Berkshire Hathaway 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

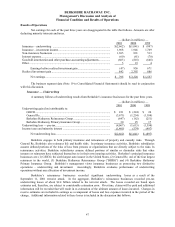

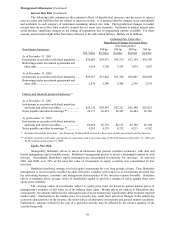

Non-Insurance Businesses (Continued)

Building products (Continued)

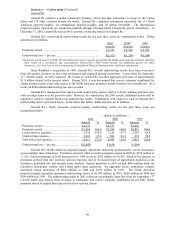

On a comparative full year basis, building products revenues were $3,746 million roughly unchanged from

the prior year. Full year operating profits of approximately $570 million declined about 4%. Most of the decline

occurred at Johns Manville where comparative results were negatively impacted by higher raw material prices and

energy costs.

Finance and financial products

Several finance and financial products businesses are included in this segment. Generally, these businesses

invest in various types of fixed-income securities, loans, leases and other financial instruments, often utilizing

leverage or borrowed funds in the process. The most significant of these businesses are BH Finance, a business

engaged in proprietary trading strategies, General Re Securities (“GRS”), a dealer in derivative contracts and XTRA

Corporation, a transportation equipment leasing business.

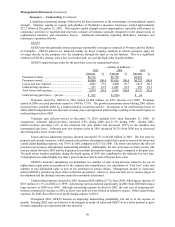

Operating income of the finance and financial products group in 2001 decreased $11 million (2.1%) as

compared to 2000. Income of BH Finance in 2001 declined $39 million from 2000. In 2001, interest income, net of

interest expense, of BH Finance increased significantly, but was more than offset by reduced realized investment

gains. Realized gains in 2000 derived from the disposition of a large portfolio of fixed income securities. Under

the current market conditions, BH Finance should continue to produce significant operating profits in 2002.

GRS’ s operating profit in 2001 was $11 million compared to a loss of $63 million in 2000. In January

2002, management announced that it would commence a long-term run-off of GRS. During the run-off period,

GRS will limit new business to certain risk management transactions and will unwind existing asset and liability

positions in an orderly manner. It is expected that the run-off will take several years to complete. It is currently

unknown what impact this decision may have on operating results in 2002.

In 2001, Berkshire’ s finance and financial products businesses also include the results of Berkadia LLC.

In 2001, the operating results included a pre-tax loss of $40 million from Berkadia. Such loss was caused by a loss

from Berkadia’ s application of the equity method of accounting related to its investment in FINOVA common stock

partially offset by net interest income. The structure of this transaction and risks associated with this transaction are

described in Note 9 to the Consolidated Financial Statements.

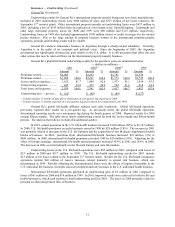

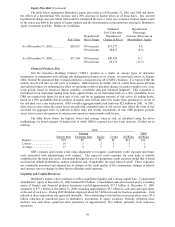

Flight services

This segment includes FlightSafety and Executive Jet. FlightSafety provides high technology training to

operators of aircraft and ships. FlightSafety’ s worldwide clients include corporations, the military and government

agencies. Executive Jet is the world’ s leading provider of fractional ownership programs for general aviation

aircraft. Revenues from flight services in 2001 increased $284 million (12.4%) over 2000. About 83% of the

increase in revenues was attributed to Executive Jet, which produced significant increases in revenues from both

flight operations and aircraft sales. Revenues from FlightSafety also increased approximately 7.7% in 2001 as

compared to 2000, reflecting both increased training revenues and product sales. Operating profits in 2001

decreased $27.1 million (12.8%) as compared to 2000. Increased operating profits at FlightSafety were more than

offset by reduced operating profits at Executive Jet. Executive Jet’ s results in 2001 and 2000 reflect operating

losses related to expansion into Europe as well as significantly higher operating costs incurred to insure that a

premier level of safety, security and service is maintained. The increases in safety and security costs were

exacerbated by the September 11th terrorist attack.

Retail

Berkshire’ s retailing businesses consist of four independently managed retailers of home furnishings

(Nebraska Furniture Mart and its subsidiaries (“NFM”), R.C. Willey Home Furnishings (“RC Willey”), Star

Furniture and Jordan's Furniture) and three independently managed retailers of fine jewelry (Borsheim's Jewelry,

Helzberg's Diamond Shops, and Ben Bridge Jeweler).