Berkshire Hathaway 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

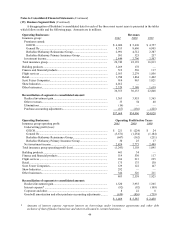

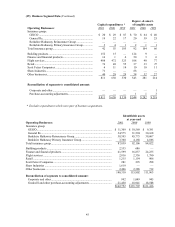

(9) Finance and financial products businesses (Continued)

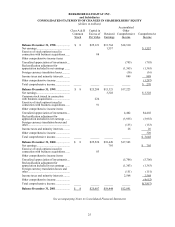

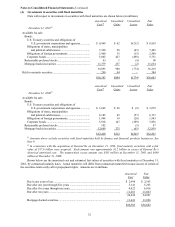

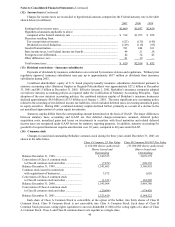

Income of Berkshire’ s finance and financial products businesses is shown below (in millions).

2001 2000 1999

Revenues

Interest income ........................................................................................ $1,377 $ 910 $ 737

Realized investment gain......................................................................... 120 367 103

Unrealized investment gain (loss) ........................................................... 5 177 (221)

Other........................................................................................................ 62 51 368

1,564 1,505 987

Cost and expenses

Annuity expenses .................................................................................... 57 54 53

Selling, general and administrative expenses .......................................... 180 123 228

Interest expense....................................................................................... 759 772 581

996 949 862

Earnings before income taxes............................................................... $ 568 $ 556 $ 125

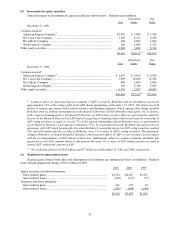

Additional information regarding Berkshire’ s finance and financial products business follows:

a) Significant accounting policies

Investment securities (principally fixed maturity and equity investments) that are acquired with the expectation of

selling them in the near term are classified as trading securities. Such assets are carried at fair value. Realized and

unrealized gains and losses related to securities classified as trading are included in income. Trading account assets and

liabilities are marked-to-market on a daily basis and represent the estimated fair values of derivatives in net gain

positions (assets) and in net loss positions (liabilities). The net gains and losses reflect reductions permitted under

master netting agreements with counterparties.

Securities purchased under agreements to resell (assets) and securities sold under agreements to repurchase

(liabilities) are accounted for as collateralized investments and borrowings and are recorded at the contractual resale or

repurchase amounts plus accrued interest. Other investment securities owned and liabilities associated with investment

securities sold but not yet purchased are carried at fair value.

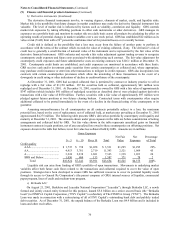

GRS is engaged as a dealer in various types of derivative instruments, including interest rate, currency and equity

swaps and options, as well as structured finance products. These instruments are carried at their current estimates of fair

value, which is a function of underlying interest rates, currency rates, security values, volatilities and the

creditworthiness of counterparties. Future changes in these factors or a combination thereof may affect the fair value of

these instruments with any resulting adjustment to be included currently in the Consolidated Statements of Earnings.

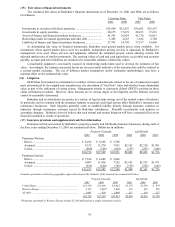

The net fair values of derivative contracts reflect the legal right to net transactions through qualifying master netting

arrangements with various counterparties. The carrying values of trading account assets and trading account liabilities

reflect a net decrease of $18,129 million at December 31, 2001 and $14,275 million at December 31, 2000 as a result of

the netting arrangements.

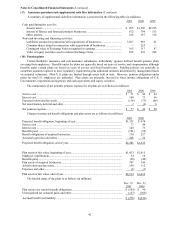

Annuity reserves and policyholder liabilities are carried at the present value of the actuarially determined ultimate

payment amounts discounted at market interest rates existing at the inception of the contracts. Such interest rates range

from 5% to 8%. Periodic accretions of the discounted liabilities are included in annuity expenses.

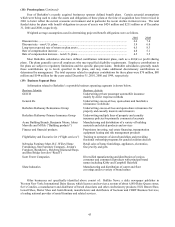

b) Derivative instruments

Interest rate, currency and equity swaps are agreements between two parties to exchange, at particular intervals,

payment streams calculated on a specified notional amount. Interest rate, currency and equity options grant the

purchaser the right, but not the obligation, to either purchase from or sell to the writer a specified financial instrument

under agreed terms. Interest rate caps and floors require the writer to pay the purchaser at specified future dates the

amount, if any, by which the option’ s underlying market interest rate exceeds the fixed cap or falls below the fixed floor,

applied to a notional amount.

Futures contracts are commitments to either purchase or sell a financial instrument at a future date for a specified

price and are generally settled in cash. Forward-rate agreements are financial instruments that settle in cash at a

specified future date based on the differential between agreed interest rates applied to a notional amount. Foreign

exchange contracts generally involve the exchange of two currencies at agreed rates on a specified date; spot contracts

usually require the exchange to occur within two business days of the contract date.