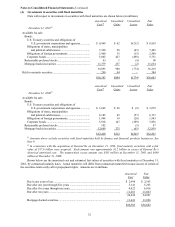

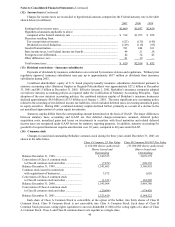

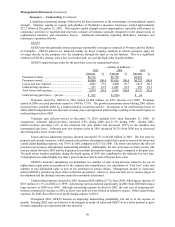

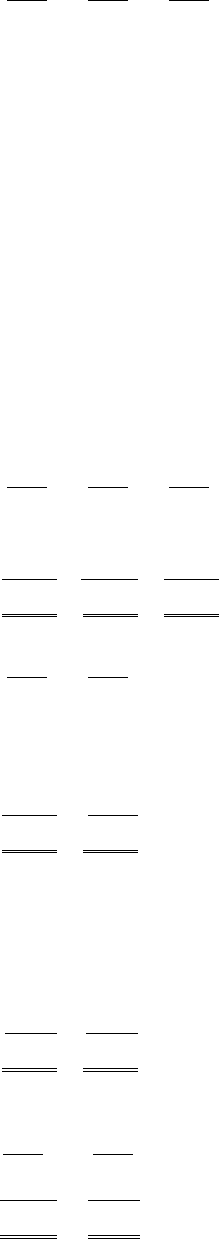

A summary of supplemental cash flow information is presented in the following table (in millions).

2001 2000 1999

Cash paid during the year for:

Income taxes............................................................................................................... $ 905 $1,396 $2,215

Interest of finance and financial products businesses ................................................. 672 794 513

Other interest .............................................................................................................. 225 157 136

Non-cash investing and financing activities:

Liabilities assumed in connection with acquisitions of businesses............................. 3,507 901 61

Common shares issued in connection with acquisitions of businesses....................... — 224 —

Contingent value of Exchange Notes recognized in earnings..................................... 105 117 87

Value of equity securities used to redeem Exchange Notes ....................................... 228 278 298

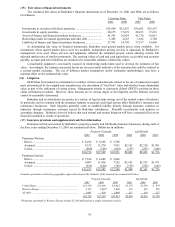

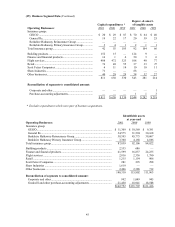

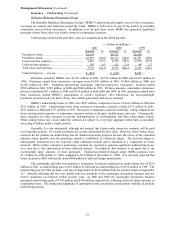

(18) Pension plans

Certain Berkshire insurance and non-insurance subsidiaries individually sponsor defined benefit pension plans

covering their employees. Benefits under the plans are generally based on years of service and compensation, although

benefits under certain plans are based on years of service and fixed benefit rates. Funding policies are generally to

contribute amounts required to meet regulatory requirements plus additional amounts determined by management based

on actuarial valuations. Most U.S. plans are funded through assets held in trust. However, pension obligations under

plans for non-U.S. employees are unfunded. Plan assets are primarily invested in fixed income obligations of U.S.

Government Corporations and agencies and cash equivalents and equity securities.

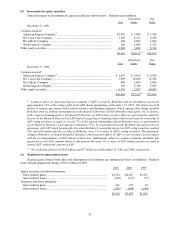

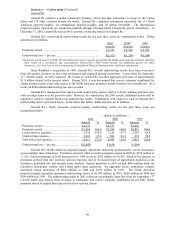

The components of net periodic pension expense for all plans are as follows (in millions).

2001 2000 1999

Service cost ...................................................................................................................... $ 71 $ 44 $ 44

Interest cost ...................................................................................................................... 140 73 66

Expected return on plan assets.......................................................................................... (136) (73) (66)

Net amortization, deferral and other................................................................................. 2 (2) 6

Net pension expense......................................................................................................... $ 77 $ 42 $ 50

Changes in projected benefit obligations and plan assets are as follows (in millions).

2001 2000

Projected benefit obligation, beginning of year................................................................ $1,335 $ 978

Service cost ...................................................................................................................... 71 44

Interest cost ...................................................................................................................... 140 73

Benefits paid..................................................................................................................... (101) (53)

Benefit obligations of acquired businesses....................................................................... 730 257

Actuarial (gain) loss and other.......................................................................................... 208 36

Projected benefit obligation, end of year.......................................................................... $2,383 $1,335

Plan assets at fair value, beginning of year....................................................................... $1,433 $1,015

Employer contributions .................................................................................................... 34 10

Benefits paid..................................................................................................................... (98) (49)

Plan assets of acquired businesses.................................................................................... 707 346

Actual return on plan assets.............................................................................................. 140 112

Expenses and other........................................................................................................... (2) (1)

Plan assets at fair value, end of year................................................................................. $2,214 $1,433

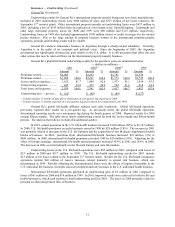

The funded status of the plans is as follows (in millions).

Dec. 31,

2001 Dec. 31,

2000

Plan assets over (under) benefit obligations ...................................................................... $ (169) $ 98

Unrecognized net actuarial gains and other....................................................................... (107) (308)

Accrued benefit cost liability............................................................................................. $ (276) $ (210)