Berkshire Hathaway 2001 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Management's Discussion (Continued)

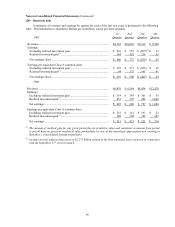

Non-Insurance Businesses (Continued)

Retail (Continued)

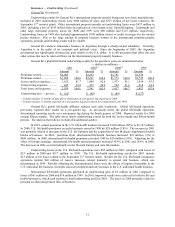

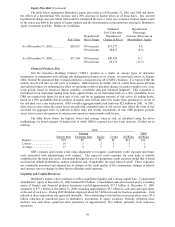

Revenues of the retail businesses in 2001 increased $134 million (7.2%) as compared to 2000 and

operating profits in 2001 of $175 million were unchanged from 2000. The increase in revenues was attributed to

the inclusion of a full year of results for Ben Bridge, the acquisition of a relatively small furniture retailer by NFM

in November 2000 and sales from a new store opened in 2001 by RC Willey in Henderson, Nevada. Otherwise,

same store sales for the home furnishing retailers were relatively unchanged between years and same store sales for

the fine jewelry retailers declined 7.6%. Home furnishings comparative pre-tax earnings were relatively unchanged

between years and pre-tax earnings declined at each of the jewelry businesses. The economic recession that

developed during 2001 and weak post-September 11th retail sales are believed to be the primary causes for these

results.

Scott Fetzer Companies

The Scott Fetzer companies are a group of about twenty diverse manufacturing and distribution businesses

under common management. Principal businesses in this group of companies sell products under the Kirby (home

cleaning systems), Campbell Hausfeld (air compressors, paint sprayers, generators and pressure washers) and World

Book (encyclopedias and other educational products) names.

Revenues in 2001 from Scott Fetzer's businesses decreased $49 million (5.1%) as compared to 2000.

Operating profits in 2001 increased $7 million (5.7%) as compared to 2000. The decline in revenues was due

primarily to lower foreign unit sales at Kirby, weakening demand for products of many of Scott Fetzer’ s smaller

businesses and lower sales volume at World Book. The increase in operating profits in 2001 was attributed to lower

raw material prices and reduced labor and overhead costs at Campbell Hausfeld and the benefit of administrative

cost reduction programs, partially offset by the impact of overall lower sales volume.

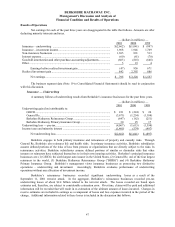

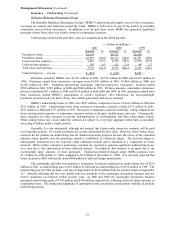

Shaw Industries

Berkshire acquired 87.3% of Shaw on January 8, 2001. Shaw is a leading manufacturer and distributor of

carpet and rugs for residential and commercial use. Shaw also provides installation services and offers hardwood

floor and other floor coverings. In January 2002, Berkshire acquired the remaining 12.7% of Shaw.

On a comparative full-year basis, Shaw’ s revenues in 2001 of $4,012 million declined by about $100

million from 2000. The decline in revenues reflects primarily a decline in square yards sold. Sales in 2001 were

negatively affected by the economic recession in the U.S., particularly in the commercial markets, and by slowing

demand after the September 11th terrorist attack.

In 2001, Shaw’ s pre-tax operating profit totaled $292 million. Shaw’ s operating results in 2001 benefited

from lower raw material costs and lower interest costs, partially offset by higher energy costs. Although uncertainty

in the U.S. economy persists, management is cautiously optimistic that sales and results will be stable in 2002.

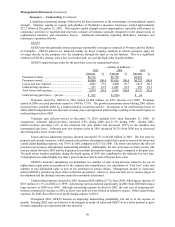

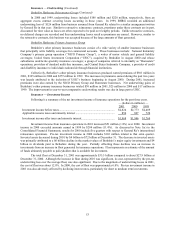

2000 compared to 1999

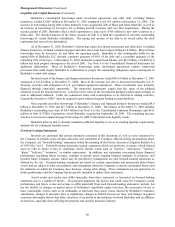

Revenues from the non-insurance businesses increased $1,959 million (32.5%) in 2000 as compared to

1999. Operating profits of $1,400 million during 2000 increased $570 million (68.7%) from the comparable 1999

amount. Business acquisitions completed during 1999 and 2000 account for a significant portion of the revenue

increase. The acquisitions of Jordan’ s Furniture (November 1999), CORT Business Services (February 2000), Ben

Bridge Jeweler (July 2000) and Justin Brands and Acme Brick (August 2000) account for about 50% of the

increase. The flight services segment and the finance and financial products segment account for most of the

remaining comparative increase. Most of the increase in the flight services segment was attributed to Executive Jet

which produced significant increases in revenues from both flight operations and aircraft sales. Operating profits

for the finance and financial products segment increased $413 million primarily as a result of realized gains on a

large portfolio of fixed maturity securities acquired during 1999 pursuant to a proprietary trading strategy. These

securities were sold during 2000. The aforementioned business acquisitions in the aggregate accounted for

substantially all of the remaining increase in operating profits.